Bitcoin faces strong resistance at the $97,000 level, highlighting the ongoing battle between buyers and sellers. However, current price actions suggest a potential corrective phase prior to a critical breakout.

Technical Analysis

Daily Charts

Bitcoin continued to surge impulsively beyond its critical $90,000 threshold, reaching the $97,000 resistance region. However, bullish trends have temporarily stalled at this important level, and prices have struggled to surpass them. The recent consolidation of nearly $97,000 reflects the presence of supply and the clear battle between buyers and sellers.

Additionally, the 100-day moving average is below the 200-day moving average, forming a death cross, which can weaken momentum. Given the current structure, Bitcoin appears poised for a short-term correction pullback or integration into the $90,000 area before potential breakouts exceeding $97K resistance.

4-hour chart

In the lower time frame, Bitcoin's struggle at the $97,000 mark is even more pronounced. After reaching this resistance, prices gradually lost bullish momentum and entered the consolidation phase between $93,000 and $97,000.

The prominent divergence of bearishness between the price and the RSI indicator suggests that the seller is gaining strength. This further supports the possibility of short-term fixes. As it stands, consolidation or minor setbacks within the $93,000-$97,000 range are the most likely scenarios before the market gains enough momentum to break this resistance.

On-Chain Analysis

Shayan Market

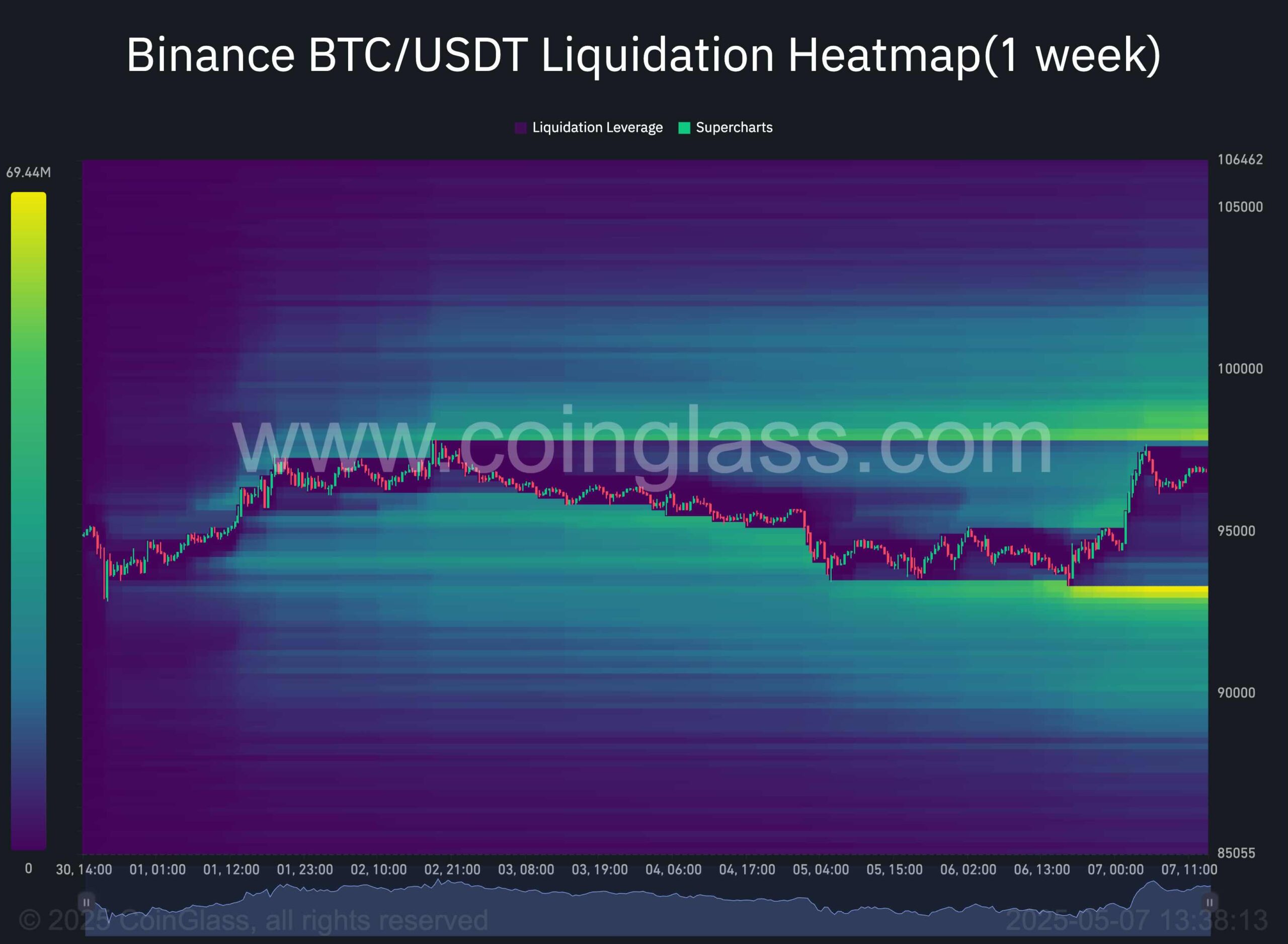

Bitcoin integrates at a critical level, but analyzing futures market metrics gives valuable insights. The chart shows a BTC/USDT Binance liquidation heatmap, highlighting the major liquidity pools that could attract price movements.

As shown, there are two important liquidity zones. One is above the $97K level, while the other is below the $93,000 price point, close to its current price. These areas could be targets for smart money that will lead to retailer liquidation. Breakouts that cross either threshold can lead to a liquidation cascade and amplify subsequent movements.

Given the overall bullish bias in the market, a temporary DIP below $93,000 is still possible before Bitcoin attempts to break out above $97,000 resistance.