BNB Chain has overtaken TRON to become the most active network for stablecoin trading due to the surge in DEX volume and the ripple effect from Binance’s trading incentives. However, analysts at ARK Invest noted that the field is becoming more fragmented.

summary

- BNB Chain has overtaken TRON as the busiest network in stablecoin activity due to increased on-chain trading and Binance-backed incentives.

- Although Ethereum and its Layer 2 still dominate institutional payments, BNB Chain currently leads in user engagement and decentralized transaction volume.

- According to the report, the market is becoming more fragmented, with liquidity spread across multiple chains rather than being concentrated in a single network.

BNB Chain has quietly dethroned TRON as the largest network in terms of stablecoin activity.

According to ARK Invest’s “The DeFi Quarterly” report, approximately 192 million addresses have interacted with stablecoins since the first stablecoins hit the market. Of this, Tether (USDT) dominates with about 115 million, but the now-defunct Binance USD (BUSD) still accounts for 35 million, followed by USD Coin (USDC) with 31 million.

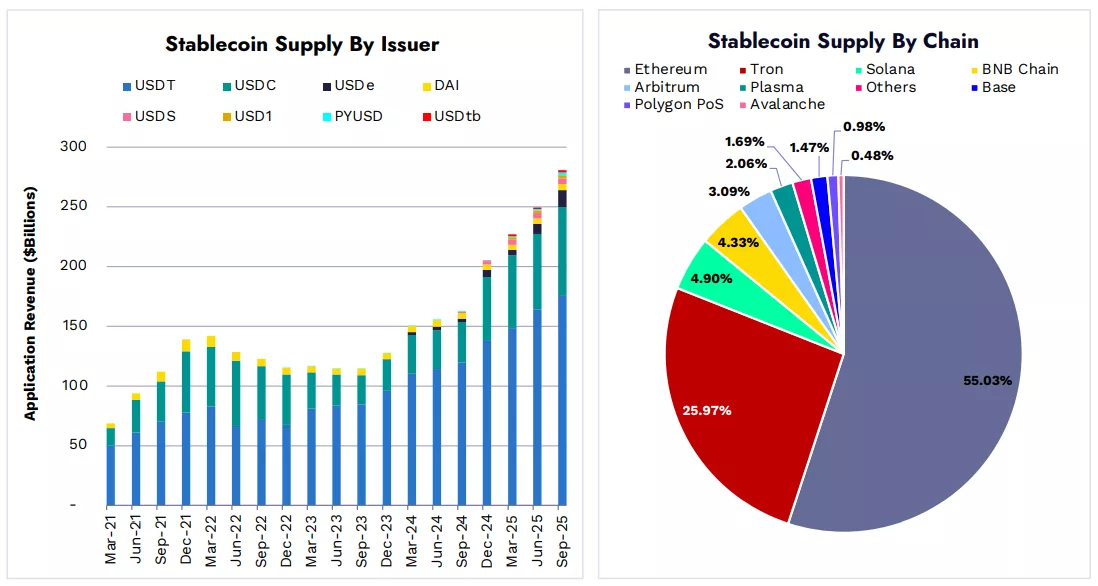

Stablecoins by issuer and chain |Source: ARK Invest

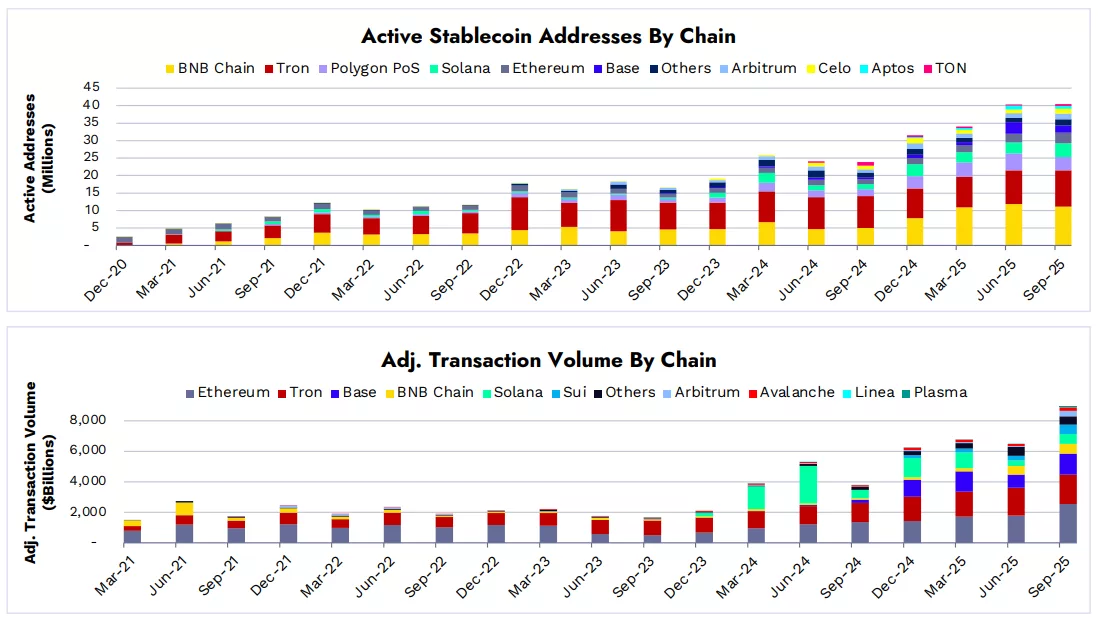

As ARK analysts note, stablecoin quarterly adjusted trading volume is “up 43% year-to-date and approaching $9 trillion in Q3 2025,” suggesting that stablecoins are circulating faster and on more networks than ever before.

network share

Ethereum remains the biggest elephant in the room. Especially when you consider layer 2 such as Base and Arbitrum, which together process around 48% of all stablecoin transactions. TRON, on the other hand, built its footprint by carrying USDT flows across emerging markets. This dynamic kept TRON relevant long after new players entered the scene.

However, the network share is changing, with the report showing that Ethereum’s share of stablecoin supply rose from 51% to 55%, while TRON fell from 32% to 26%. And somewhere in that restructuring, the BNB chain made a move, regaining some slack as Solana lost ground and trading activity moved elsewhere.

Active stablecoin addresses per chain |Source: ARK Invest

This row of the report captures changes in supply distribution between chains. BNB Chain's gain came as Solana stalled and spot DEX activity moved.

DEX volume tells the same story. Since late 2024, decentralized trading has surged about 61%, from about $1 trillion to $1.7 trillion. Meanwhile, Solana's share plummeted from 47% to 19%, while BNB Chain's share jumped from 11% to 47%.

Boom or TVL

The change follows Binance's zero-commission trading program, which “sparked PancakeSwap's trading volume and redirected memecoin trading from Solana to BNB Chain,” as explained by ARK Invest.

The program also made certain trade flows on the BNB chain more attractive as traders moved meme coins and retail liquidity to a chain closely aligned with Binance, the report said.

You may also like: BNB Chain Announces $45 Million Airdrop Reward to Traders Who 'Experienced Loss' Due to Meme Coin Crash

Additionally, BNB Chain also stands out for its transaction efficiency. As of Q3 2025, the chain had the highest spot DEX volume relative to total value locked (TVL). According to the report, the network's quarterly transaction volume has soared to 94.7x that of TVL, a ratio that is much higher than Ethereum's roughly 3.83x.

While Ethereum still attracts large, long-term funds and moves less frequently, the BNB chain concentrates higher turnover and more speculative flow.

Intensifying competition in a fragmented space

Stablecoin supply trends are also changing. The combined market share of USDT and USDC has declined slightly this year from 93% to 89% due to the rise of new entrants. Ethena Labs' USDe rose about 68% to nearly $14 billion, while PayPal's PYUSD rose 135% to about $2.4 billion, most of it in Ethereum, ARK noted.

In addition to that, the ratio of DEX to CEX has also changed. That ratio rose by about 192% in 2024 due to an increase in on-chain trading versus centralized exchanges.

BNB Chain may not be able to replace Ethereum as the primary network for institutional stablecoin storage or the primary payment hub, but it holds the throne in terms of active user engagement and DEX-driven transactions, even though Ethereum and its Layer 2 still handle the largest share of dollar-denominated transactions, the report notes.

As the ARK report suggests, the broader result is market fragmentation. Stablecoins are moving through more chains and venues than ever before. This fragmentation poses new challenges for liquidity and routing, but also leaves room for each network to specialize in what it does best.

read more: Ondo Global Markets promotes RWA adoption on BNB chain