Important insights:

- Bitcoin's advantage dives 61.87% lower after a substantial slide in BTC price over the past seven days.

- Institutional demand signal that reduces interest in Bitcoin.

- Exchange Flows Signal Rising Sales Pressure

Bitcoin has shown that it has waned demand above $104,000, as evidenced by lateral price action over the past six days. As a result, investors were concerned about the risk of prices that could fall below $100,000.

One of the main reasons for these concerns was the steady decline in Bitcoin domination over the past seven days. The advantage peaked at 65.38% last Wednesday, then tanked at 6.86% in 24 hours.

Bitcoin Dominance/ Source: TradingView

The domination of Slide Bitcoin confirmed that liquidity in the crypto segment shifted in favor of altcoins. As a result, the bullish momentum that had been fueled by rally after last week's $100,000 milestone has disappeared.

The weak demand for ETFs in BTC indicates a high risk of bearish pivots

Bitcoin rallies in the first week of May were characterized by a healthy institutional influx. But things have changed as evidenced by this week's weak ETF flow. This is also directed towards increasing uncertainty in direction.

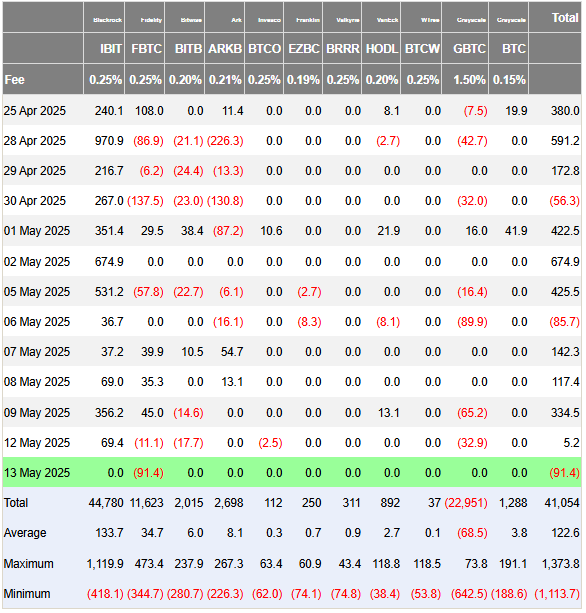

Bitcoin ETF has experienced a collective leak worth $86.2 million between Monday and Tuesday. This was probably showing that they would make some profit in anticipation of some downsides. However, it is also worth noting that the spills are still relatively low. This means that ETFs may be testing the market.

Bitcoin ETF Flow/Source: Farside

Institutional activity was previously a decent measure of the level of attention that Bitcoin received from large corporations. However, this is not always the case, especially when the whales move in different ways. This may be the case for this week's market, and may explain why the cryptocurrency king was still resisting the downside.

Coinglass' Bitcoin Order Book data revealed that whale activity has provided net spot influx worth around $30 million over the past 24 hours. This meant that despite growing concerns about pullbacks, the whales were still buying BTC.

This means that whales are protecting BTC from more negative aspects, which could be a reason they are trading above the $100,000 price level at press. This is in line with a recent analysis that reveals that whales and institutional traders led the recent rally.

According to the analysis, retail participation in the retail segment in the latest gatherings was weak. They reached a conclusion after evaluating retail activity from the Korean market. The latter is driven primarily by retail and has recently been characterized by low activity.

The weaker retail demand may explain why the whales were unable to make a hurry to make profits. Whales may not be encouraged to sell as retailers often provide exit liquidity.

Furthermore, the analysis noted that retail activity usually appears towards a slow cycle of bullish stages.

Will Bitcoin Bulls hold on to the selling pressure of BTC Prices for a long time?

An analysis of facility, whales and retail activities may explain why whales have a vested interest in maintaining BTC over $100,000. And with market sentiment being pushed more greedy, FOMO could force retail to return soon.

The Bitcoin exchange flow has been almost evenly matched over the past 24 hours. The influx margined the outflow slightly, reflecting the lateral activity highlighted by uncertainty about the next movement.

BTC and large remaining risk-on assets owed a recent recovery to macroeconomic conditions. The fact that the market has been away from one of the biggest crashes could give credibility to bullish momentum in the second half of May.

That momentum will likely be driven by whales and institutional activities. If this occurs, we can potentially observe that Bitcoin will push into price discovery. At that point, FOMO will rise and cause more retail participation.

While bullish outlooks can unfold, it is also worth noting about unexpected outcomes that can lead to different outcomes.