Bitmine Immersion Technologies, a publicly traded crypto treasury firm linked to investor Tom Lee, has significant unrealized losses on its Ether holdings following a recent wave of market liquidations, highlighting the risks faced by crypto balance sheet strategies during sharp economic downturns.

After earning an additional 40,302 Ether ($ETH) Last week, its total holdings increased to over 4.24 million $ETHBitmine’s unrealized losses rose to more than $6 billion, according to data from Dropstub, a platform that tracks digital asset prices and portfolio valuations.

Based on current market prices, Bitmine's Ether holdings are valued at approximately $9.6 billion, down from an October peak of approximately $13.9 billion, reflecting the impact of widespread crypto sales.

sauce: drop rod

The paper's losses increased as the price of Ether fell towards $2,300 on Saturday, a move Kobisi Letter noted was due to a weak liquidity situation.

“In a market where liquidity is volatile at best, continued extreme leverage levels have created an 'air pocket' in prices,” the market commentator said, adding that “herd-like” positioning had fueled the selling.

Related: Bitmine’s staking Ether holdings suggest $164 million in annual staking revenue

Difficult reset of crypto markets

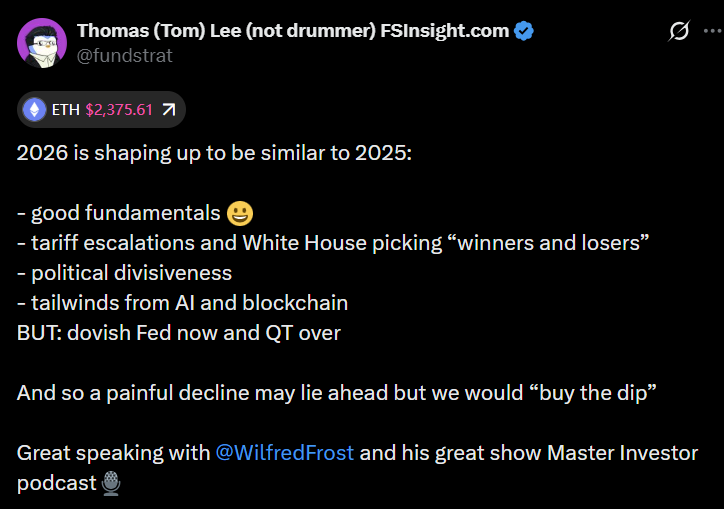

Despite previously giving an optimistic outlook for the end of 2025, Tom Lee warned that the situation was changing and 2026 was likely to start in a “difficult” situation ahead of a potential recovery at the end of the year.

In a recent interview, Lee said that the crypto market is still feeling the effects of deleveraging, even though long-term fundamentals remain intact. He pointed to the October 10 market crash, which wiped out around $19 billion in value, as a key turning point in resetting risk appetite across digital assets.

sauce: tom lee

A recent assessment by market maker Wintermute reflects that view, arguing that structural improvements are needed for a sustained recovery in 2026. These include new momentum in Bitcoin (BTC) and Ether, broader exchange-traded fund participation, expanded digital asset treasury mandates, and a rebound in retail capital inflows.

Wintermute said these elements are needed to restore the broad wealth effect across the market. But retail participation remains limited as investors continue to gravitate towards fast-growing themes such as artificial intelligence and quantum computing.

Related: Bitcoin falls out of the world's top 10 assets due to liquidation