In September 2025, competition in the Bitcoin mining sector intensified, mining difficulty reached an all-time high, and the production of most major miners decreased.

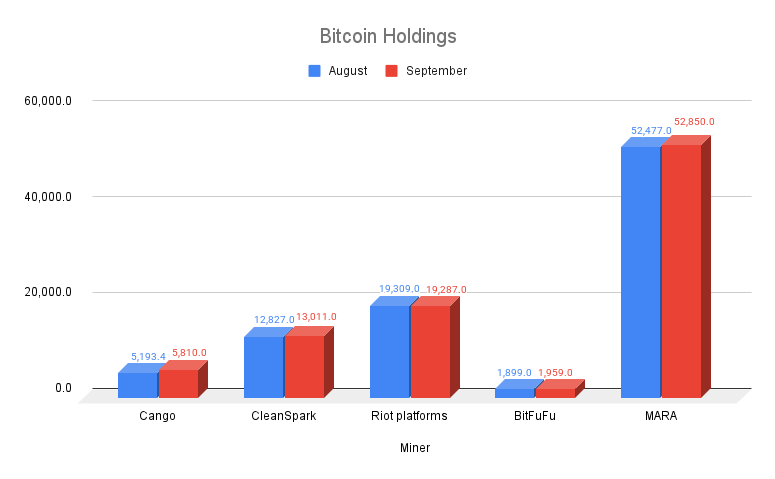

While large companies with strong balance sheets and accumulation strategies continued to grow in this environment, smaller miners faced increasing pressure from operating costs and technological change.

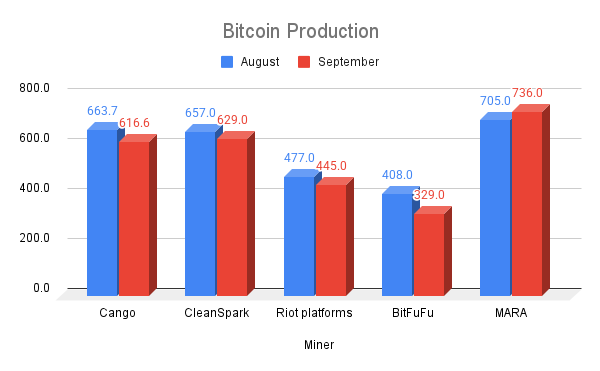

Bitcoin production decreases as difficulty increases

According to a public report compiled by BeInCrypto, Cango mined approximately 616 BTC in September, down from 663 BTC in August.

CleanSpark generated 629 BTC, a slight decrease from the previous month. Riot Platforms generated 445 BTC (477 BTC in August). Although BitFuFu’s output plummeted to 329 BTC, Marathon Digital Holdings (MARA) maintained its lead by mining 736 BTC, further expanding its Bitcoin reserves.

Bitcoin production by major mining companies. Source: BeInCrypto

This data suggests that while larger miners have been able to maintain relatively stable production, smaller miners are beginning to feel the strain of rising difficulty and energy costs.

BTC holdings of selected companies. Source: BeInCrypto

Meanwhile, Bitcoin's network difficulty rose to 142.34T in September, an all-time high. This consistent increase in difficulty means that each unit of hashrate produces fewer BTC and the hash price (revenue per unit of computing power) decreases.

As a result, miners' profit margins continue to shrink, especially for miners with high energy costs or inefficient hardware.

Bitcoin mining difficulty. Source: Blockchain.com

Notably, New York's new anti-Bitcoin mining bill recently proposed a progressive tax on Bitcoin mining companies, with the revenue earmarked for reducing residents' utility bills. The bill's prospects are uncertain, but it could disrupt multibillion-dollar data center plans and tighten crypto regulations in the state.

In summary, Bitcoin production in September revealed increased technological pressure on the mining industry. As difficulty continues to rise and profit margins shrink, large miners like MARA with efficient infrastructure and BTC accumulation strategies remain in a strong position.

Small businesses will need to carefully consider selling BTC, reducing power capacity, or expanding their operations to survive an increasingly competitive and volatile landscape.

The post Bitcoin Soaks After September Production Amid Growing Difficulties — MARA Maintains Lead appeared first on BeInCrypto.