Cryptocurrency rose to $110,000 after the U.S. Bureau of Economic Analysis released its personal consumption expenditure report on Friday.

After Tepid Inflation Report, BTC inch facing up

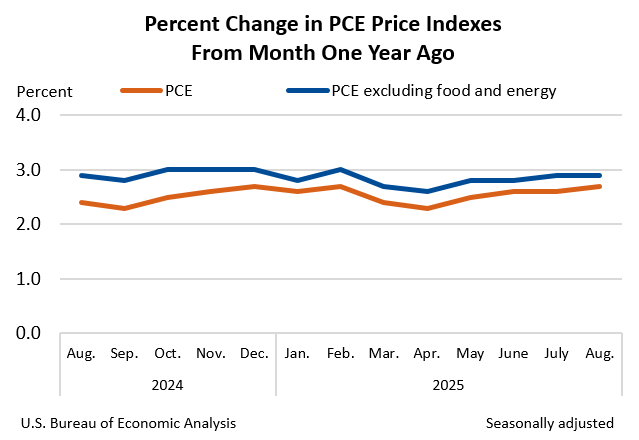

The Bureau of Economic Analysis released its relatively calm Personal Consumption Expense (PCE) report on Friday, bringing prices up 0.3% in August and annual inflation to 2.7% in line with economists' forecasts. The July rate was 2.6%, with Bitcoin barely responding to the news at first, but ultimately clearing the $110K threshold in the late afternoon.

(Inflation in August 2025 was barely changed, but remained sticky/US Bureau of Economic Analysis)

Core inflation that removes food and energy in the volatile category showed a slightly lower 0.2% increase in prices last month and a corresponding annual PCE rate of 2.9%. The US Federal Reserve considers the PCE price index as a “favorable measure of inflation.” The central bank's mission is calling for price increases to around 2% per year, but troubling employment data in early September expects two more interest rate cuts before the end of the year, despite reports of sticky inflation today.

Bitcoin's response to PCE data was initially muted, but cryptocurrencies ultimately mimicked the trajectory of stocks. The S&P 500, Nasdaq, and Dow reached 0.56%, 0.31% and 0.81% at the time of writing, respectively.

“This is not really good news for the Fed,” said former Cleveland Industry President Loretta Mester in an interview with CNBC. “They have very narrow lanes. They want to support the labour market, but they need to maintain some limits on their policy stance to defeat inflation.”

Market Metric Overview

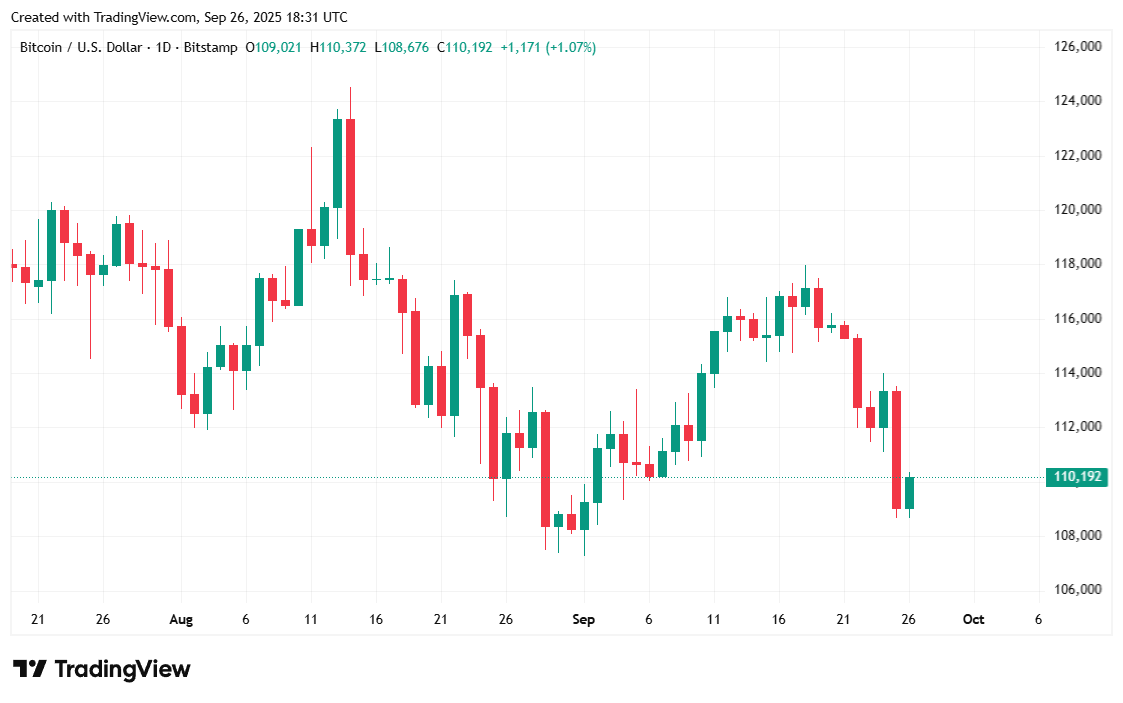

According to CoinmarketCap, Bitcoin was trading at $110,205.45 at the time of writing, but fell 0.57% in 24 hours and 4.97% in 7 days. Cryptocurrency has fluctuated between $108,713.39 and $110,275.44 since yesterday.

(BTC Price/Trade View)

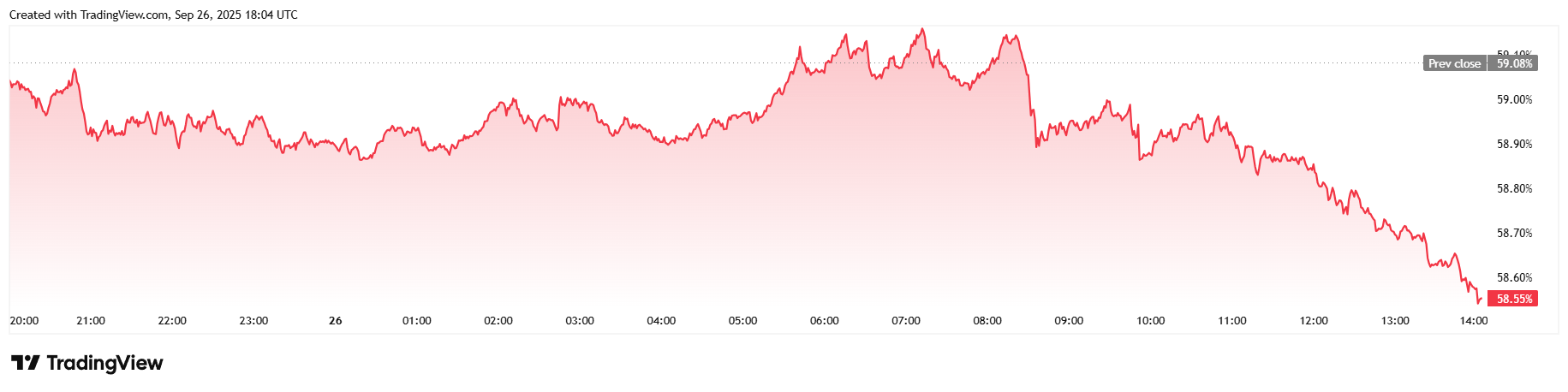

The 24-hour trading volume fell 2.22% to $66.03 billion at the time of reporting. Market capitalization rose 0.56% to $2.18 trillion, while Bitcoin's domination fell 0.90% in 24 hours, sitting at 58.55%.

(BTC dominance/trade view)

Total open interest on Bitcoin futures rose 1.45% from Thursday to $79.07 billion, according to Coinglas data. Bitcoin liquidation in the last 24 hours totaled $3253 million, with a long liquidation with that total of $20 million and shorts making up the remaining $11.77 million.