Itau Asset Management, Brazil's largest private asset manager, has established a dedicated crypto division and has appointed former Hashdex executive Joa Marco Bragada Cunha to lead the new unit.

The unit is based on existing cryptographic products from ItaúAsset, such as the bank's Bitcoin Exchange Trade Fund (ETF) and the retirement fund that provides exposure to digital assets. ItaúAsset manages more than 1 trillion Reais ($185 billion) in client assets.

“The crypto assets segment has unique properties for generating alpha, a relatively new market that creates great opportunities due to its volatility,” says Cunha. He previously served as portfolio management director at Hashdex, the Brazilian company behind one of the nation's first crypto ETFs.

https://www.youtube.com/watch?v=cl1nv-uxag0

This move adds to a broader push to Itaú's digital assets. The bank already offers direct transactions of 10 cryptocurrency pairs through mobile apps, including Bitcoin, Ether, Solana and USDcoin, and processes custody in-house.

ItaúAsset said the new division will develop additional crypto products, ranging from fixed-income-style equipment to highly volatile strategies such as derivatives and staking-based funding. The unit operates within the mutual fund structure of the company that oversees over 117 billion Reais across 15 investment desks.

Related: Brazil's House of Representatives holds hearings on the creation of the National Bitcoin Reserve

Brazil is leading the region in adopting crypto

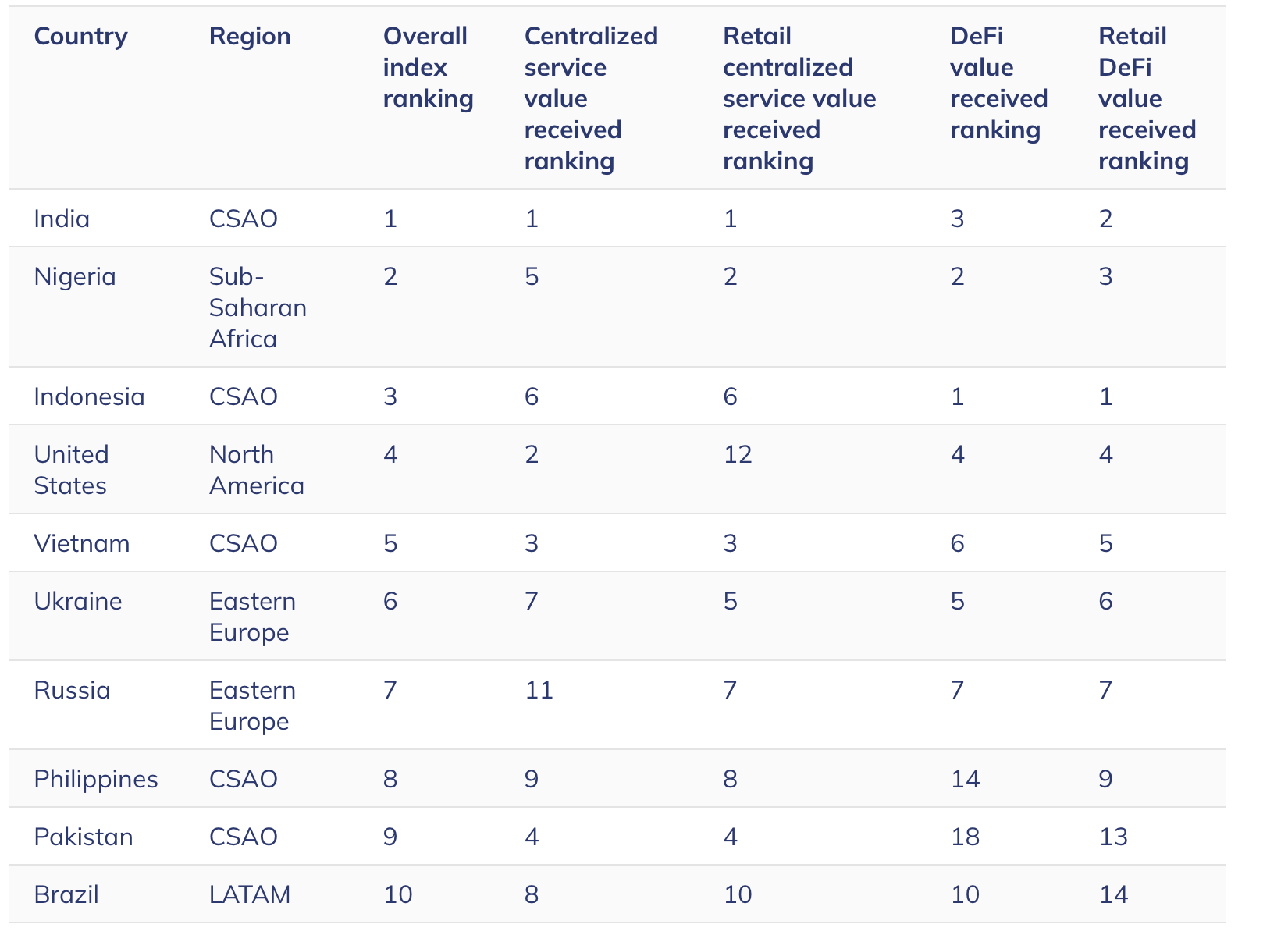

Brazil has emerged as one of the world's largest crypto markets and ranked 10th in the world in chain analysis.

Source: Chain analysis, 2024 Global Recruitment Index

Growth is driven by a supportive regulatory framework. In 2023, Brazil implemented its first comprehensive cryptography, established rules for virtual asset service providers, and allowed central bank monitoring of the sector.

After the law came into effect, ItaúUnibanco began trading Crypto for its retail clients in December 2023, initially providing Bitcoin (BTC) and Ether (ETH) transactions within the mobile app, initially in detention of assets directly provided by banks.

In February 2025, Brazilian securities regulators approved the country's first spot XRP ETF from Hashdex. Around the same time, local lender Braza Bank announced plans to issue actual stub coins on Ripple's XRP ledger.

Still, some regulatory uncertainties remain within the country. In June, Brazil introduced tax reforms, replacing its progressive model with all crypto capital gains with a 17.5% flat.

The policy eliminates a long-standing exemption that allows up to 35,000 Reais ($6,500) on monthly tax-free sales, expanding to independent, Offshore Holdings, Defi and NFTS transactions.

EO faced an immediate rebound and was cancelled later in the same month.

Magazine: Move to Portugal and become a crypto digital nomad – everyone else