Bitcoin (BTC) surpassed the $90,000 mark for the first time since March 5th. The latest surge continued with a sharp rise in ADX, the formation of bullish side clouds, and a rise in favor of EMA alignment.

Market sentiment is in favor of bulls as they hit more pressure than sales activities and ETF inflows at three months. If resistance is violated, BTC can pave the way for $100,000, reinforcing its role as a hedge amid wider market uncertainty.

Bitcoin Bulls regain control as it signals ADX to enhance the uptrend

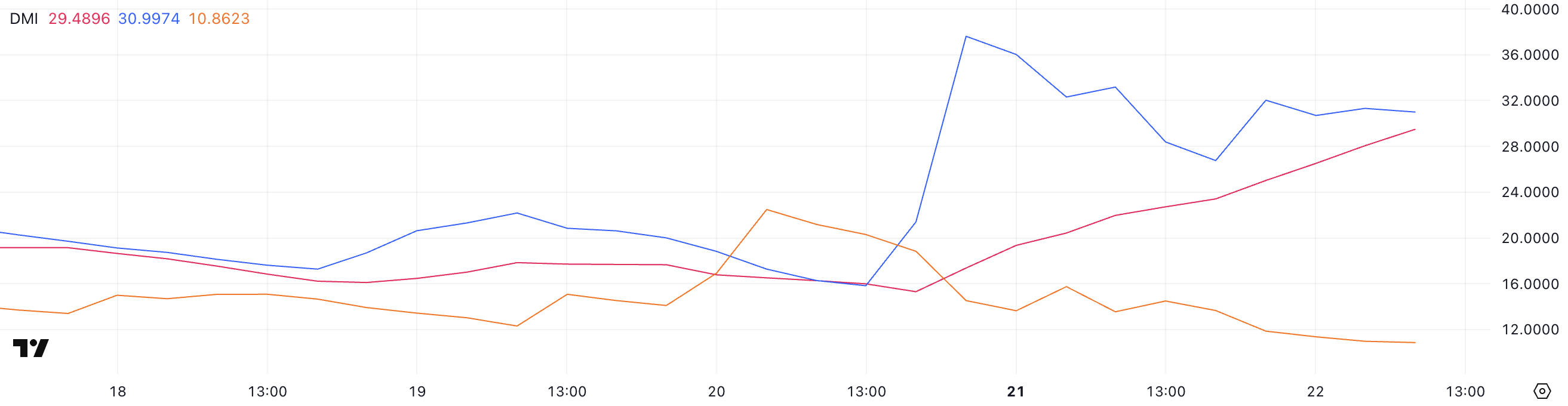

Bitcoin's Directional Motion Index (DMI) shows a significant change in momentum, with ADX rising from just 15.3 from 29.3.

ADX or mean directional index measures the intensity of a trend regardless of the direction. Measurements below 20 indicate weak or horizontal markets, while values above 25 indicate strong trends.

With the ADX approaching 30, the current movement has gained traction and we are seeing a more clear directional trend in place.

BTC DMI. Source: TradingView.

Looking deeper into the DMI component, the +DI (positive directional indicator) is currently 30.99, slightly lower than the 37.61 peak yesterday, but almost doubled from 15.82 two days ago.

This suggests that it has eased slightly over the past 24 hours during the recent surge in pressure. Meanwhile, the -DI (negative directional indicator) suddenly fell from 22.48 to 10.86, indicating a clear weakening of sales pressure.

The combination of powerful ADX and high +DI vs reduction-DI means that Bull is currently in control. If the trend is established, Bitcoin can continue its upward trajectory in the short term.

Bitcoin trends are enhanced with clear bullish momentum signals

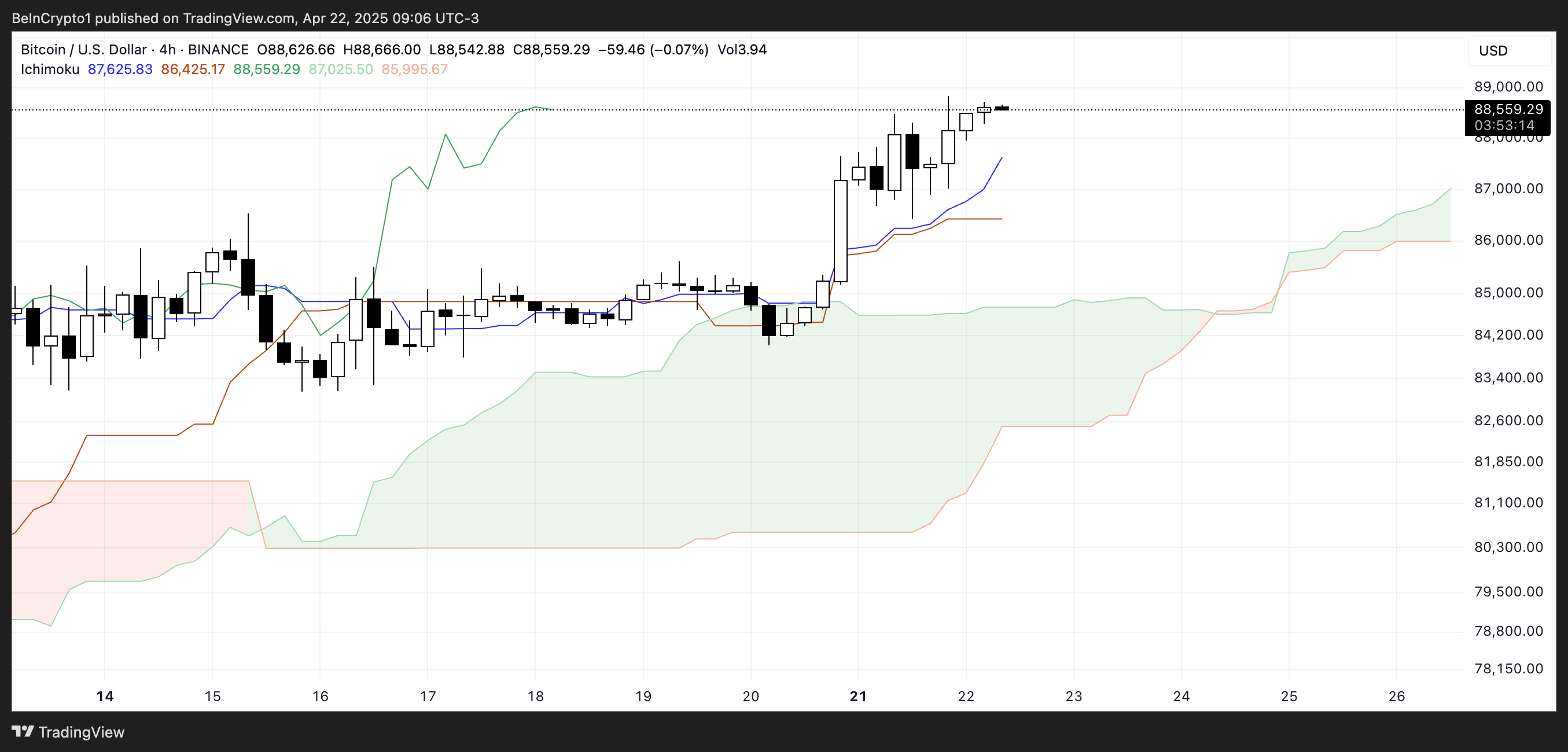

Bitcoin's Ichimoku Cloud Chart shows a clear bullish signal. Price action is far outweighing the spider (cloud), showing strong upward momentum.

The cloud itself turns from red to green, indicating a transition from bearish to bullish emotions.

The Tenkan-Sen (blue line) remains above the Kijun-Sen (Red Line) and enhances the short-term bullish bias. The gap between them continues to widen and is a sign of increasing momentum.

btc icchimoku cloud. Source: TradingView.

Additionally, Future Cloud (Senkou Span a and b) corners upwards. This suggests that bullish trends may persist if current conditions are true.

The Chikou span (green lag line) is placed above price candles and clouds to confirm trend integrity in terms of delay.

Together, these factors refer to healthy uptrends, but there are no immediate signs of reversal unless a strong breakdown appears under the Tenkan-Sen or the cloud.

As bullish momentum builds, there will be a new breakout in Bitcoin's eyes

Bitcoin's EMA line is bullish, with the short-term average placed above the long-term ones showing strong upward momentum.

Bitcoin's price is approaching a significant level of resistance at $92,920. Break out above this zone and you can open the door for even more profits.

If pressure gets stronger you could reach a potential goal of $96,484as Bitcoin ETF has registered its largest net inflow in three months.

The current structure suggests that the Bulls are in control as long as the level of support is respected and upward momentum remains sustained.

According to Tracy Jin, COO of Crypto Exchange MEXC, Bitcoin's recent performance has revived its label as “Digital Gold.”

“Bitcoin's recent strength in the face of market-wide volatility is reviving its long-term position as 'digital gold'. As US stocks return to their tariff-era lows and the dollar plunges into the three-year Nadir, the ability to post Bitcoin profits is reshaping investors' perceptions. ” Jin told beincrypto.

BTC price analysis. Source: TradingView.

However, if the trend loses strength and a reversal occurs, Bitcoin could face a short-term pullback towards support at $88,800.

Rests below this level weaken the structure and increase the chances of deeper correction. The next important areas are $86,532 and $83,133.