Bitcoin fell nearly 11% in January amid widespread market turmoil, extending its losing streak to four months, its longest since 2018. Opportunistic investors are keeping an eye on the decline as gold also faces a sharp decline.

summary

- Bitcoin price remains below $80,000 as the cryptocurrency market continues to struggle amid a widespread market downturn.

- U.S. stock markets rose modestly, while oil prices fell and gold retreated from record highs.

- Technical indicators and market sentiment suggest that Bitcoin’s recovery could be a bullish trap, with a further fall to $70,000 possible if it fails to regain momentum above $100,000.

Bitcoin ($BTC) is currently hovering just above $78,400. In fact, the market capitalization of all coins increased by 1.7% to over $2.7 trillion, but it is still a long way from the all-time high of about $4.1 trillion set in August 2025.

Top tokens as of Monday afternoon (EST) include MYX Finance, Memecore, River, Jupiter, Morpho, and Hyperliquid.

The stock market posted modest gains, with major large indexes such as the S&P 500 and Nasdaq 100 up 0.7% and 1.1%, respectively. The iShares Russell 2000 ETF led the market's gains, rising 1.32% by midday.

You may also like: Neo founder launches NGR to advance research and real-world adoption of Neo 4

Meanwhile, oil prices plummeted as US troops gathered in the Gulf.

Global benchmark Brent fell 4.75% to $66, while West Texas Intermediate plunged to $61. At the same time, gold, often seen as a safe-haven asset, retreated from its all-time high of $5,568 to $4,600.

Further data from Polymarket shows that the probability of the US attacking Iran continues to decline. The probability of a strike by the end of the year rose from 80% to 6.69%.

The cryptocurrency crash also stalled as the Fear and Greed Index fell to 14, the lowest level this year. In most cases, a cryptocurrency rebound occurs when the index moves into the extreme fear zone.

Bitcoin price technical analysis suggests this rally could be a bullish trap

$BTC Price list |Source: crypto.news

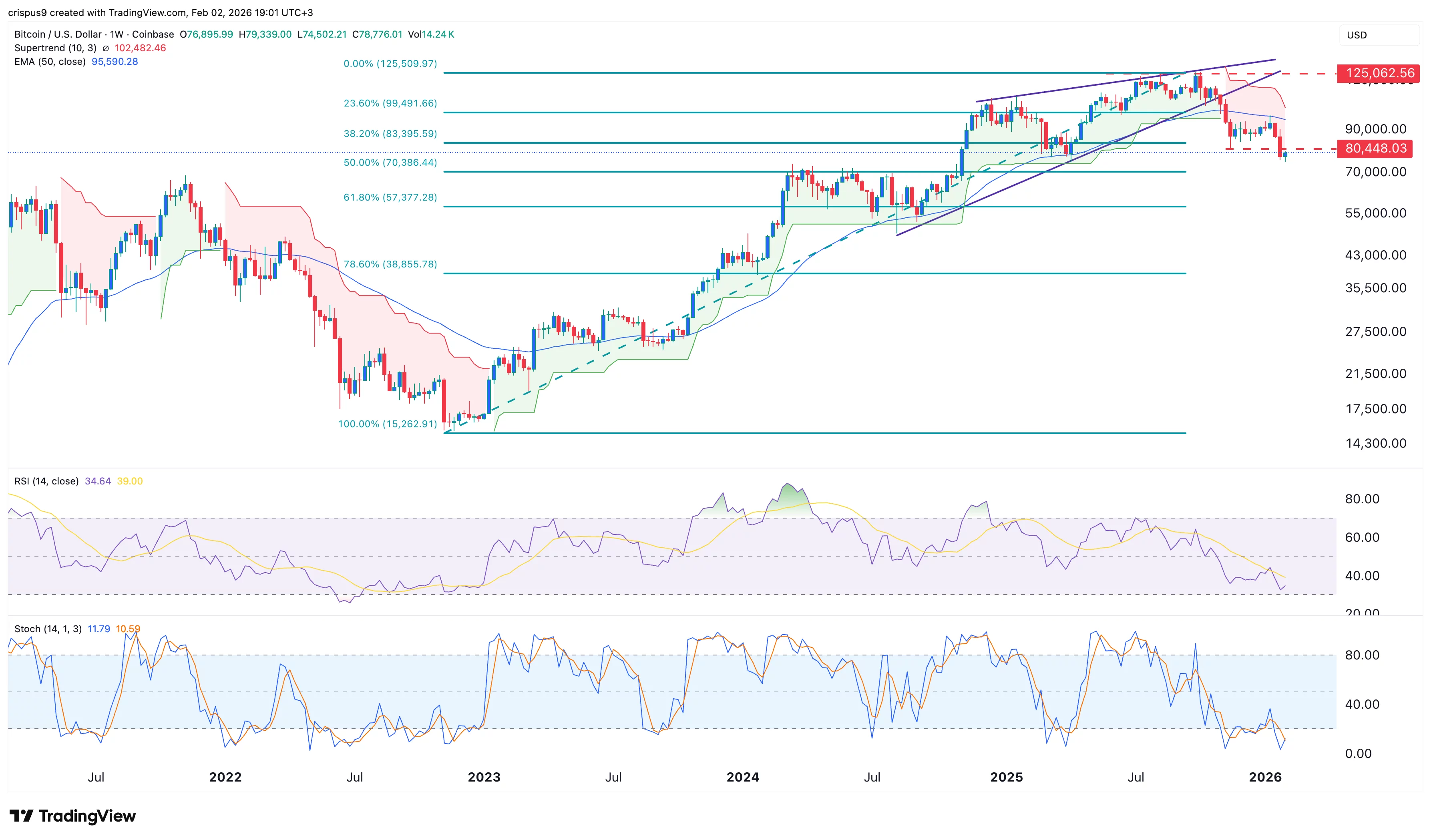

Looking at the weekly chart, $BTC Prices have plummeted in the past few months.

The super trend indicator has already switched from green to red. The last time this happened was in 2021, after which the coin fell by over 70%.

Bitcoin fell below the 38.2% Fibonacci retracement level and the 50-week exponential moving average. The relative strength index and stochastic oscillator continued to decline.

Therefore, these technical indicators suggest that Bitcoin price may continue to decline in the short term. If this happens, the decline could continue and fall to the 50% retracement level of $70,000. Therefore, there is a risk that cryptocurrencies will continue to fall in the coming weeks.

This view is in line with Michael Novogratz's recent prediction that a full recovery will be confirmed when Bitcoin crosses $100,000 and $103,000.

read more: Jeffrey Epstein files reignite crypto speculation as Ripple rejects XRP link