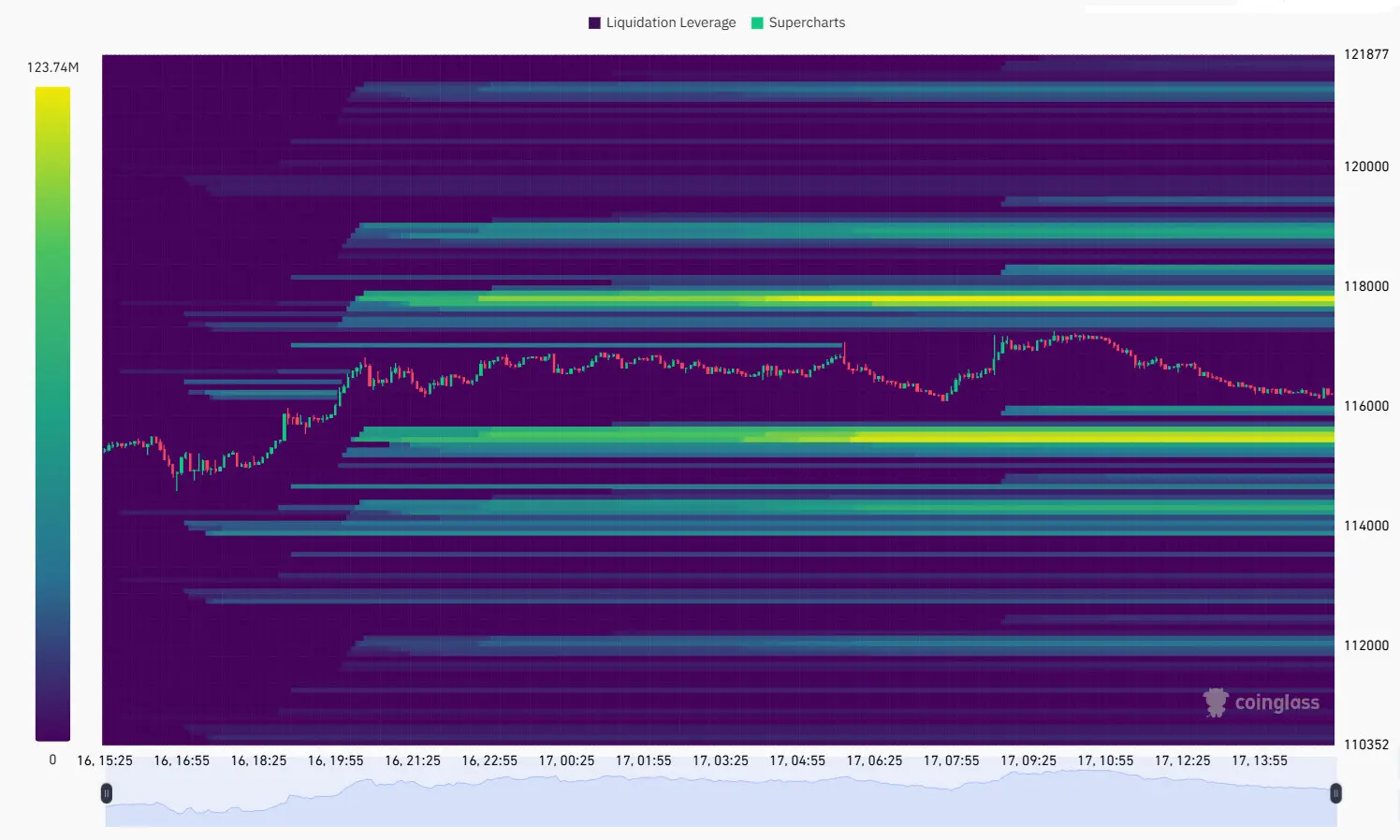

BTC faces a decision as prices are almost completely falling between the two liquidation zones. Positions occur at the $115,000 and $118,000 levels, with traders remaining to determine which position to attack.

BTC may undergo additional volatility in the coming hours, based on the short and long positions that occur. BTC traded at $116,353, but leveraged positions up and down could cause more significant price movements.

The BTC is equipped between two liquidity zones, with a chance of over $115,000 in long positions or a $118,000 short trader liquidated. |Source: Coinglass

If traders do not close positions on time, a hike to the $118,000 level will liquidate $123.74 million with Binance.

The downward movement will liquidate $131.54 million and be less than $115,000. With a near-perfect liquidity buildup, BTC is volatility within the thousands of dollars.

A more extreme downward movement is that the BTC slide is as low as $104,000 or even under $100,000 based on the CME futures map. However, future pricing movements could carry more than $13.5 billion in derivatives open interest as of September 17th, after initially going through liquidity available on Binance.

In which direction do you take BTC?

On past days, the market has not given a clear direction and short-term price movements could track the future Fed FOMC Interest rate decisions.

BTC's public interest remained above $400 billion, but it has been rewind for the past few days. Over the past 24 hours, BTC has tended to move due to short liquidation, wiping out more than $3.2 billion. For now, BTC has not been threatened by surrender and continues its current bull market with relatively small drawdowns.

The ratio between long and short positions has shifted slightly towards BTC's aspirations, but for now most traders are cautious. The code's fear and greedy index settled at 57 points at the neutral level.

BTC's advantage has returned above 56.1% as attention is paid to the Altcoin season. However, in addition to expanding the company's finances, whale accumulation and institutional purchases continue.

Will BTC end in Green in September?

BTC is closely monitoring its performance in September. This month has shown a variety of trends over the years. For BTC, the ending in Green in September was translated into an even bigger year-end gathering.

So far, the BTC performance in September is the best in 13 years. In just two more weeks, BTC may set a pace at the end of the year.

Historically, the September FOMC meeting has coincided with a significant BTC meeting, regardless of interest rate direction. Rate reductions do not guarantee bull runs.

In high lipids, long positions account for more than 58% of the trade. The concept of the largest long position is $122 million, and the largest short position is valued at $311.6 million. There tends to be more cloud money and smart traders based on sentiment metrics Bearish.