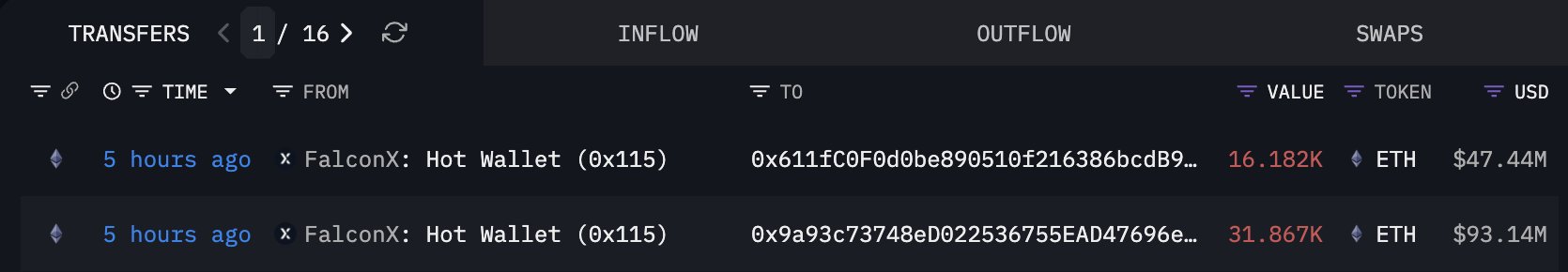

Two large Ethereum transactions flowed from FalconX and Lookonchain connected them to ETH treasury company BitMine.

BitMine received 48,049 Ethereum from FalconX

In a new post about

In two transactions, the coins were transferred to two different wallets. The larger transfer contained 31,867 ETH, and the smaller transfer contained 16,182 ETH. In total, the tokens were worth approximately $140.58 million at the time of trading.

The two transfers made by BitMine to acquire ETH during the past day | Source: @lookonchain on X

The move came as Ethereum plummeted along with the broader cryptocurrency sector, sending its price below the $3,000 level. So, it seems likely that this is a sign that BitMine is buying the dip.

Originally a company focused on Bitcoin mining, BitMine transitioned to an Ethereum treasury vehicle in June of this year under the leadership of Chairman Tom Lee. Afterwards, the company quickly accumulated cryptocurrency and established itself as ETH's 'strategy'.

On Monday, BitMine issued a press release announcing that reserves had reached 3,967,210 ETH. So far, the company has not officially announced its latest purchase, but if confirmed, it will push its total reserves past the 4 million ETH milestone.

The company has set a target of 5% of the total circulating Ethereum supply. Currently, the company still has a long way to go before it achieves this goal, but with about 3.3% of supply currently in wallets, it has certainly made significant progress.

With holdings valued at more than $11 billion, BitMine is the second-largest holder of a cryptocurrency company in the world, after Strategy. However, unlike Michael Saylor's company, the Ethereum hoarder is currently underfunded. Nonetheless, if both blockchain transactions coincide with purchases, this is a sign that BitMine is still working to accumulate more.

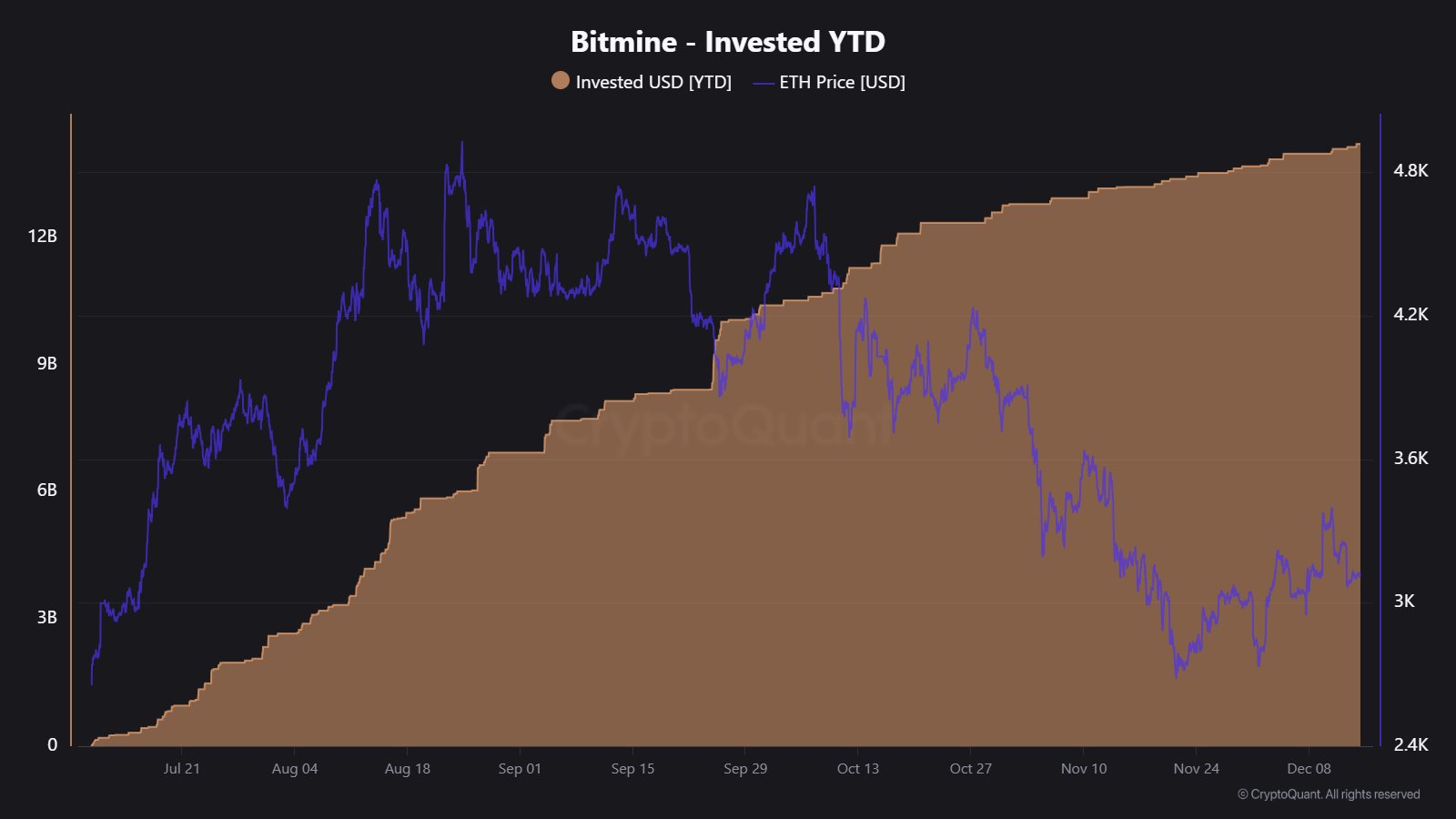

In his X post, CryptoQuant community analyst Maartunn talked about how the Ethereum price has changed since BitMine started accumulating. As you can see from the chart, ETH showed rapid growth during the initial purchase period.

The trend in the capital invested by BitMine into ETH | Source: @JA_Maartun on X

But apparently, despite continued buying from treasury companies, asset prices first plateaued and then fell. “Large buying ≠ continued momentum,” the analyst said.

ETH price

Ethereum rebounded to $3,400 last week, but then experienced bearish momentum again as the price returned to the $2,930 level.

Looks like the price of the coin has plummeted over the last week | Source: ETHUSDT on TradingView

Dall-E, CryptoQuant.com, featured image from intel.arkm.com, chart from TradingView.com

editing process for focuses on providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards, and each page is diligently reviewed by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of the content for readers.