Analysts are questioning whether November deserves its reputation as Bitcoin's “strongest month” in history, after Bitcoin has fallen 10% over the past seven days and at one point fell below $90,000.

“Historical averages suggest strength, but the numbers are biased and the current backdrop is anything but normal,” James Harris, CEO of crypto yield provider Tesseract, told Cointelegraph.

Harris said that while it was notable that it was below the long-term average, it was “not the whole picture.”

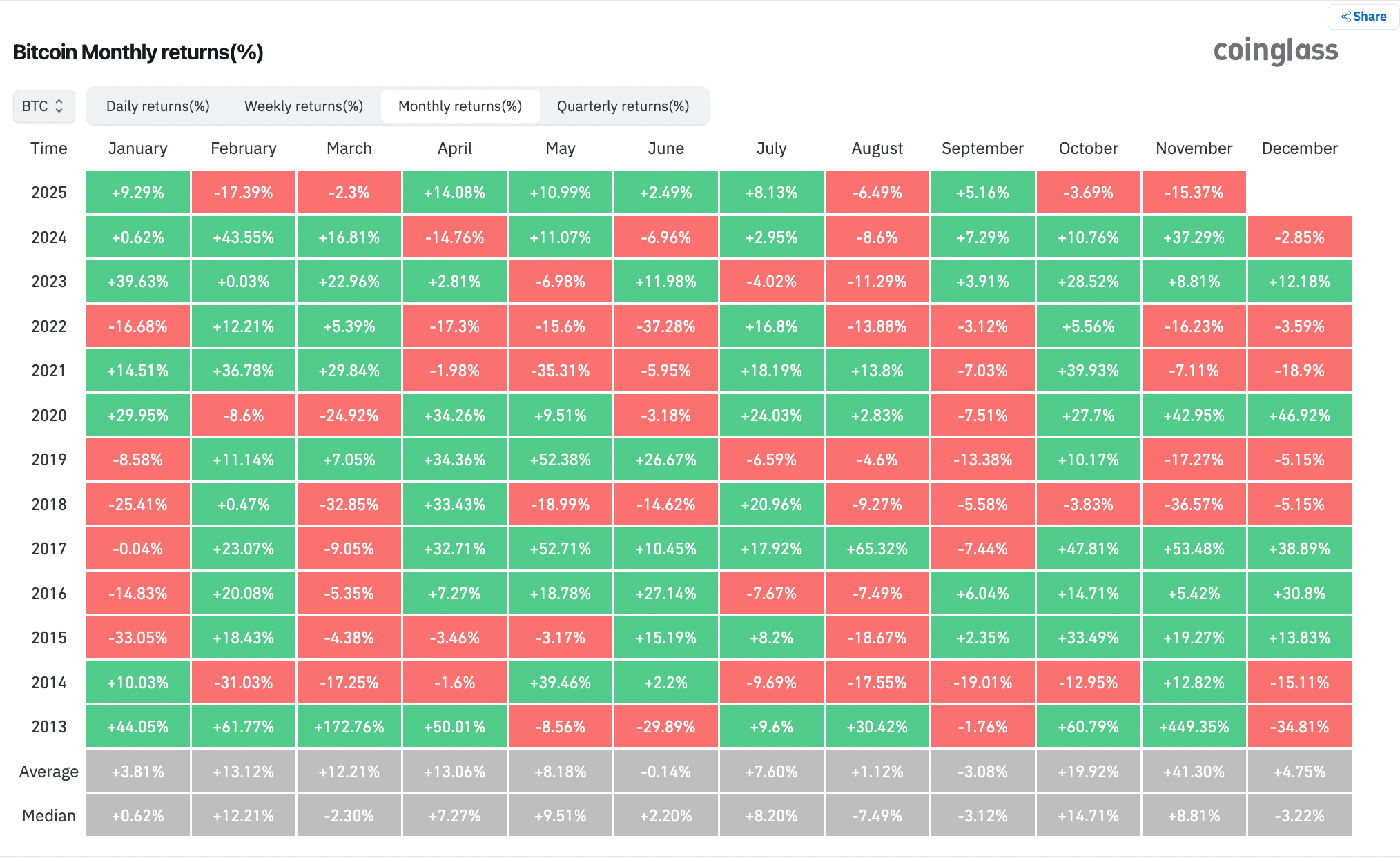

According to Coinglass, Bitcoin (BTC) has fallen 15.37% since the beginning of the month and is on track to record its worst November since 2019, when it ended the month down 17.27%.

Bitcoin ended October down 3.69%. sauce: coin glass

Bitcoin is up 1% over the past day, rising from a low of less than $89,400 to $93,290, according to CoinMarketCap.

Harris said comparing the current market environment to past years is “not identical,” noting that the U.S. government shutdown delayed major economic indicators by six weeks.

“When we reopened, the information backlog caused investors to reprice inflation and assess their expectations almost overnight,” he said.

Confidence among market participants that the US Federal Reserve will cut interest rates in December also plummeted to 41%, according to the CME FedWatch tool.

It is possible that Bitcoin will hit a new all-time high before the end of the year, but it is unlikely.

Harris said there is still a chance that Bitcoin will regain momentum and hit new all-time highs by the end of the year, but he is not betting on it.

“It's possible, but it's not something we're predicting,” he said.

Bitcoin last hit an all-time high of $125,100 in early October, and traders are eyeing November, its strongest month in history, for a possible continuation of the bull market.

Bitcoin’s average return in November since 2013 was 41.35%, a figure that was further inflated by 2013’s 449% surge and was about 277% higher than March, the second-highest gain of the year.

Bitcoin shows 'early signs of stabilization'

Bitfinex analysts believe the worst of Bitcoin's decline may be nearing its end.

At the time of publishing this article, Bitcoin is trading at $93,290. sauce: coin market cap

“It feels like the time has come for a regional bottom to be established relatively quickly,” analysts said in comments shared with Cointelegraph.

“Through multiple historical cycles, sustainable bottoms have formed only after short-term holders have suffered losses, and not before,” they added.

Related: Cryptocurrencies crash over the weekend, temporarily erasing 2025 gains for Bitcoin

However, the November rally that traders are hoping for could actually spill over into December. The Bitfinex team said it was seeing “early signs of stabilization following one of the sharpest corrections of the cycle” and selling pressure was starting to ease.

Analysts at crypto payments firm B2BINPAY agreed: “A sustained recovery could form just as quickly.”

“The first meaningful resistance is in the $97,000 to $100,000 range,” they said. “Sentiment is very likely to remain defensive until BTC tries to recover it.”

magazine: Crypto Massacre — Is Bitcoin’s 4-Year Cycle Over? Trade Secrets