Bitget Wallet has partnered with MasterCard and infrastructure provider ImmerSve to launch crypto link cards. Holders can make payments directly from their digital wallets and are available to all merchants who accept MasterCard globally.

Bitget Wallet will work with leading payment processor MasterCard and infrastructure provider ImmerSve to provide new crypto cards. This product is intended to make cryptographic usage seamless by spending balances directly from the crypto wallet. Holders can pay more than 150 million merchants who accept MasterCard globally.

Exchange wallet app processes real-time funds via on-chain swap and deposits. Users can apply for the card digitally and add it to a mobile wallet that can be used by both physical and online merchants.

“Digital wallets are becoming as ubiquitous as email addresses. MasterCard is working with innovative companies like Bitget Wallet and Immerve to make Crypto Transactions simple, secure and accessible at scale.” said Scott Abrahams, Executive Vice President of MasterCard's Global Partnerships.

ImmerSve will become the main card issuer, but transactions resolve on-chain and process payments and notifications via MasterCard Digital First Technology. Issuing cards includes monitoring of KYC and money laundering.

The new cards will gradually unfold with plans to start with the UK and the European Union and expand to Latin America, Australia and New Zealand within a few months.

Bitget attracts interest in real cryptographic applications

Cards arrive when crypto payments are increasing and are driven by an increase in supply of stablecoins. The Crypto Payments ecosystem also aims to connect to mainstream fintech solutions.

“Cryptocurrency payments must be as seamless and secure as traditional transactions. This partnership allows Bitget Wallet users to pay with Crypto Anywhere MasterCard. Jamie Elkare, CMO said With a Bitget Wallet.

Bitget wallets reach over 80 million users worldwide, providing independent users to all their assets. This card allows you to apply these independent assets to everyday commerce. Cardholders have optional incentives, including transaction-based rewards, balance yields in wallets, and one-time KYC bonuses.

Defi Use Case revives Bitget usage statistics

The recent revival of Defi and decentralized trading has led to an increase in use cases for Bitget wallets. Multi-asset wallet supports over 130 blockchains, 20,000 decentralized apps and 1 million tokens. The wallet is also a trading hub, swapping hundreds of available DEXs with seamless bridging.

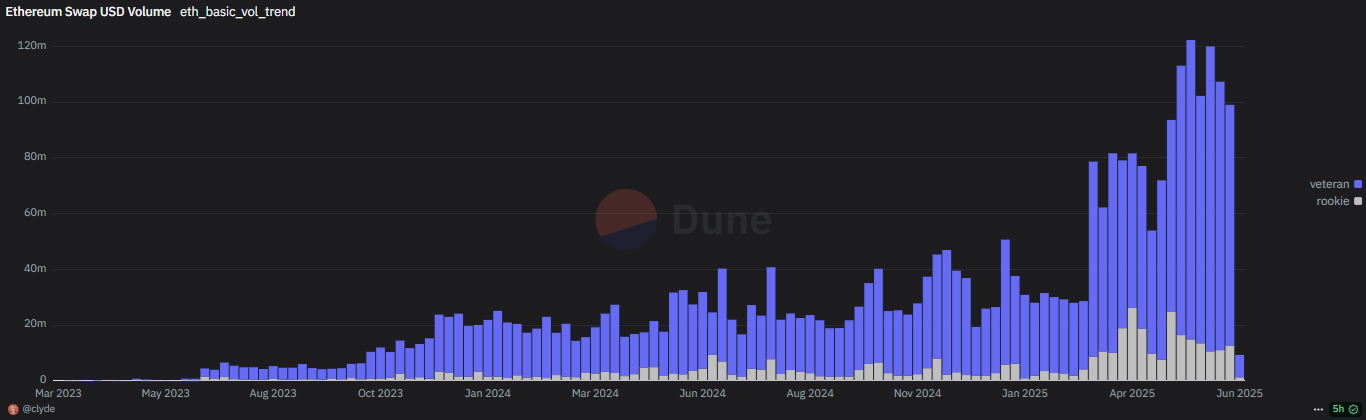

Bitget saw the return of older Ethereum traders as Defi was revived. The Bitget wallet has a considerable amount from BNB Smart Chain Swap. |Source: Dune Analytics

I also watched Bitget in 2025 Influx Of the older returning traders at Ethereum, they far outweigh the amount of new traders. The wallet was placed to take advantage of defi recovery and waves of new tokens and projects.

Bitet is protected by an additional $300 million user protection fund in the case of hacks and exploits. Wallets are already facing problems with flawed trading smart contracts when hackers find a loop and misuse voxel tokens, causing losses up to. 100 million dollars.

Currently, Bitget has a very active swap from Tron, with Ethereum, BNB Smart Chain, Arbitrum and Solana also among the main networks. Exchanges see more than 30% of exchange traffic from BNB Smart chains, which are booming due to special campaigns and incentives.