Analysts say that as long as long-term holders continue to take profits, the Bitcoin price will face a difficult path.

Analyst James Cech said on Sunday that the crypto market's failure to recover was not due to manipulation, paper bitcoins or repression, but “just good old sellers.”

Check added that the significant sell-side pressure from existing Bitcoin (BTC) holders is not yet widely recognized.of At the moment it is a source of resistance.

The analyst shared a graph that shows the average age of used coins has been increasing throughout the cycle, with long-term holders selling.

In another chart, realized gains soared to $1.7 billion per day, while realized losses rose to $430 million per day, the third-highest level this cycle.

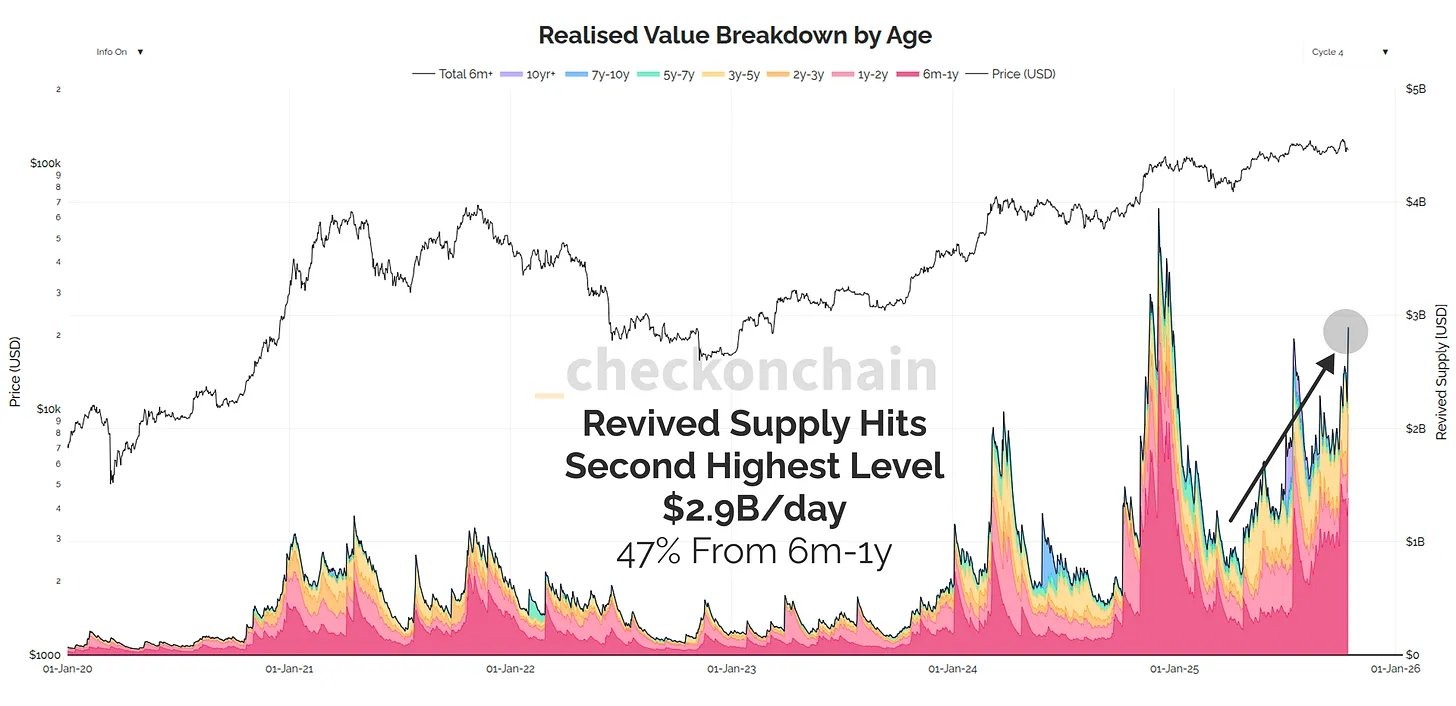

Meanwhile, “revival supply” from old coins reached the second-highest level at $2.9 billion per day.

When the old one makes a profit, the old coins are resupplied. sauce: james check

Bitcoin OG takes profits

Cryptocurrency investor Will Clemente opined that “BTC’s relative weakness last year was primarily due to the transfer of supply from OG to TradFi,” which can be seen in on-chain data.

“As much as everyone focuses on BTC’s relative weakness, this dynamic will become largely irrelevant in the coming years.”

Galaxy Digital CEO Mike Novogratz echoed similar sentiments in an interview with Raoul Pal last week.

“There are a lot of people in the Bitcoin world who have been on it for a long time and finally decided, “I want to buy something,'' he said, citing a friend who bought a yacht and became a member of a sports team.

“We've had some great results, so we're reducing headcount and we're just digesting that revenue.”

Novogratz acknowledged that the only sources his company has identified are “old OG” and miners.

Weekly closing price maintains support

According to TradingView, Bitcoin maintains support at the weekly closing price of $108,700.

“If we continue to hold here, the price could rise to over $120,000 over time. Stability here is absolutely key,” analysts Recto Capital said on Sunday.

At the time of writing, the asset had recovered $110,000, but faces further resistance beyond this level.