Cryptocurrency exchange Coinbase has added Binance’s BNB token to its listing roadmap as a range of online exchanges discuss the process.

On Tuesday, Limitless Labs CEO CJ Hetherington wrote a post on X that contrasts what he claims is a requirement for tokens to be listed on Binance rather than Coinbase. The CEO said Binance's requirements included a 2 million BNB deposit for a spot listing, while Coinbase's requirements were limited to “building something meaningful on Base.”

The online exchange has sparked controversy, which seemed to intensify when Coinbase's Head of Base, Jesse Pollack, said, “The cost of listing on an exchange should be 0%.”

Binance initially responded to Hetherington in a now-deleted X post, threatening legal action against the CEO and saying some of his claims were “false and defamatory.” The exchange claimed that it did not receive any fees for listing the tokens.

“While we stand by our position, the way we communicated went too far and we sincerely apologize to our users, partners, and the entire industry,” Binance said in a follow-up to the now-deleted post on Wednesday.

Related: Bybit denies $1.4 million in publication fees and Company X's school advertising accusations

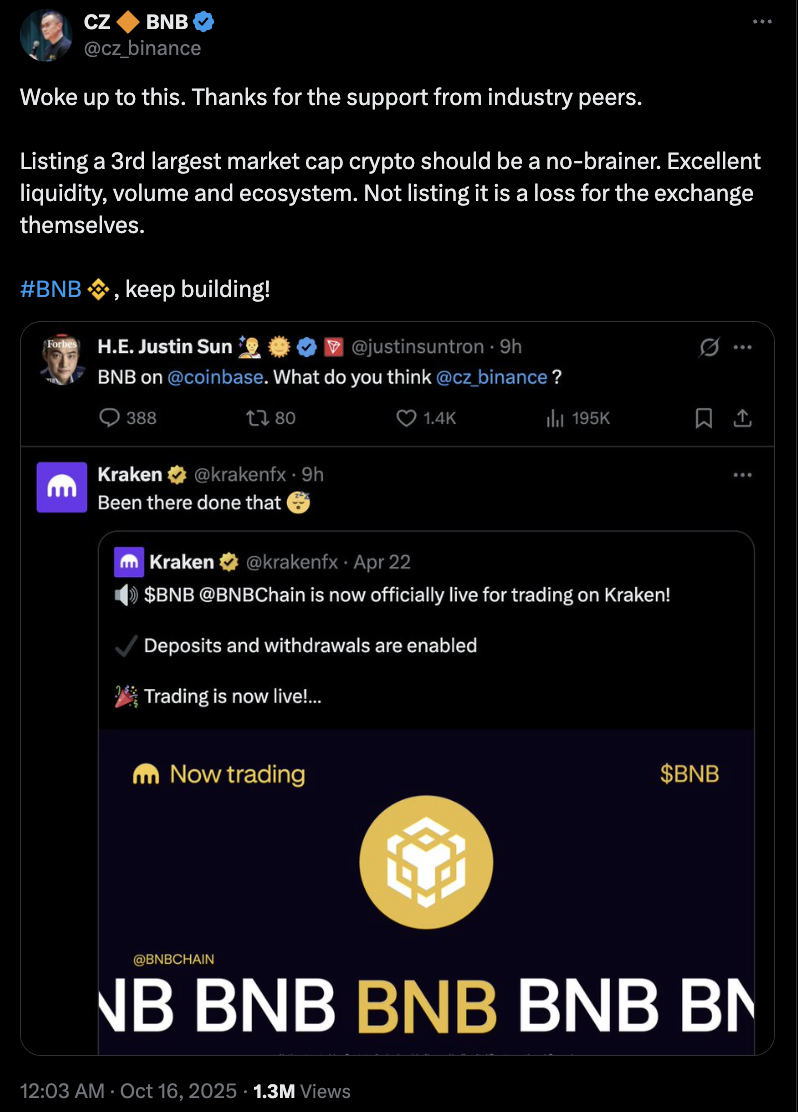

Influenced or not by the social media controversy, Coinbase added BNB to its roadmap on Wednesday, indicating plans to list the token. Former Binance CEO Changpeng “CZ” Zhao praised the move, but later urged Coinbase to “list more BNB Chain projects.”

sauce: Zhao Changpeng

CZ is Binance's largest shareholder, but he no longer plays a management or operational role following an agreement with US authorities to step down as CEO in 2023. However, CZ reportedly still controls 64% of BNB's circulating supply of approximately 94 million tokens as of June 2024.

Improving the transparency of exchange listings

Cryptocurrency traders know the value of having a token listed on a top-level exchange in driving prices up quickly, either immediately after news or slowly through increased adoption. Both Coinbase and Binance have taken steps to implement new changes to their token listing process as the number of cryptocurrencies increases.

In March, Binance launched a community collaborative governance structure, allowing users to vote on whether their tokens should be listed or removed from the list. The announcement comes a few weeks after CZ posted on

Coinbase CEO Brian Armstrong made similar remarks in January, saying the company needed to rethink its listing process given that “approximately 1 million tokens are currently being created each week and growing.” In September, the exchange announced that all token applications are “free and merit-based” and published a guide that includes business evaluations and legal reviews.

As of Thursday, BNB was the third-largest cryptocurrency with a market capitalization of about $160 billion. At the time of publication, BNB price was $1,149, according to Nansen data.

magazine: Back to Ethereum: How Synthetix, Ronin and Celo saw the light