Bitcoin (BTC) is trading within the combined range of $104,000 to $116,000, revealing the key levels in which on-chain data can determine the next directional movement.

According to a September 4 report by GlassNode, Bitcoin entered a decline in volatility after a record high in mid-August, dropping to $108,000 before rebounding to its current level.

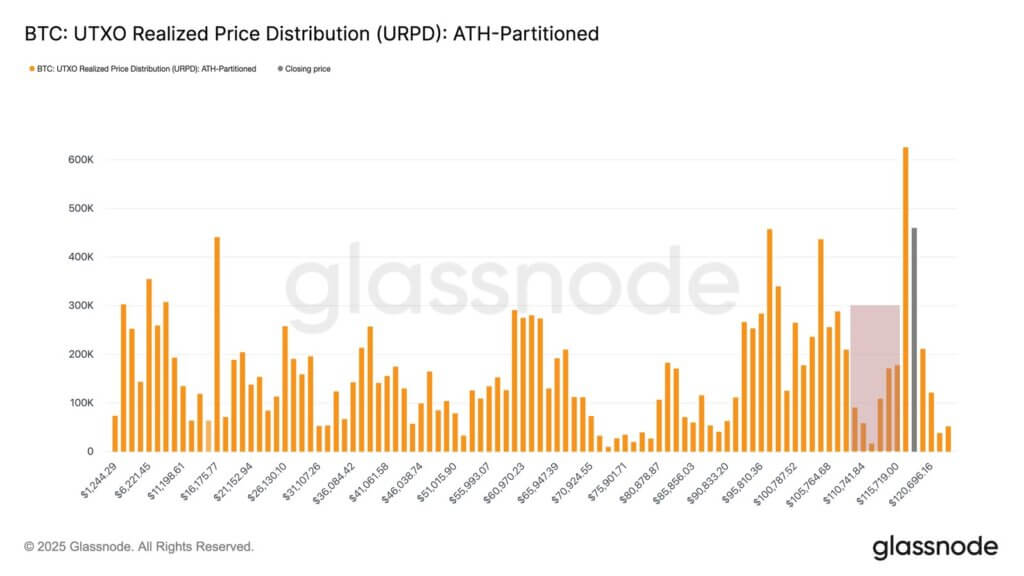

UTXO's price distribution shows investors have accumulated pullbacks, filling the “air gap” between $108,000 and $116,000 through consistent dip viewing behavior.

The current trading range corresponds to quantile cost basis levels of 0.85 and 0.95, ranging from $104,100 to $114,300. Historically, this zone serves as a consolidated corridor following an euphoric peak, creating a market that is often next to the choppy.

Below $104,100 it regenerates the post-fatigue phase of AT seen before this cycle, but recovery above $114,300 informs updated demand management.

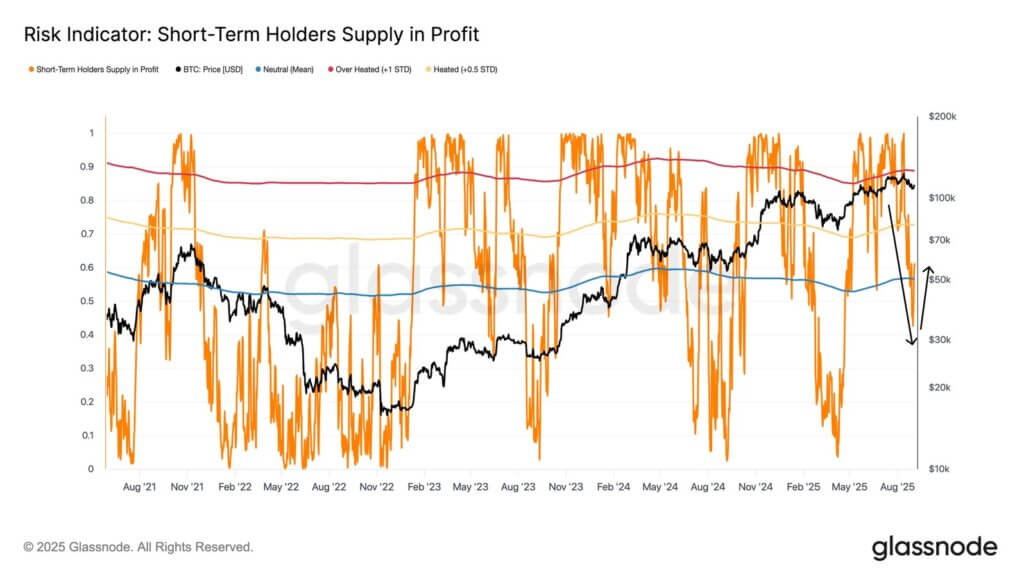

Short-term holder trends

Short-term holders face pressure within the range, and their profit margins collapsed from over 90% to 42% during the decline, reaching $108,000.

A sharp reversal usually causes fear-driven sales from recent buyers before seller fatigue allows for rebound.

Currently, over 60% of short-term holders are back in profit, representing neutral positioning compared to recent extremes.

More than 75% of short-term holder supply achieves profitability, so there are only maintenance recoverys above $114,000-$116,000, which can restore the trust needed to attract new demand.

The futures market funding rate is $366,000 per hour, and is placed neutrally between a baseline and overheating level of $300,000,000, above the $1 million seen in March and December 3024.