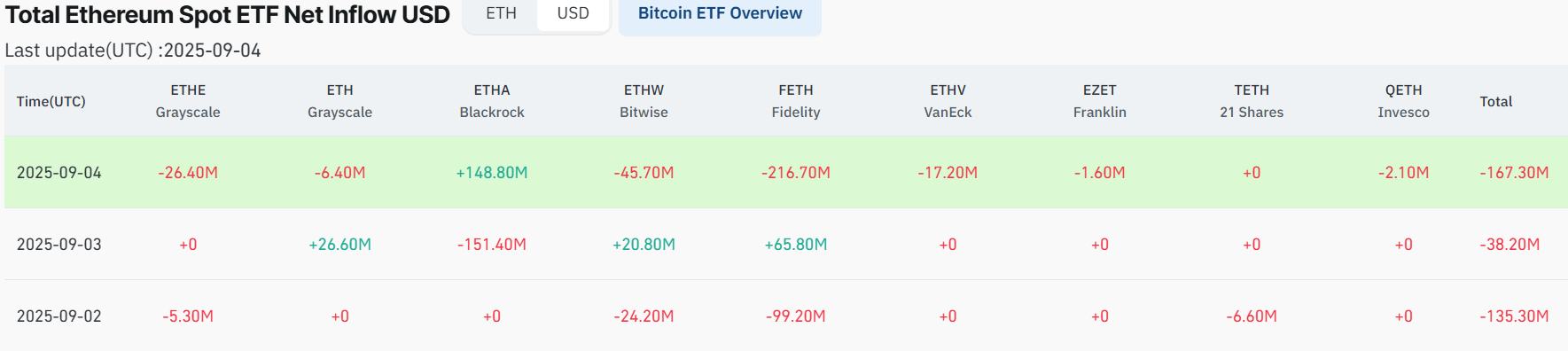

The advantage of BlackRock's Spot Ethereum (ETH) Exchange Trade Fund (ETF) was on display on September 4th, when the world's largest investment company warped its competitors in the market.

In this case, BlackRock recorded a net Ethereum ETF inflow of $148.8 million, becoming a far higher rival to the only major buyer, according to data obtained by Finbold. Coinglass.

In contrast, some competitors faced intense redemptions. In particular, Fidelity led the sale with a $226.7 million spill followed by Bitiwise at $45.7 million.

Grayscale's Ethe flowed $26.4 million, while its independent Ethereum Trust saw an additional $6.4 million redemption.

Meanwhile, Vaneck, Franklin and Invesco lost less by $17.2 million, $1.6 million and $2.1 million, respectively. Overall, the market recorded net withdrawals of $167.3 million for all issuers despite the BlackRock surge.

Ethereum ETF records more spills

However, the photos were different on September 3, when the market outflow was a more modest $38.2 million. Fidelity raised $65.8 million, while Bitwise added $20 million, while BlackRock recorded a $151.4 million spill.

On September 2nd, this trend was equally negative, with a total redemption of $135.3 million driven by a large sales at loyal and Bitwise.

BlackRock's Ethereum Investments has played a central role in raising the price of assets in recent weeks, and it is worth noting that ETH has risen to a new all-time high of nearly $5,000.

In late August, BlackRock's ETHA led the sector inflow with $323 million in one session, pushing the cumulative Ethereum ETF inflow by more than $13 billion.

In fact, BlackRock's success in both Bitcoin and Ethereum also encouraged speculation about the next step. The report suggests that asset managers are considering offering a broader range of crypto ETFs, potentially expanding to assets such as Solana and Cardano.

Featured Images via ShutterStock