On Tuesday, Arizona-based alternative asset manager Calibercos Inc. announced it has completed its initial purchase of ChainLink (Link) tokens under its new digital asset financial strategy. The move sparked an unprecedented rally, with CWD stocks rising 2,500%.

Despite the bold shift positioning calibre at the intersection of real estate and blockchain infrastructure, analysts warn that financial instability, extreme volatility, and limited institutional coverage leave high-risk bets on equities.

First NASDAQ Company Anchor Links Ministry of Finance

Calibercos is the first NASDAQ registered company to pinpoint corporate financial policies surrounding ChainLink. Calibercos described initial link acquisition as a system test for internal processes and planned to accumulate over time.

Funds come from stock credit lines, cash reserves and stock-based securities.

CEO Chris Loeffler said the strategy “strengthens ChainLink's conviction as an infrastructure that connects blockchain with real assets.”

The company emphasized that the framework includes tax, accounting, custody and governance structures, aiming to differentiate it from more speculative crypto theater. Management has assembled Pivot as part of a broader effort to position Calibercos as a blockchain-native financial company.

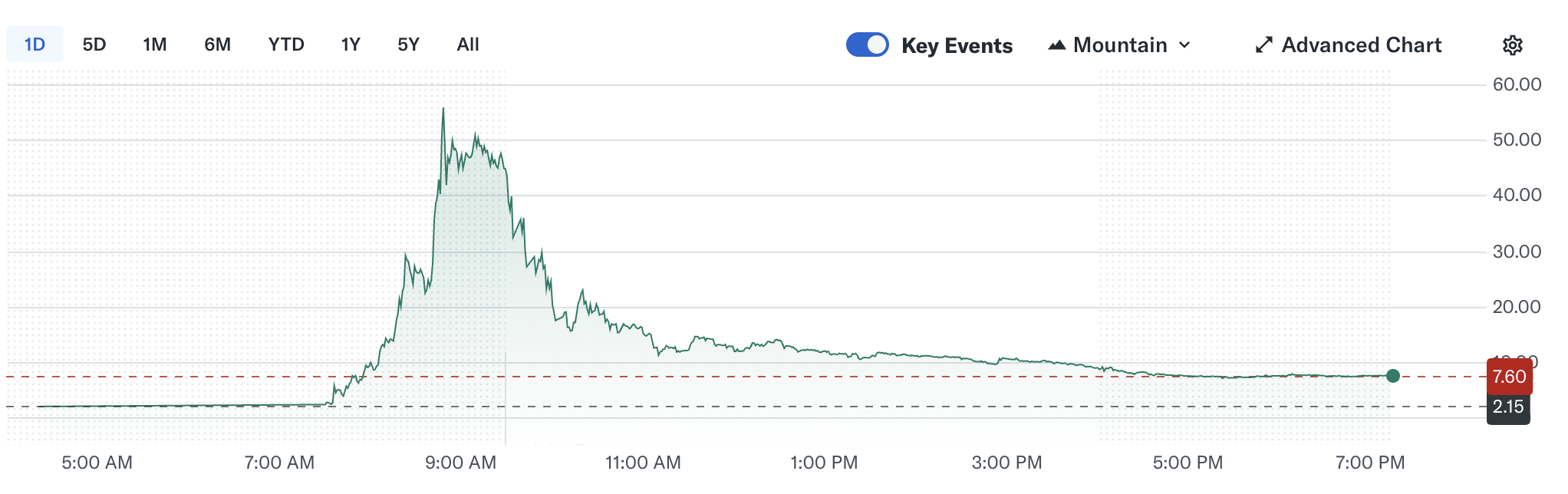

CWD shares broke out in the announcement, with over 79 million shares trading with a typical daily average of less than 10 million. Its shares (trading for nearly $2.10) are surrounded by a $56 peak at over 2,500% before settlement at $7.60 from the end.

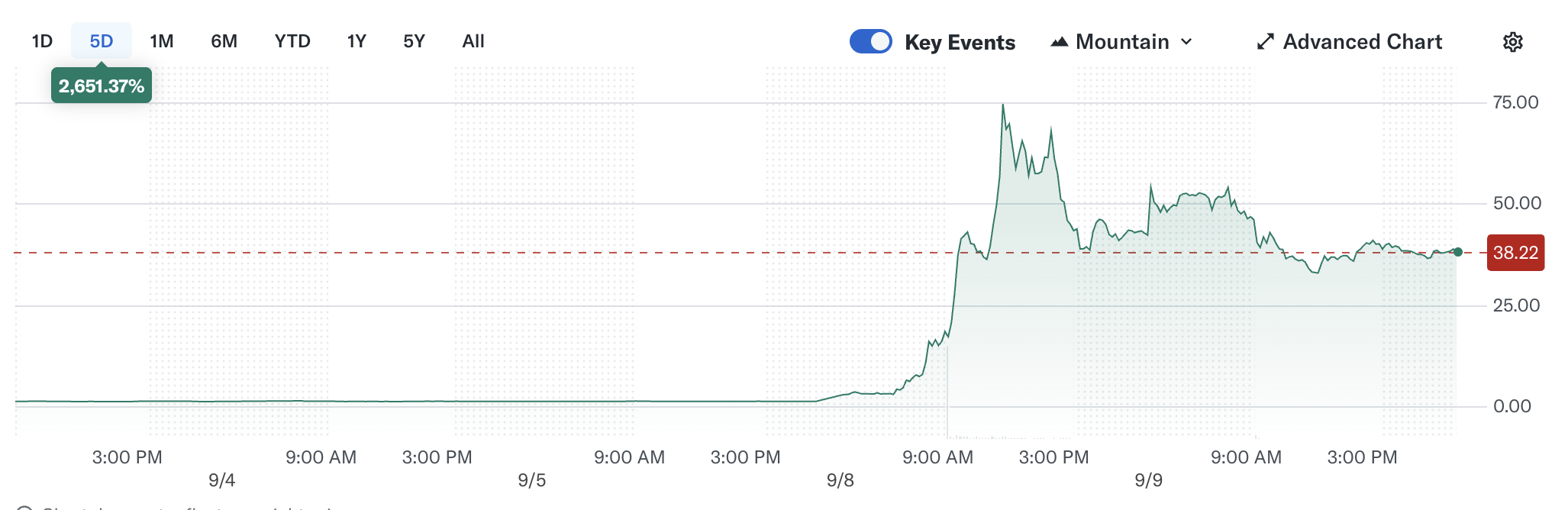

The rally followed early momentum on August 28th after Calibercos first disclosed plans to adopt ChainLink as a financial asset, attracting rapid attention from retailers and speculative investors.

Despite Tuesday's rally, Calibercos shares remained down more than 80% over the past 12 months. Analysts are currently assessing stock holds at a price target of $2.50, which lags behind current trading levels after the announcement.

CWD Stock Performance over the past day / Source: Google Finance

Crypto Rally meets the strictest basics

Calibercos updates took place amid a wave of corporate financial experiments using digital assets. Eightco, a peer, announced plans to fund the purchase of World Coin just a day ago, causing a 1,400% spike in stock. Both moves highlight the rise of retail enthusiasm for businesses linking their balance sheets to crypto assets, even when economic distress remains.

Last Week's 8 Stock Performances / Source: Google Finance

However, many analysts flagged Calibercos' decline in revenue and massive leverage as a significant headwind. They warned that the assessment was narrative-driven and exposed to speculative fluctuations, and that CWD became a dangerous agent for crypto adoption rather than a stable long-term investment.

In 2024, revenues fell by more than 40%, but net losses increased by more than 50%. Limited analyst coverage and opaque governance add risk.

According to market commentators, stocks remain suited primarily to “meme stock lovers” rather than institutional investors seeking durable value.

Calibercos stock first appeared on Beincrypto, with a 2,500% rise in Link Treasury BET.