Ethereum has regained the $3,000 level after weeks of heavy selling pressure, but the recovery remains fragile as momentum continues to wane. Markets are still dominated by fear, and confidence among retail traders has been significantly weakened.

Analysts are warning that the bull market is losing control of the trend, with some starting to call for the early stages of a potential bear market. With Ethereum trading nearly 40% below its August all-time high, there has been hesitation after each rally and the broader market environment has not yet stabilized.

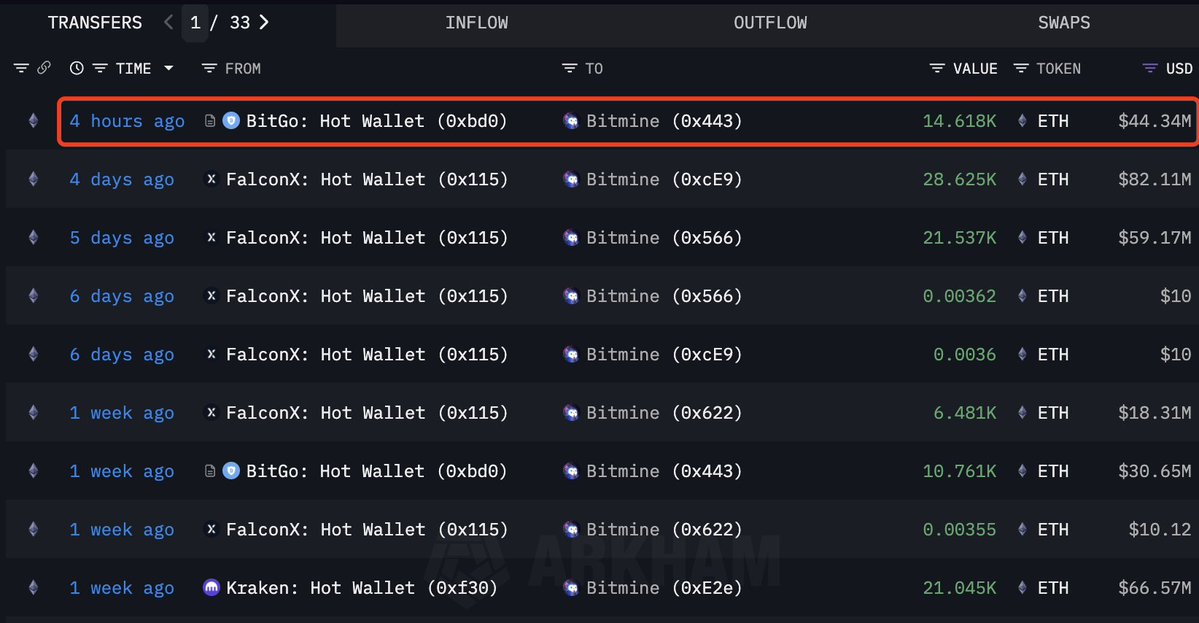

Despite this uncertainty, large players continue to accumulate ETH, providing a signal that contrasts with the prevailing bearish sentiment. According to new data from Lookonchain, Bitmine has been continuously purchasing Ethereum throughout this recession and has shown no signs of slowing down in its accumulation strategy.

This continued interest from large holders suggests that institutional and high-net-worth buyers may still see long-term value at current levels, even if short-term traders remain cautious.

Bitmine's accumulation intensified as Ethereum struggled to gain momentum.

Lookonchain reported that Bitmine continued its aggressive accumulation strategy, purchasing an additional 14,618 ETH worth approximately $44.34 million a few hours ago. This new acquisition further strengthens Bitmine’s already massive Ethereum position, which currently totals 3.436 million ETH. At current prices, their holdings are worth approximately $10.39 billion, highlighting their long-term confidence despite ongoing market turmoil.

This level of accumulation by major companies stands in sharp contrast to the broader sentiment across markets, where uncertainty and fear persist. Retail investors remain cautious, with many analysts arguing that Ethereum's failure to regain momentum above $3,000 is a sign that the trend is weakening.

However, Bitmine's continued buying suggests a fundamentally different outlook – one rooted in long-term valuation rather than short-term volatility.

Large, disciplined buyers often accumulate during weak markets and view discounted prices as strategic entry points. Bitmine’s behavior reflects this pattern and may indicate expectations of higher prices in the coming months.

Nonetheless, if Ethereum is to benefit from this institutional trust, it will need to stabilize and build a stronger support base. The coming weeks will reveal whether this continued whale demand will outweigh broader selling pressure and help ETH break out of its current downtrend.

ETH attempts to recover but faces strong resistance

Ethereum is attempting to recover after weeks of sustained selling pressure and has regained the $3,000 level, but is still struggling to build meaningful momentum. The chart shows ETH bouncing back from recent lows near the mid-$2,600 range. At this time, a demand group emerged and stopped the rapid decline.

However, despite this bounce, Ethereum currently remains below all three major moving averages (50-day, 100-day, and 200-day), which serve as tiered resistance zones.

The 50-day SMA is trending downward and has already broken below the 100-day SMA, signaling a weakening market structure. Meanwhile, the 200-day SMA is slightly above the current price, reinforcing the idea that ETH is still in a vulnerable position. Price action remains choppy, with persistent lower highs forming since the peak in early October, reflecting continued bearish control.

Volume patterns also confirm this warning. The recent rebound has resulted in a slight increase in buying activity, but it is still well below the selling volumes observed during the November capitulation. A meaningful trend reversal would require ETH to break the $3,300-$3,400 area, regain its moving average, and set higher lows.

Featured image from ChatGPT, chart from TradingView.com

editing process for focuses on providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of the content for readers.