August is not known exactly as a great month for Bitcoin (BTC). It has been more than a decade since major cryptocurrencies were traded on exchanges. This month, no matter how strong the trend is, we often bring some of our biggest dips.

Looking back at the past 13 years, Bitcoin has only closed four times in August. rest? It is mostly red, and losses often span double digit territory.

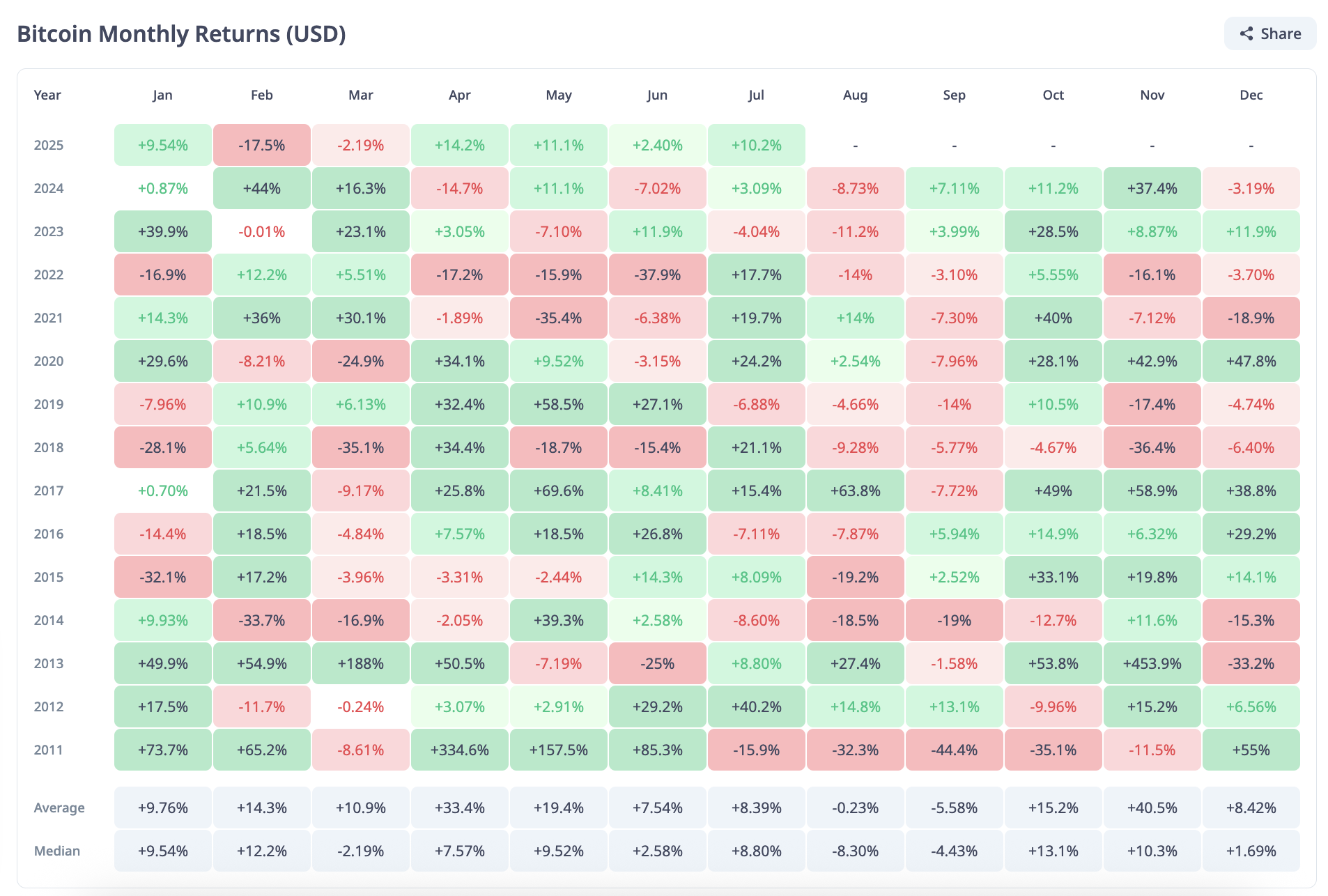

According to Cryptorank, the median return in August was around -8.3%, which has become quite ugly in a few years, including 2011, 2014, and 2015. Even in relatively good years like 2022 and 2023, BTC saw a decline of 14% and 11.2% in August, respectively.

It was the same story every year: summer gatherings burst, volume fades, traders disappear, and prices quietly drop as macro horror begins.

But here's the catch – I haven't played by normal rules in 2025. After a volatile start, Bitcoin made a comeback, winning nearly 30% in the second quarter and surged at 10.3% solids in July. The price structure appears to be stable rather than reaching its limits.

Curse or a cycle break?

Although no dumps have been made in early August so far, on-chain data suggests that sales pressure has not been as strong as in the past few years. The exchange balance is low, with more money in it, and for now at least, the fear of another long-term slump in the summer is beginning to fade.

If Bitcoin can do good in August, it's not just a one-off. It could be the beginning of a major change in market behavior. Q4 is usually when things get busy and may set the tone of next things by breaking the August curse.

This time, the market appears to be ready, but it could probably give Bitcoin a chance to shine in August.