Bitcoin (BTC) has ripped past its highest ever high, climbing over $118K and above $120,000, but the metrics of the rally have become far more complicated than mere bullish sentiment. On-chain data shows supply and demand imbalances reminiscent of the second half of 2020.

BTC prices are now up 105% from last year, leading the Altcoins with massive bullish sentiment. The market capitalization of the cumulative crypto is close to the $3.7 trillion mark with a 24-hour transaction volume of approximately $163 billion.

At the same time, Bitcoin's advantage lies on the high side of 64%, with indicators of fear and desire flashing “greed” among traders.

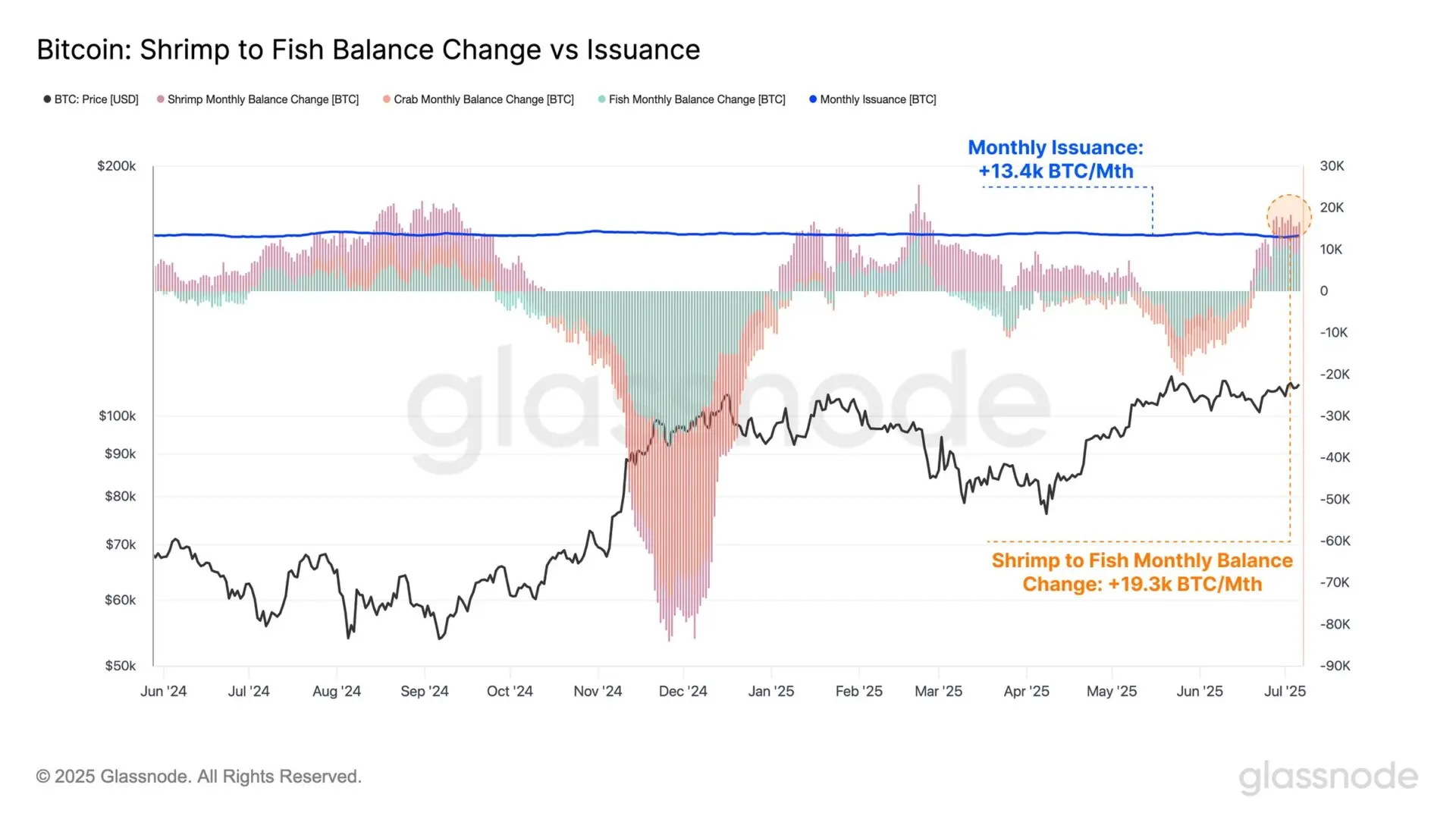

Miners can't keep up with demand

According to GlassNode data, wallets that hold less than 100 BTC accumulate Bitcoin at a pace of 19,300 BTC per month. This number is already 6,000 BTC (13,400 BTC) than Minor issues monthly.

It added that this wide range of retailers and luxury owners is absorbing more than 100% of their net supply. If some bitcoin remains in the market, the ETF, institution, or the Ministry of Finance has deferred the rest.

The Bitcoin balance of exchanges has also declined, and the supply shock has become a reality. Exchange balances are declining, long-term holders are increasing, and miners are unable to keep up. Long-term holders (LTHS) absorb more BTC than miners do, and don't even think about sales.

Source: Coinglass

Long-term holders' net unrealized gains/losses (NUPL) currently sits at 0.69, which is below the 0.75 threshold red zone. In the final cycle, the market spent 228 days in the happiness zone, and this cycle was only 30 days.

Even the classic commercial craftsmen, short-term holders, have yet to show signs of dumping. Their average entrance price is around $100,000. That means you're making a profit of 17-18%.

The Bitcoin Boom Turns Corporate Heads

There is a macro photo. This means that Bitcoin is not only gaining prices, but gaining legitimacy. Institutional investors are leaning while companies are converting cash to BTC. Michael Saylor's Strategy (MSTR) turns out to be a child of the company's Bitcoin accumulation poster. It currently owns around 600,000 btc and holds $28 billion in paper profits.

Only Satoshi and BlackRock exceed MSTR. However, unlike BlackRock, which holds BTC via ETF (IBIT) on behalf of investors, the strategy holds BTC completely on the balance sheet. Saylor wasn't shy about it, and when BTC hit its all-time high yesterday, he said:

Other companies are riding the same wave. Japan's Metaplanet is over 15,500 btc, up from nearly $1.83 billion, the company's current metaplanet. El Salvador, the original Bitcoin Nation, currently owns 6,234 BTC, worth $733 million and has a paper profit of $232 million.

Semler Scientific (SMLR) also follows the BTC on-balance sheet strategy. It earned 4,636 BTC and $160 million. The French blockchain group is mixed at 900 btc, and has increased by $30 million on paper.

The rally was not quarantined by Bitcoin. Ethereum once again breaks the $3,000 mark, with XRP, Sol and Doge all assembled with it. XRP prices have increased 25% over the past seven days. It trades at an average price of $2.78 at press time.