Cryptocurrency markets will enter 2026 with reduced leverage, stronger structures, and a shift toward defensive positioning, as Bitcoin maintains its leadership and financial institutions favor large-cap exposure, according to a new institutional report.

Financial institutions turn defensive as virtual currency risk prices are reviewed

Digital asset markets started 2026 on more stable footing after last year's widespread deleveraging risks across the sector. According to the Charting Crypto Q1 2026 report produced by Glassnode and Coinbase Institutional, leverage has declined, derivatives positioning has become more conservative, and market participants are re-pricing risk.

Bitcoin continues to anchor the market. BTC’s lead remains close to 59%, even as small- and mid-cap tokens struggle to maintain gains made early in the cycle. Institutional survey responses cited in the report show a clear preference for large-cap exposures, reflecting continued geopolitical uncertainty and a cautious attitude toward risk.

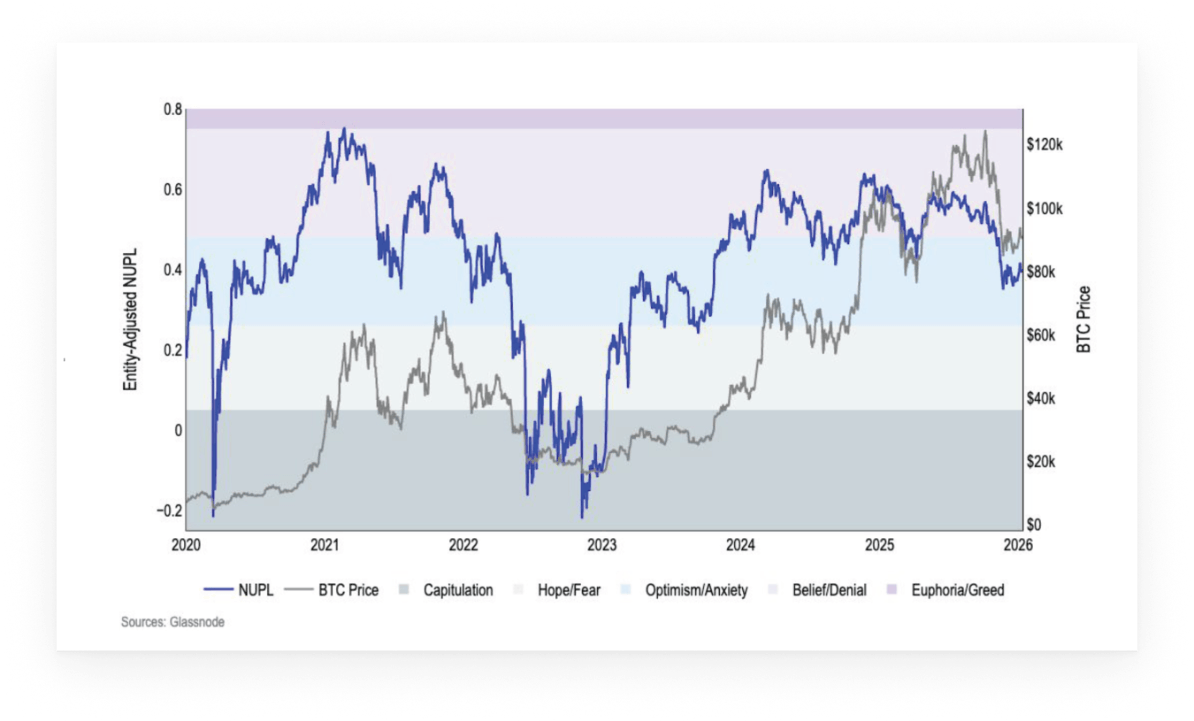

Sentiment towards Bitcoin remains subdued. The Net Unrealized Gains and Losses (NUPL) indicator stabilized at a lower level after October's large liquidation event. Structurally, there is scope for sentiment to improve if volatility reduces or the macro environment remains supportive.

One of the most notable changes occurred in the derivatives market. Deleveraging in October significantly reduced system-wide leverage, with the leverage ratio in perpetual futures falling to approximately 3% of crypto market capitalization excluding stablecoins. Rather than exiting completely, traders moved to options.

One of the most notable changes occurred in the derivatives market. Deleveraging in October significantly reduced system-wide leverage, with the leverage ratio in perpetual futures falling to approximately 3% of crypto market capitalization excluding stablecoins. Rather than exiting completely, traders moved to options.

Open interest in Bitcoin options now exceeds perpetual futures, and positioning is increasingly focused on downside protection and a clear risk structure. This shift suggests market structure is more resilient, even if short-term confidence remains muted.

The report also highlights signs of Bitcoin circulation. Active supply within the past three months increased to 37% in the fourth quarter of 2025, while long-dormant supply declined slightly, suggesting some reallocation by long-term holders.

Ethereum, on the other hand, appears to be entering the later stages of its current cycle, which started in mid-2022. However, the report claims that traditional cycle signals are losing predictive power as Ethereum's economics evolve. Due to rate compression and changing usage patterns in Layer 2 networks, future performance is likely to depend not only on historical cycle timing, but also on liquidity conditions and positioning.

Overall, the report concludes that while sentiment remains cautious, the crypto market is structurally healthier than during past cycle transitions, with discipline replacing excesses.