- Bitcoin price is regaining bearish momentum with a bullish rebound from the $60,000 support before continuing its prevailing downtrend.

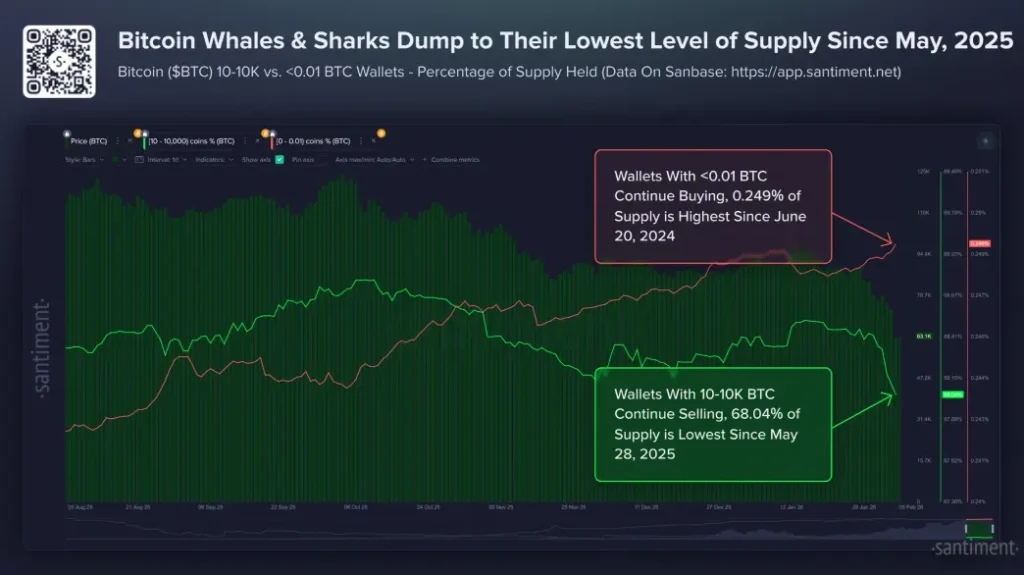

- Whale and Shark wallets hold $10 to $10,000 $BTC It currently controls 68.04% of supply, the lowest level in nine months.

- The Santi analysis provides an extremely bearish outlook: $BTC The fear and greed index fell to 9%.

Cryptocurrency pioneer Bitcoin soared more than 11.83% during Friday's U.S. market hours, trading at $70,623. The buying pressure likely came as a rebound after a correction, stabilizing price movements after yesterday's flash crash. Recent on-chain data shows retail investors continue to accumulate assets $BTC However, the risk of a prolonged correction remains as large investors sell.

$BTC Prices plummet to 9-month low due to whale distribution

During today's Asian market hours, Bitcoin prices fell to the $60,000 range, the lowest level since October 2024. The recent market correction, fueled by chain liquidations and macroeconomic uncertainty, led to a 50% loss in Bitcoin prices. $BTCThe value has since exceeded its peak of $126,000 in October 2025.

In a recent tweet, on-chain analytics platform Santiment highlighted a clear change in holder behavior behind some of the pressure. Wallets identified as whales and sharks — wallets with 10 to 10,000 pieces $BTC — Their collective dominance has fallen to 68.04% of total supply, the lowest share in the past nine months.

The group unloaded about 81,000 pieces. $BTC Supply increased during the eight days ending in early February, and supply is now on the decline. A recent snapshot shows the micronet amount (3,800 $BTC ), but the overall trend is still one of dispersion.

At the same time, smaller “shrimp” addresses (less than 0.01) $BTC) has steadily grown to a supply share of 0.249%, the highest in about 20 months. This pattern reflects continued buying by retail participants despite the decline.

This redistribution (large holders selling and small holders accumulating) often coincides with prolonged market softening in previous market cycles. Such dynamics can perpetuate weakness, as concentrated entities reduce their exposure and wait for stronger signals to return. This divergence is consistent with factors such as deleveraging in futures markets, capital outflows from institutional products, and a shift to traditional safe-haven assets such as gold in the face of geopolitical and macroeconomic tensions.

From February 6th to 7th, Bitcoin achieved a volatile recovery, rising more than 10% to trade in the $70,000-$71,000 range, but it is still far from its previous peak and volatility continues.

Bitcoin price bull run could reach $80,000 before next jump

Bitcoin prices briefly dipped below $60,000, but rebounded quickly by more than 13.3% on Friday. Due to a significant spike in trading volume, the coin price managed to regain the $71,300 level.

Prices tend to stabilize after extreme moves in a particular direction, so this rally likely came as a correctional relief rally. In daily chart analysis, $BTC It shows that the coin price could come under selling pressure again at $74,400, followed by $80,000.

The daily exponential moving averages of 20 and 50 could act as immediate rebound resistance for buyers.

$BTC/USDT- 1 day chart

These overhead resistances could restore depleted bearish momentum and set Bitcoin price for an extended correction. If the downtrend continues, it could re-test the $60,000 floor and then $55,000.