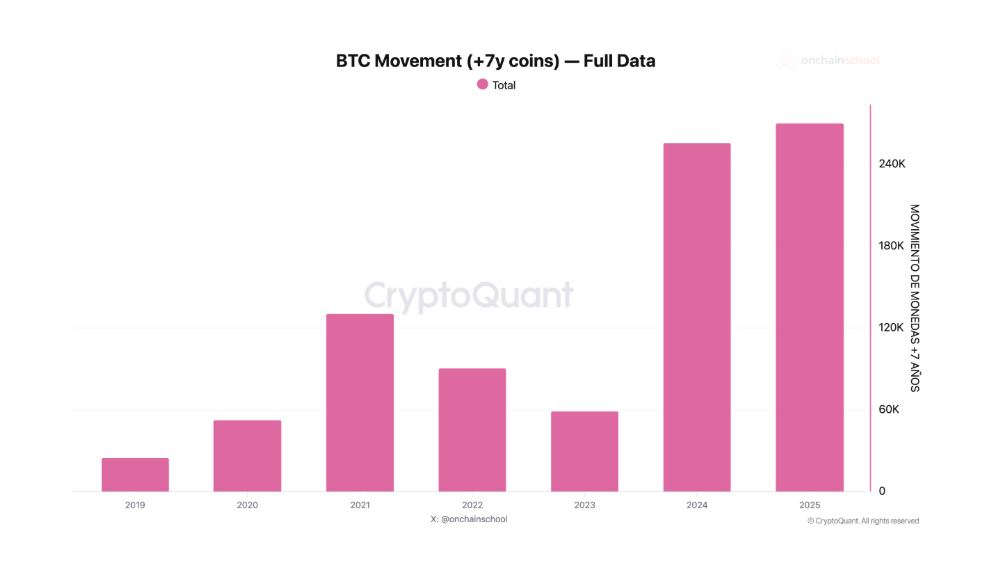

In 2025, a record number of old whale wallets moved coins. One of the big changes came from a wallet that had been around for over seven years.

A series of price peaks in BTC prompted the movement of coins into old whale wallets. In 2025, a record number of old BTC whales moved coins. Transfers were made from wallets that were more than seven years old, with occasional transactions from wallets from 2013 and beyond. 2010.

Most of the activity has come from OG whales, including notoriously hacked wallets and former exchanges. One of the biggest transfers was 80,000 BTC From a still unidentified whale after being held for 14 years.

Most recently, Whale from the Satoshi mining days sold more of his remaining coins. Whale's wallet held up to 8,000 BTC, but after transferring 150 BTC to the exchange, it was reduced to 3,850 coins.

Some of the transferred coins ended up on exchanges, but in 2025 there will be even more ways to leverage the value of BTC. The old whale found himself sitting on something like a thick treasury, and some of it ended up supporting treasury companies. For others, lending was a way to tap into the value of BTC without selling it directly.

BTC's price peak has prompted more old whales to move their coins for safety or for profit. |Source: CryptoQuant.

BTC absorbed most of the whale sale value

In 2025, the BTC market was strong enough to absorb whale selling. However, occasionally large amounts of BTC are sold short-term, causing the price to fall. Some sellers use a combination of spot trading and derivative positions to try to increase the price of BTC while selling short.

The rise of PERP DEX trading in 2025 also contributed to the revitalization of whale wallets. Some of the OG whales moved their old coins to take advantage of the derivatives market instead of profiting from the spot market.

More than 50% of BTC is still held by individuals

More than 50% of BTC is still stored in personal wallets. On-chain researchers have identified current treasuries, mine reserves, exchange wallets, custodial wallets, and ETF wallets.

An estimated total of 53.48% of BTC wallets are owned by individuals, of which approximately 170,000 wallets are tagged and tracked.

Even for small holders, we are seeing significant changes in accumulation and trading. Over the past year, over 2.41 million new Shrimp wallets were started for purchase with less than 1 BTC.

The 100-1,000 BTC “Shark Wallet” category was also growing rapidly. Over the past year, 3,461 new Shark wallets have been generated. In total, 14 of the largest whale wallets with over 10,000 BTC were split, and 20 whale wallets between 1,000 and 10,000 BTC also moved coins.

It shows that even though the number of whales is decreasing, large wallets can still control the market. The new whale wallet is being traded more actively. On the other hand, the 1 million BTC accumulated in the treasury has little direct impact on the market, and the relatively low movement of active coins can cause market fluctuations.

Get them seen in important places. Advertise on Cryptopolitan Research and reach the most astute investors and builders of cryptocurrencies.