With the BTC price well above the $110,000 threshold, Matrixport reveals something different to the others that this BTC Bull Rally came before it.

In a recent post, Matrixport analysts note that there is clearly no retail investors in the latest Bitcoin (BTC) rally. Unlike the previous bull market, when rallies were fueled primarily through retail participation, this time we conclude that the portion of retail investors when driving rallies is no longer expanding as before.

“This rally is being developed primarily without retail participation. Instead of the usual topic and happiness, there is no significant retail momentum,” wrote a Matrixport analyst in the latest executive summary released on May 23.

Instead, the main drivers of current Bitcoin rallies are institutional investors who recognize the value of storing funds in BTC as a hedge against inflation. Matrixport believes it is important to understand the impact of corporate players on BTC prices as demand from retailers to institutional investors continues to accelerate.

“We have seen a stable and quiet transfer of Bitcoin from early adopters, investors, miners and exchanges to new class investors, primarily with new class investors in the company.

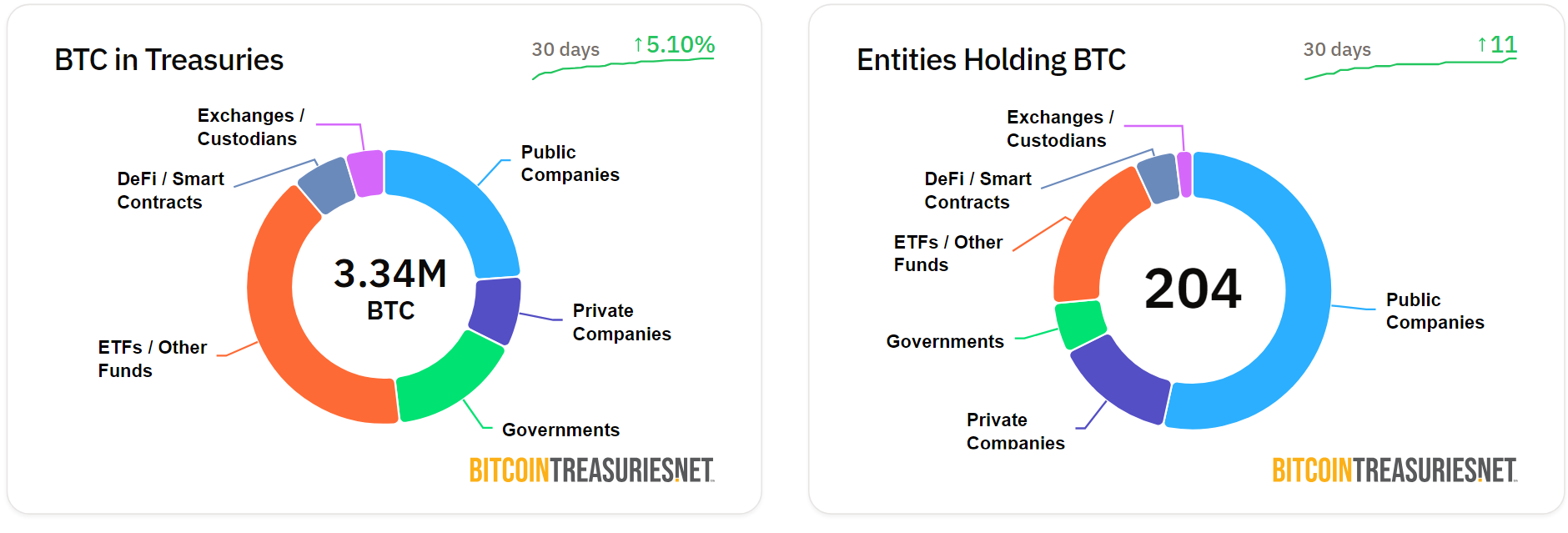

Currently, approximately 204 entities hold Bitcoin in the Ministry of Finance, totaling 3.34 million BTC on May 23, 2025. Source: Bitcoin Treasuries

You might like it too: Cryptoquant CEO admits he was wrong about Bitcoin's Bull Cycle

According to data from Bitcoin Treasuries, as of May 23, 2025, there are a total of 204 institutions holding Bitcoin, with over 50% of the entities being publicly traded. Over the past month, 11 new companies have adopted BTC for their finances.

Most recently, the strategy announced plans to issue it to $2.1 billion in permanent preferred stock in Series A. The funds generated from sales are used for general corporate purposes, including the acquisition of more Bitcoin. As BTC's largest corporate holder, its strategy holds over 214,000 BTC and more than $23.6 billion.

Furthermore, by realizing that recent gatherings are not driven by traditional retail engagement, Matrixport analysts believe many traders are missing out on the current BTC price boom. Many retail traders tend to make “costly mistakes” during instant dips in the cycle.

These mistakes can be avoided by predicting cycle corrections. This is usually communicated by indicators and signals that pop up online or in the analysis.

Another detail pointed out in Matrixport is that BTC price gatherings are being driven by the accumulation of spot markets instead of speculative derivatives activities. This could mean longer-term positioning in the crypto market, rather than just short-term trading hype.

At the time of pressing, Bitcoin is relatively stable, above $110,000. According to data from crypto.news, BTC prices are currently at $110,923 after a 0.42% increase. Its market capitalization is $2.19 trillion, with daily trading volumes of over $39 billion.

BTC price chart for trading in the past few hours, May 23, 2025 | Source: crypto.news

You might like it too: Here's what Polymarket is thinking about the next cryptocurrency cycle: