Nearly four months after the Securities and Exchange Commission (SEC) granted BlackRock Inc.'s application to allow it to invest in an Ethereum ETF, the $10 trillion investment firm has registered a new Ethereum Trust.

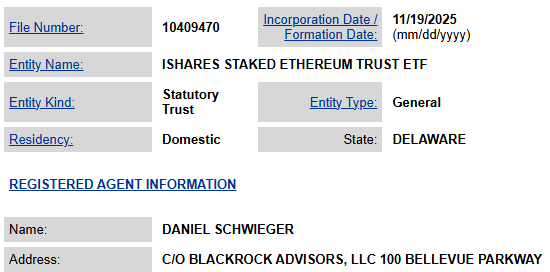

iShares Stake Ethereum Trust was incorporated today in Delaware, according to state filings.

Delaware corporation registration

BlackRock's ETHA is the largest Ethereum ETF with over $13 billion in assets under management (AUM), while its next largest competitor, Fidelity, holds just $2.5 billion in ETH.

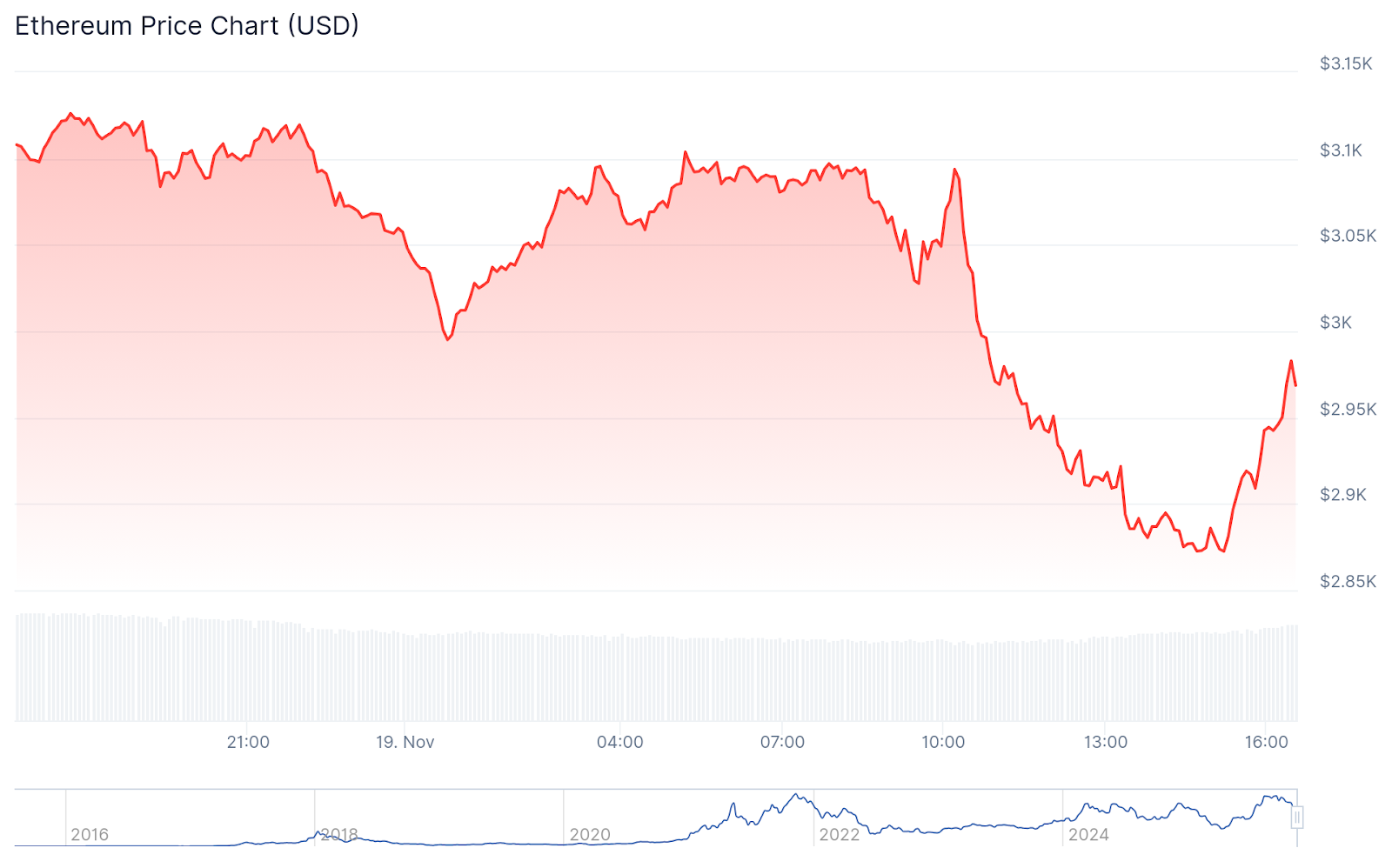

ETH rebounded 2% on the news, but it's worth noting that this price rally coincided with a broader crypto market rally that saw Bitcoin rise above $90,000 following Nvidia's quarterly earnings report. Despite this rescue rally, ETH is still down 4% on the day.

ETH Chart – CoinGecko

Ethereum ETF staking will be BlackRock's first crypto product to offer yield to investors, potentially greenlighting further staking crypto ETFs from BlackRock and other issuers.