By Omkar Godbole (unless otherwise indicated)

Decentralized platform traders are seeing more than 50% of Bitcoin odds as Crypto Market gets caught up in US stag concerns

The YES shares of Polymarket's “Bitcoin Dip under $100,000 before 2026” traded for 55 cents, implying a 55% chance. That pricing appears to be justified against the background of recent economic data.

“The market has passed darker as both manufacturing and services ISMs are weaker than the most bearish forecasts at the moment. Job growth could be rolling hard.”

“When these studies come together in economic footprints, the meaning is phenomenal. There is a chance that NFP prints can go over 100,000. Not only is it soft, but it's recession-flexible.

Interest traders have already increased bets on Fed cuts. Still, observers are split over whether or not fueled rate reductions will be reduced by the precursors of economic weakness for risky assets, including cryptocurrencies.

According to Ines, lower rates often make high-risk assets more attractive, but Wall Street appears to be expecting pain, and momentum traders have moved to selling. The same applies to Bitcoin. The short-term puts listed on Deribit are now more expensive than calls and reflect negative side concerns.

Still, in the options market, it's less likely to have $10,000 of Bitcoin by the end of the year than Polymet. That's clear from $10,000K, from -0.25 delta in December. Delta refers to the sensitivity of the option's price to changes in the underlying asset, and represents the probability that the option will expire its profit.

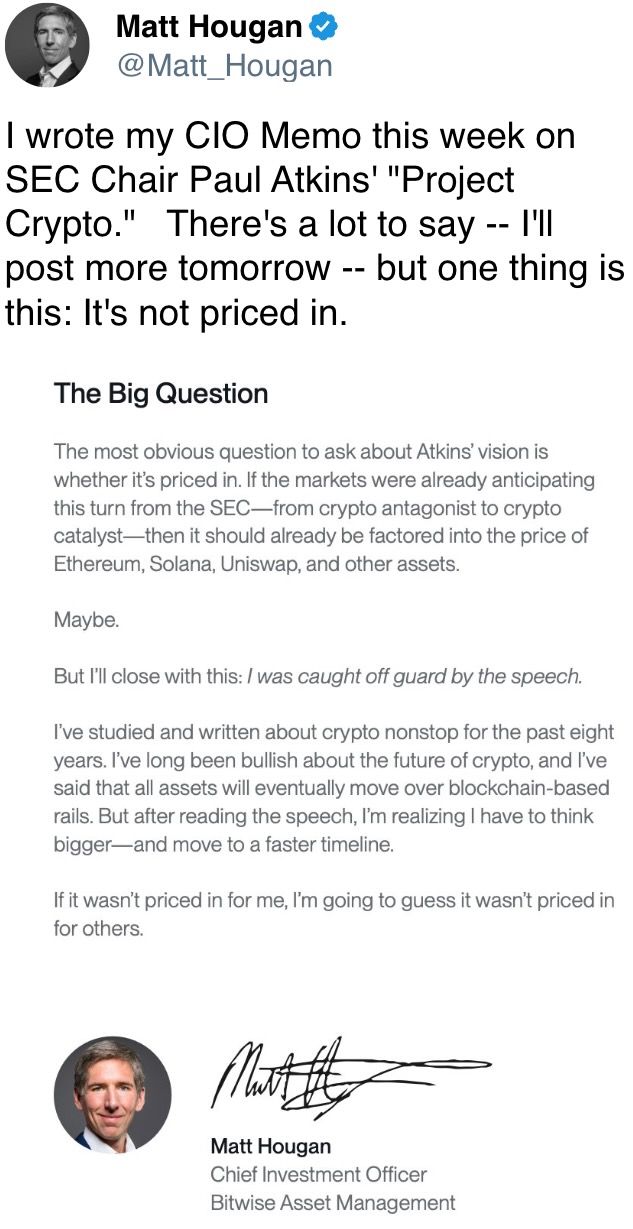

The SEC appears to be more constructive as the SEC states that under certain conditions the staking activity and receipt of tokens does not constitute a security offer. This guidance clears the way Spot Ether ETF regulators involve staking.

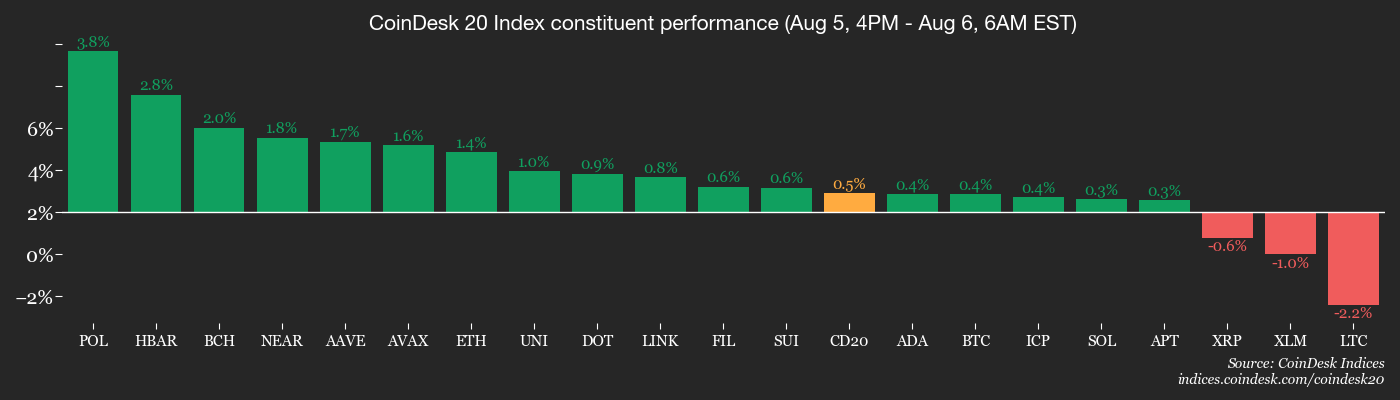

Speaking of the wider market, Altcoins seemed weaker than their majors. The Coindesk 80 index was 2.9% lower in 24 hours, trading slightly more than the 2.3% of the Coindesk 20 index.

In other news, SBI, Japan's largest bank, has announced ETFs related to Bitcoin and XRP. The governance proposal spreading to the Metamask community revealed the wallet's plan to launch “Metamask USD” Stablecoin through a partnership with Stripe's payment infrastructure.

In the traditional market, futures tied to the S&P 500 traded 0.2% higher, showing a slightly positive opening on Wall Street, but the dollar index was around 98.70. Keep alerts!

What to see

- Crypto

- August 7th, 10am: The circle will be holding a webinar. “The era of genius acts begins.” This session will cover the first US federal payments stable framework and its impact on crypto innovation and regulations.

- August 15: Record the date of the next FTX distribution to the holders of the Class 5 customer qualifications, general unsecured and convenience claims for Class 6.

- August 18: Coinbase Derivatives launches Nano Sol and Nano XRP US Perpetual Style Futures.

- Macros

- August 6th 2pm: Federal Reserve Governor Lisa D. Cook will give a speech entitled “The United States and the Global Economy.” Live stream link.

- August 7, 12:01am: The new US mutual tariffs outlined in President Trump's July 31 executive order will be effective for a wide range of trading partners who have not secured transactions by August 1. These tariffs range from 15% to 41% depending on the country.

- August 7th: 8am: Mexico National Institute of Statistics releases consumer price inflation data for July.

- Core inflation rate before mom. 0.39%

- Around the core inflation rate. 4.24%

- Before moms inflation. 0.28%

- Around the inflation rate. 4.32%

- August 7th: 3pm: Mexico's central bank, Banco de Mexico, announces its monetary policy decision.

- Overnight interbank target rate EST. 7.75% vs. 8%

- August 8: Federal Reserve Governor Adriana D. Coogler's resignation will be effective and create an early vacancies for the Governor's Committee that will allow President Trump to nominate his successor.

- Revenue (Estimation based on fact set data)

- August 7: Block (XYZ), Post Market, $0.67

- August 7: CleanSpark (CLSK), Postmarket, $0.19

- August 7: Coincheck Group (CNCK), Post Market

- August 7: Crypto Mining (CIFR), former market

- August 7: HUT 8 (HUT), pre-market – $0.08

- August 8: Terawulf (Wulf), former market, – $0.06

- August 11: Exod, Postmarket

- August 12th: Bitfarm (BITF), former market

- August 12th: Foldable (FLD), Post Market

Token Event

- Governance votes and phone calls

- Arbitrum Dao is voting to renew its partnership with Entropy Advisor for two more years starting in September 2025, and for another two years. The proposal includes $6 million in funding and 15 million ARBs of entropy incentives, focusing on financial management, incentive design, data infrastructure and ecosystem growth. Voting will end on August 7th.

- Benddao is voting for a plan to stabilize Bend by burning 50% of the Treasury tokens, restarting lender compensation, and using 20% of protocol revenue to start monthly buybacks. Voting will end on August 10th.

- 1inch Dao is voting for a $1.88 million grant to fund participation in nine global crypto events by the second half of 2025. The proposal aims to increase developer engagement, increase institutional ties and increase adoption across ecosystems such as Ethereum and Solana. Voting will end on August 10th.

- August 6th, 1pm: LivePeer hosts fireplaces on Twitter and Discord.

- August 7th 12pm: Cello hosts the governance call.

- August 8th at 11:30am: Axie Infinity will host city hall at Discord.

- Unlock

- August 9: Unlocking 1.3% of distribution supply worth $1,232 million (IMX).

- August 12: APTOS unlocks 1.73% of distribution supply worth $48.18 million.

- August 15th: An avalanche unlocks 0.39% of distribution supply worth $36.87 million.

- August 15: StarkNet (STRK) unlocks 3.53% of its distribution supply worth $14.77 million.

- August 15: SEI unlocks 0.96% of distribution supply worth $1592 million.

- August 16: arbitrum unlocks 1.8% of its circulation supply worth $3582 million.

- August 18: FastToken unlocks 4.64% of its distribution supply worth $91.4 million.

- Token launch

- August 6: worldcoin listed in binance.us.

meeting

Coindesk Policy & Regulation Conference (Formerly known as Cryptographic State) At a one-day boutique event held in Washington on September 10th, generals, compliance officers and regulatory executives will be able to meet with civil servants responsible for crypto law and regulatory oversight. Space is limited. Please use Code CDB10 for 10% off registration until August 31st.

- Day 3: Blockchain Conference Science of 2025 (Berkeley, California)

- Day 2: Blockchain Rio 2025 (Rio de Janeiro, Brazil)

- Day 5: Rarebo (Las Vegas)

- August 7-8: Bitcoin++ (Latvia, Riga)

- August 9th-10th: Baltotic Honey Badger 2025 (Riga, Latvia)

- August 9th-10th: Conviction 2025 (Ho Chi Minh City, Vietnam)

- August 11th: Paraguay Blockchain Summit 2025 (Asuncion)

- August 11th-13th: MATB 2025 (Intanbul)

- August 11th-17th: Ethereum NYC (New York)

Token talk

By Shaurya Malwa

- Pump.Fun regained the lead in the launch of Solana Token with 13,690 new tokens in 24 hours, slightly surpassing Letsbonk.Fun's 13,392, according to Dune Analytics data.

- Despite its successor in token counting, Letsbonk retained the advantage at $87.7 million in daily trading volume compared to Pump's $82.4 million.

- The revival of pump activity coincides with the new momentum of the native pump token, rebounding 17.8% to $0.003247 over the past week. It has decreased by 52% from the peak after ICO.

- Pump raised $600 million in 12 minutes during ICO last month and began buying back millions of dollars.

- Supported by the Bonk community and integrated with Raydium's Launchlab, Letsbonk will support Bonkol and other Solana Ecosystem Initiatives while channeling half of its toll revenue to Bonk Token Burns.

- Solana faces competitive pressure from the base, where token launch activities outweigh Solana in the raw numbers for that portion. This is driven by the integration of Zora and Farcaster via the base app. This automatically creates a social post with an ERC-20 token.

- Solana still leads Memecoin's trading volume, but the rapid growth of the base shows dynamic changes, especially in the production of experimental and socially driven tokens.

Positioning of derivatives

- Futures open interest in the top 10 coins except BTC has declined by 4% to 10% over the past 24 hours, indicating capital outflow from the market. BTC's open interest was kept flat.

- Funding rates exceed 5% per year for most major tokens. This shows the advantage of a bullish long bet. Also, if prices continue to fall, it means a long liquidation.

- Bitcoin's CME futures also show capital outflows, and have an open interest in standard contracts (sizes 5 BTC) since late April. The BTC and ETH futures foundations remain locked between 5% and 10% with no signs of improvement.

- In DERIBIT, risk inversion for BTC and ETH options shows a weakened (Put) bias to the October expiration date. OTC desk blockflow features a rollover of BTC puts.

Market movements

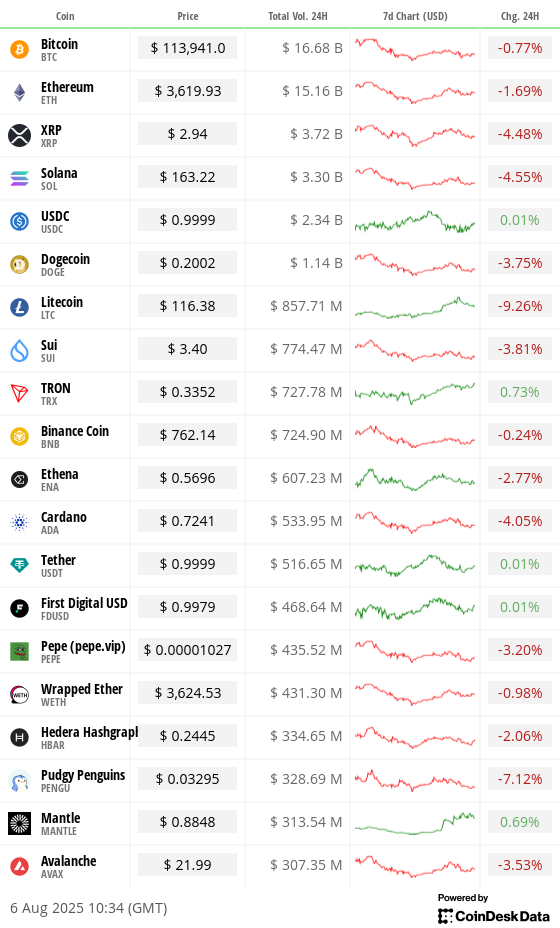

- BTC is up 0.237% from 4pm on Tuesday at $114,105.72 (24 hours: -0.55%)

- ETH is up 1.39% at $3,626.69 (24 hours: -1.34%)

- Coindesk 20 is up 0.78% at 3,768.88 (24 hours: -2.33%)

- Ether CESR Composite Staking Rate Increases 7 bps at 2.93%

- BTC's funding rate is 0.0086% (9.3699% per year) for Binance

- DXY has not changed at 98.73

- Gold futures fell 0.56% to $3,415.60

- Silver Futures has not changed for $37.80

- The Nikkei 225 rose 0.6% to 40,794.86

- Hangsen was unchanged at 24,910.63

- FTSE is up 0.22% at 9,162.81

- The Euro Stoxx 50 is up 0.28% at 5,264.22

- DJIA fell 0.14% on Tuesday at 44,111.74

- S&P 500 closed 0.49% at 6,299.19

- Nasdaq Composite fell 0.65% at 20,916.55

- S&P/TSX Composite rose 2.03% to 27,570.08

- S&P 40 Latin America closed 0.71% at 2,590.51

- The 10-year financial ratio in the US is 4.239%, up 4.3 bps

- E-Mini S&P 500 futures are up 0.23% at 6,339.50

- E-Mini Nasdaq-100 futures remain unchanged at 23,141.75

- The e-mini dow Jones Industrial Average Index is up 0.31% at 44,374.00

Bitcoin statistics

- BTC advantage: 61.82% (unchanged)

- Ether to Bitcoin ratio: 0.03177 (+0.38%)

- Hash rate (7-day moving average): 952 EH/s

- Hashpris (spot): $56.64

- Total fee: 3.67 BTC/$418,957

- CME Futures Open Interest: 137,790 BTC

- BTC priced in gold: 33.7 oz

- BTC vs. Gold Market Cap: 9.53%

Technical Analysis

Binance-Listed ETH/BTC pair. (TradingView)

- Ether Bitcoin (ETH/BTC) pairs formed a bull flag pattern on their daily charts. This pattern represents a temporary pause with the first uptrend, which usually remels a higher refresh.

- Movement through the top edge of the flag indicates the resumption of the ether rally against Bitcoin.

Crypto stocks

- Strategy (MSTR): Tuesday at $375.46 (-3.54%), +0.87% at $378.71

- Coinbase Global (Coin): $297.99 (-6.34%), +1.41% at $302.18 +1.41%

- Circle (CRCL): $153.93 (-6.61%), $151.93 at -1.3%

- Galaxy Digital (GLXY): $27.68 (-4.19%), closed at -0.58% at $27.52

- Mara Holdings (Mara): Closed at $15.62 (-2.62%) and has not changed before the market

- Riot Platforms (Riot): Closed at $11.13 (-2.54%) and has not changed before the market

- Core Scientific (CORZ): $14.08 (+3.15%), closed at -0.43% at $14.02

- CleanSpark (CLSK): Closed at $10.83 (+1.98%), +0.37% at $10.87

- Coinshares Valkyrie Bitcoin Miners ETF (WGMI): Closed at $24.85 (+0.08%)

- Semler Scientific (SMLR): Closed at $34.87 (-1.41%)

- Exodus Movement (Exod): $28.9 (-2.27%), +0.69% at $29.10 +0.69%

- Sharplink Gaming (SBET): $20.23 (+5.69%), closed at -1.33% at $19.96

ETF Flow

Spot BTC ETF

- Daily Net Flow: -$199 million

- Cumulative net flow rate: $5.363 billion

- Total BTC holdings: 129 million

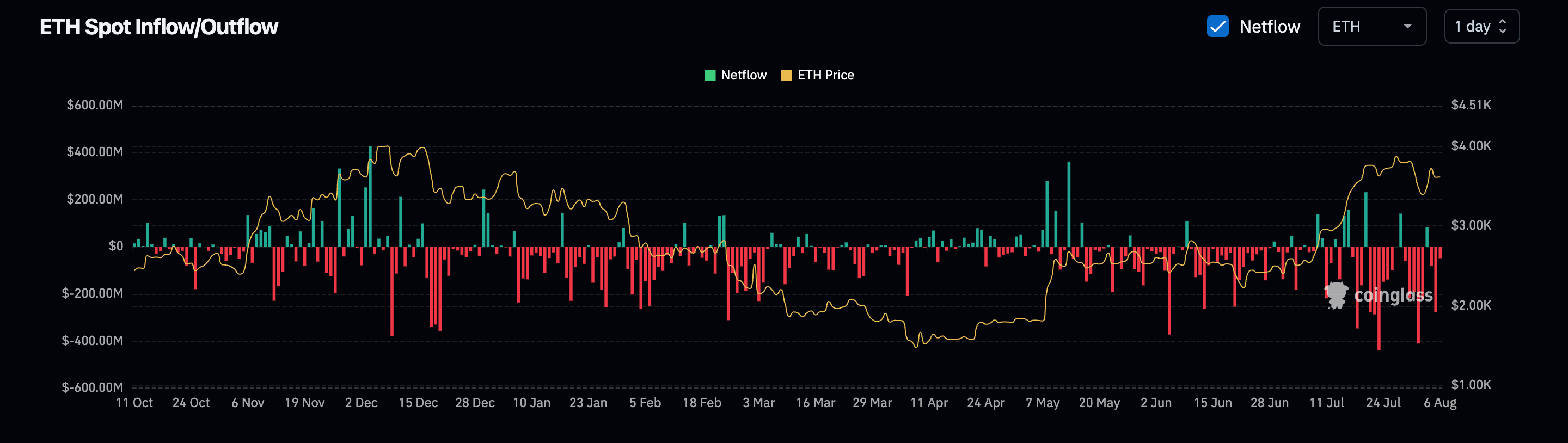

Spot ETH ETF

- Daily Net Flow: $73.3 million

- Cumulative net flow: $91.2 billion

- Total ETH holdings: 557 million

Source: Farside Investors

One night flow

The chart of the day

Ether: Daily exchange. (coinglass)

- The chart will involve a central exchange of daily pure influx of ether.

- There have been a massive leak recently, and there have been signs that investors will accumulate cryptocurrency in the dip.

While you're asleep

- Bitcoin ETFs fear that US stagflation will put pressure on BTC and stocks (Coindesk), resulting in millions of people bleeding for the fourth day in a row.

- The Swiss president will meet with tariffs (Bloomberg) to meet Rubio on Wednesday: The $38 billion US trade deficit promoted by gold and drugs will complicate consultations, with analysts warning that the proposed 39% tariff could threaten 1% of Swiss economic output.

- Take advantage of the Bearish Strategy ETF Surges 19% to direct the outlook for MSTR and Bitcoin (Coindesk). The double short MSTR ETF, which rose 19% last week, saw net inflows of $16.3 million over the past six months, while bullish counterparts experienced significant outflows.

- China warns that it will scan WorldCoin-style IRIS national security threats (Coindesk). China's national security ministry warned that incentivized IRIS scans could allow foreign companies to remove biometric data, raising concerns about surveillance abuse and deep-sea response infiltration.

- India's central bank holds fees amid rising tariff tensions with Donald Trump (Financial Times). The RBI has kept its reporate to 5.5%, citing the uncertainty of tariffs and the impact of a multiple of this year's 100 basis points as the US threatens more tariffs than India's Russian oil imports.

- Trump just got a fresh shot by bent the Fed to his will (Wall Street Journal): With Adriana Kugler's early resignation, the president now has the appointment of rate setters.

With ether