Bitcoin's spot price fell more than 5% against the US dollar on Tuesday, wiping out more than $7,000 in value since the first trade of the day. This decline has hit the miners directly behind the hashing power, with revenues dropping to levels not seen since April 8, 2025, and leaving many rigs running to survive.

Falling Bitcoin hash price puts pressure on mining margins

As of 2:30 p.m. ET, Bitcoin is trading wildly, falling 5% against the U.S. dollar and fluctuating between $100,175 and $107,302 per coin. Bitcoin has fallen below the $100,000 level on some exchanges, such as Bitstamp.

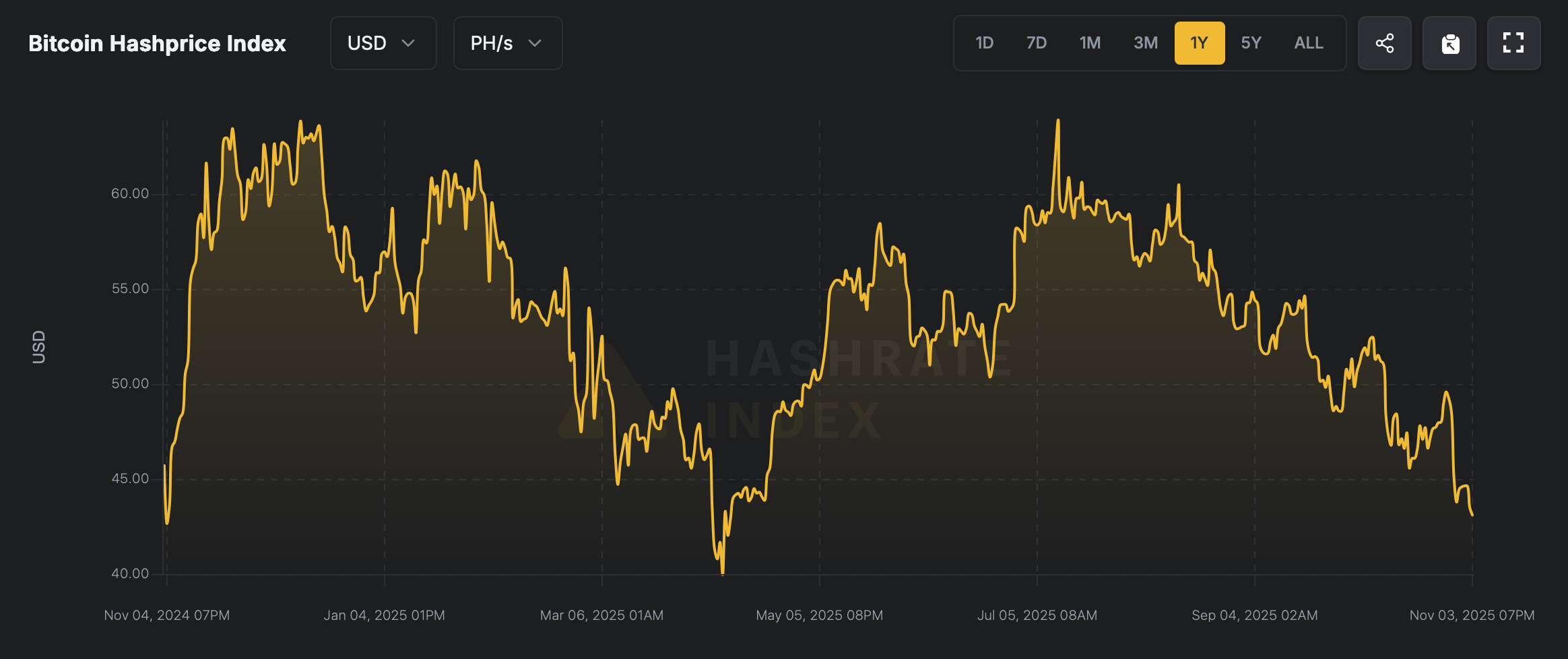

According to data from hashrateindex.com, the Bitcoin hash price (current rate of SHA256 hash rate of 1 petahash per second (PH/s)) is currently $40.85. It was at a healthier price of $49.61 per PH/s just 8 days ago, and miners are definitely feeling the difference by 17.66%.

Bitcoin hash price on November 4, 2025, according to hashrateindex.com.

It's not been a dream week for Bitcoin miners who have seen their value melt away, but the downturn began in July. Back on July 11, 116 days ago, the hash price was $63.92 per PH/sec. Fast forward to November 4, 2025, and miners will earn 36.09% less for the same hashing power. Even though hash prices have fallen, Bitcoin's network remains a serious powerhouse, exceeding zettahashes, or more than 1,000 exahashes per second (EH/s).

At the time of writing, approximately 1,111.99 EH/s has secured the chain, and it is progressing smoothly. Block spacing is still around the 10-minute sweet spot, and so far the difficulty forecast for November 12th suggests little change. If prices continue to fall while difficulties remain high, miners, especially those operating older rigs or paying high energy bills, could face a profitability crisis.

The combination of falling hash prices and constant hash rates could force smaller operations to shut down their machines and consolidate power among industrial-sized farms. On the other hand, if tensions ease due to a rebound in the Bitcoin price or an adjustment in difficulty, the tide could change. Cheaper energy, more efficient hardware, or new market optimism might help miners breathe again, but for now, it's a waiting game in the high-voltage business.