Brian Armstrong, co-founder and CEO of Coinbase, said: laughed it off He claims he is not bullish on the company after it was revealed that he was selling the company's stock without buying any of it through a 10B5-1 plan.

The controversy arose after Armstrong responded to a post by Nick Prince, head of product at Base. The post praised one of Coinbase's newest features that allow users to invest in stocks. straight From the platform.

“It feels good to buy Coinbase through Coinbase,” Armstrong said. Although he notes that regulatory restrictions prevent him from using Coinbase directly as a Chapter 16 officer, he claims to be using a 10b5-1 trading plan.

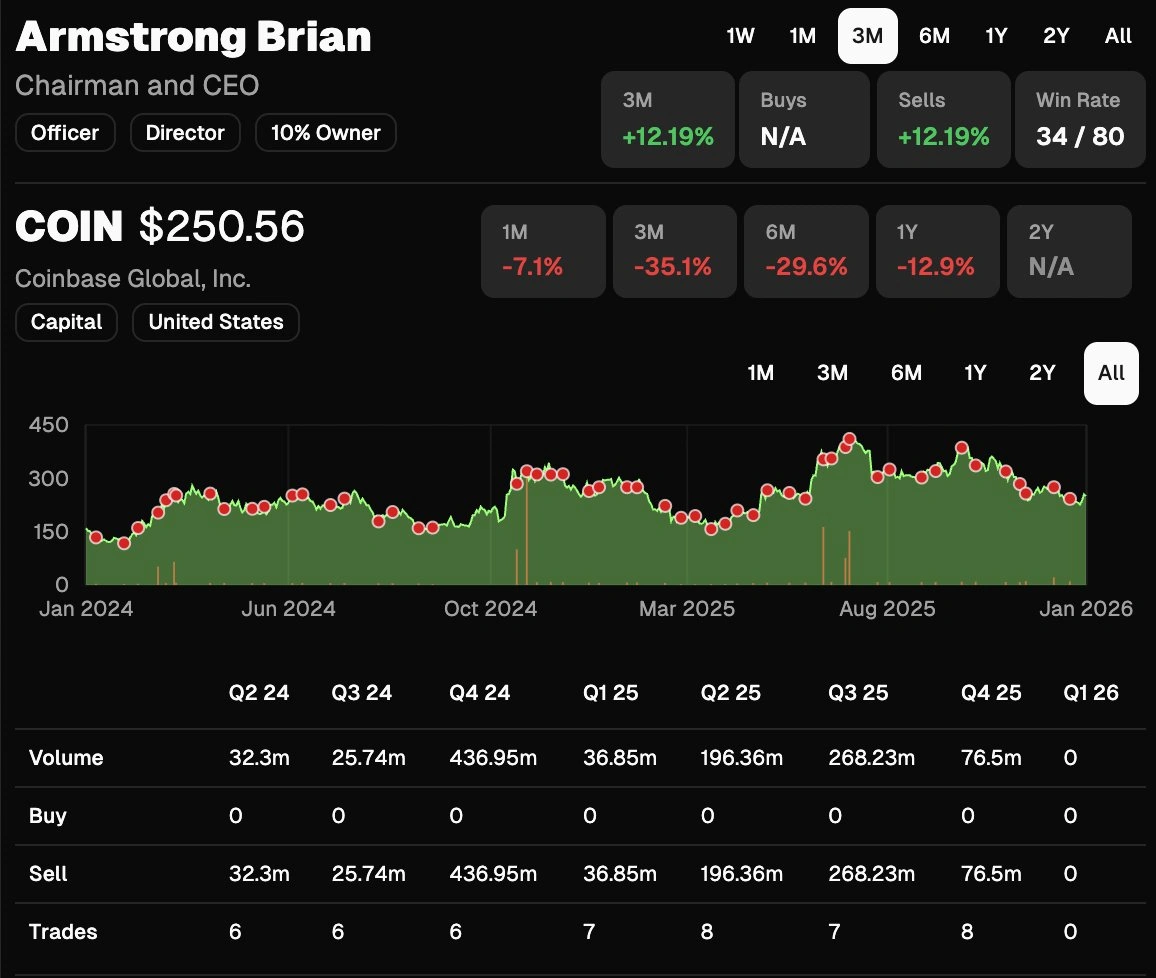

CEO Watcher is a platform to quickly track insider trading activity applied context Armstrong said he executed 88 sales of Coinbase stock through his scheme, but no purchases.

Mr. Armstrong acknowledged his observation about your 1 net worth stock, no? Therefore, there is only one direction go.”

Coinbase co-founder claimshe He still keeps most of his net worth in Coinbase stock, adding that he has been in the business “for a very long time” and is using the proceeds from the sale “to help start more companies.” good. “

Will Brian Armstrong buy Coinbase stock?

Mr. Armstrong's recent trading activity indicates that of Steady divestment pattern. On January 5th, he sold $9.9 million worth of Coinbase stock, as disclosed in an SEC filing. On December 22, 2025, he sold 40,000 shares of company stock valued at approximately $10.2 million.

Mr. Armstrong sold up to $9.9 million in Class A common stock on January 5, according to transaction tracking.

There have Armstrong adopted the current 10b5-1 plan, which sold in significant volumes in the third quarter of 2025. 15 plantst 2024.

Market awareness and focussk

WInvestors typically discount sales made through pre-set plans, but the size of Mr. Armstrong's trades continues to draw intense scrutiny from tracking platforms and market observers.

The irony of the situation is that commentators don't understand that Mr. Armstrong is advertising that you can buy Coinbase stock on Coinbase, even though you can't buy his own company's stock on the platform or even through the channels available to him.

Financial analysts say that after spending more than a decade building Coinbase, concentrating virtually all of one's assets in a single stock holding would be a unique risk, regardless of confidence in the company's prospects.

And Armstrong seems to understand that, as he pointed out that some of those sales are going to other companies.

Coinbase pursues ambitious all-exchange visaahn

THis exchange regarding Armstrong's trading history comes as Coinbase pursues an ambitious expansion beyond cryptocurrencies. In his 2026 roadmap, Armstrong outlined plans to transform Coinbase into a “everything exchange” offering access to cryptocurrencies, stocks, prediction markets, and commodities, but that vision also includes the recently launched traditional stock trading feature that sparked initial discussions.

The company is also developing partnerships for prediction markets and continues to build out its base layer 2 network alongside stablecoins and payment infrastructure.

Coinbase isn't the only exchange to expand beyond cryptocurrency trading. As reported by Cryptopolitan, Bitget is pushing towards 2026 as a universal exchange (UEX), while Binance continues to expand its services, including launching gold and silver perpetual contracts earlier today.