Axiom, a trading platform focused on decentralized finance, has been attracting attention in the crypto space since its launch in early 2024. Built to simplify on-chain trading, it combines wallet functionality with advanced tools for buying and selling assets. As the platform reports strong revenue growth and recent enhancements, questions arise about its ability to compete with established players. In this article, we will explore Axiom background, performance metrics, and key products.

Establishment and backing

Axiom was co-founded by 22-year-old computer science students Henry Zhang and Preston Ellis, both 22-year-old computer science graduates from the University of California, San Diego. The duo launched the project in 2024 and aimed to create an intuitive interface defi trading. With a notable early result, Axiom secured funding from Y Combinator. It is a well-known startup accelerator known for supporting technology ventures such as Airbnb and Stripe. The seed round brought in $500,000 and provided resources for development and expansion. The involvement of Y Combinator shows confidence in the Axiom model. This highlights speed and user control in markets where complexity is often criticized. While no other major supporters have been made public, the accelerator network has been able to open the door for further investment.

Revenue and Market Location

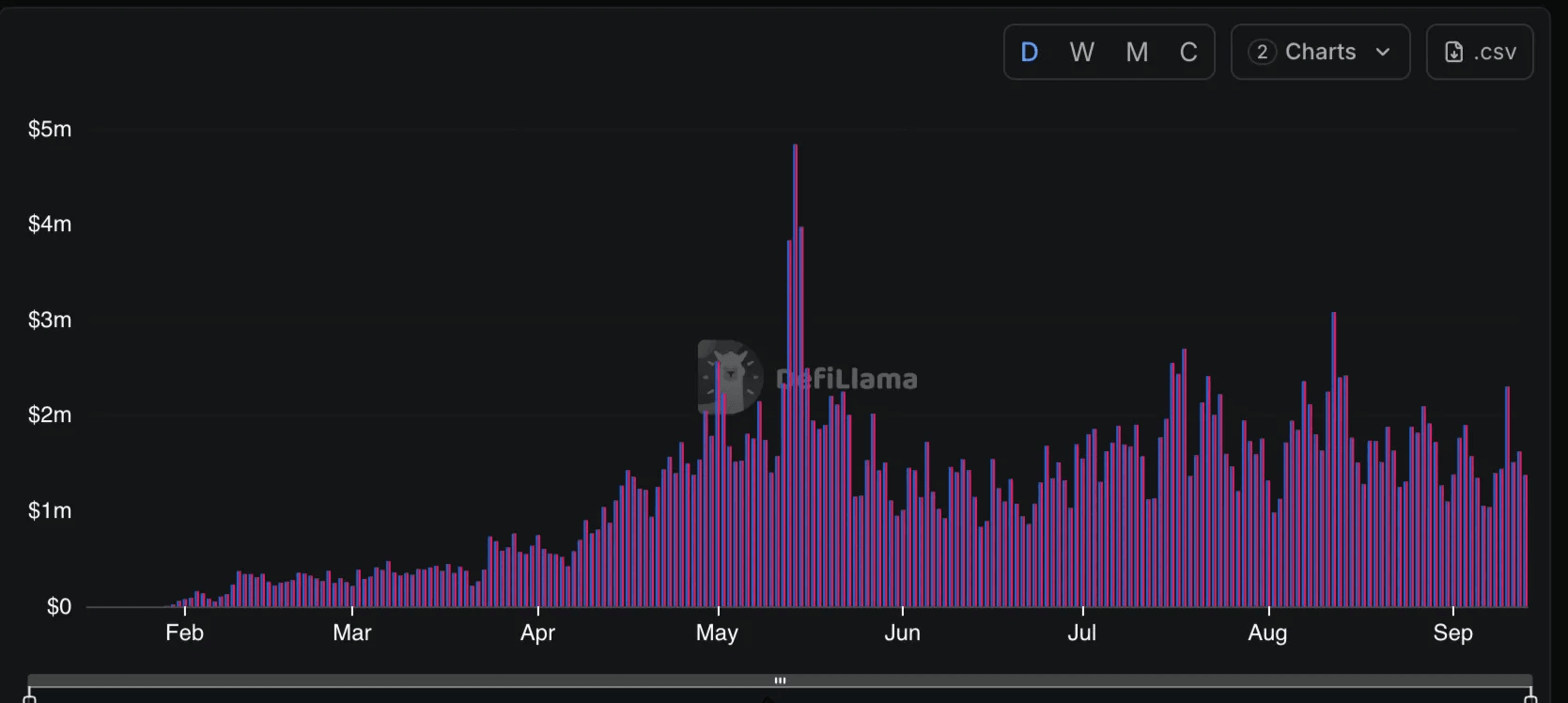

Financial data highlights Axiom's rapid rise. According to Defilama's income Dashboardthe axiom ranks fifth in the protocol, generating at least $10.65 million over the past seven days in mid-September 2025. It is tethered, circles, high lipids, and pump. The numbers mainly reflect fees from trading activities Solana– Base MemeCoins And forever.

Axiom Pro Fees and Revenue Dashboard (Defilama)

The broader report highlights this momentum. By April 2025, Axiom had reached $10 million in monthly recurring revenue, surpassing its total revenue 100 million dollars Within four months of launch. Daily trading volume reached $100 million by mid-April, earning about half of Solana's Memocoin market share at the time. These figures come from a large number of users engaged in low-cost transactions. Axiom revenue for the last 30 days is about $47 milliononly behind Solana in Pump.fun. These numbers are driven by focusing on common assets such as memokine and yield-bearing products. Such performance is based on the broader market situation to maintain it, but it sets an axiom as a revenue candidate.

Core Features and User Tools

On its foundation, Axiom operates as a hybrid Crypto trading app and a non-mandatory wallet. Users have full control over their assets as they handle security through a turnkey infrastructure, including an air gap architecture to prevent unauthorized access. Currently, they support Solana and plan to add more chains in the future. The platform integrates multiple protocols and allows you to acquire products on memokine, permanent, and one interface.

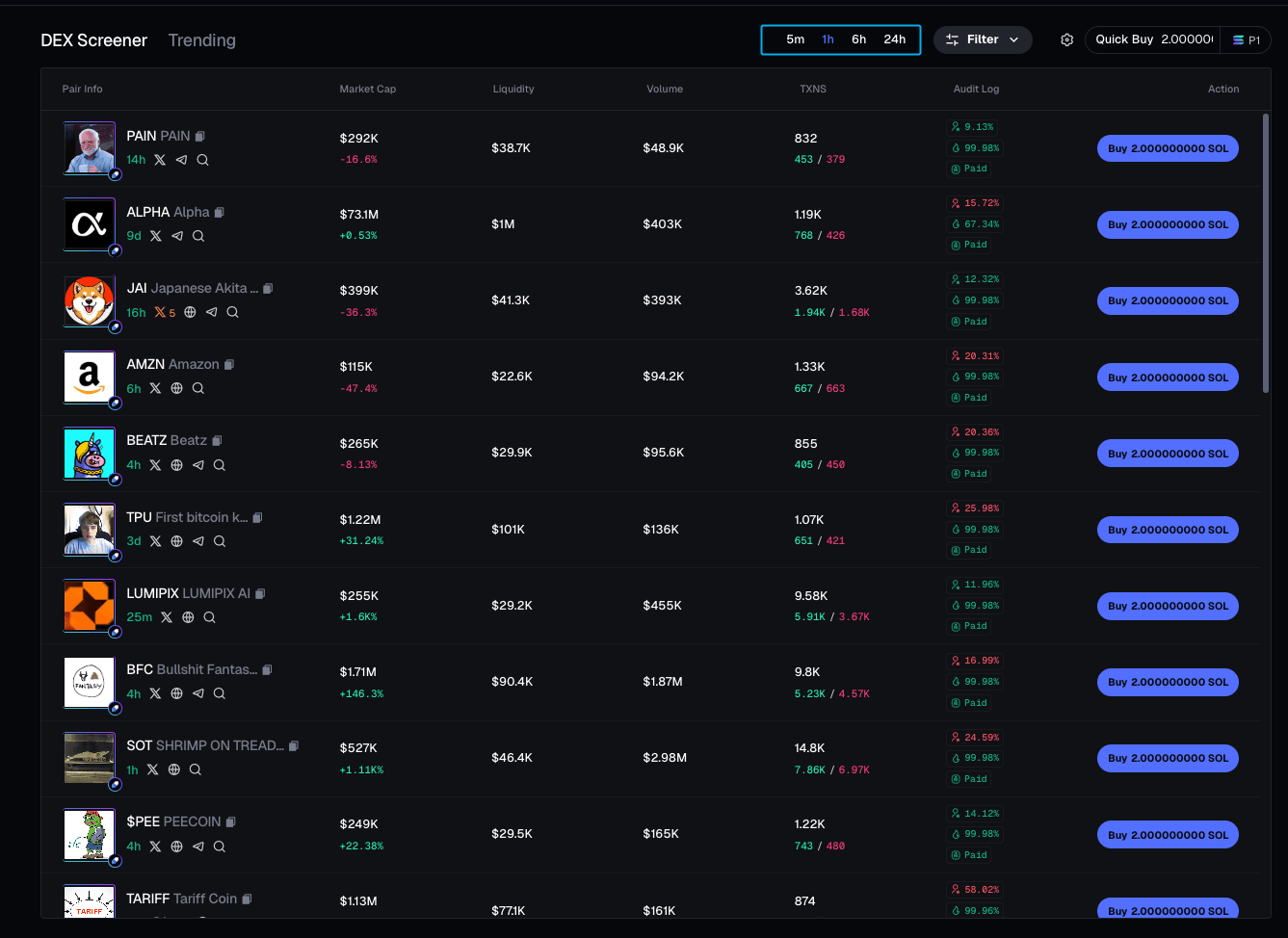

Key tools help users discover and execute transactions efficiently. The Explore Tokens section allows traders to search for assets using filters such as market capitalization and volume. “Pulse” provides real-time market pulses, displays tokens based on algorithmic signals, and “Sirse Tokens” suggests comparable assets to diversify your portfolio. Swapping is done through a streamlined interface that supports one-click purchases and sales using the option of restricted orders to set a specific price. The Portfolio Tracker displays holdings, profit and loss (PNL) data, and analysis, including a calendar view of past performance.

Explore the page (axiom.trade)

Security remains a priority. Wallets use advanced key management throughout the blockchain to ensure recovery without compromising your funds. Users can track multiple wallets up to age 25 in a recent update and monitor social signals such as Twitter activities of major opinion leaders (KOLS). Add a reward incentive layer. The transaction earns redeemable axiom points for SOL or other perks, along with a referral program that shares revenue from invited users.

For those new to defi, this includes connecting your Solana wallet via the Axiom.trade app. Fund with a Sol or Token and use the dashboard to scan for opportunities. The fees are competitive, often less than 0.1% per transaction, making them accessible to frequent traders.

Recent developments and updates

The Axiom team has rolled out frequent enhancements, as seen in the announcement of the X account (@axiomexchange). In late July 2025, it included Vision, a tool that identifies KOL and insider wallets, along with an improved wallet tracker that supports up to 10,000 addresses. The Pulse Display settings have been expanded to include transition market capitalization lines and cash data for top traders. Previously, in July, the “surge” feature introduced algorithmic alerts to market movements, with new pulse tracker and overhauls for the holder section.

June brought the fastest submission engine, PNL calendar and new leaderboards for rewards. Social integration has grown and has covered platforms like Facebook and Twitch for tooltip previews. By early June, custom themes, fee tracking on PNL, and pump livestream support for tokens such as Boop and Bonk were added. The May change featured custom PNL cards for Instagram and YouTube, multi-wallet support, and previews.

These iterations address user feedback and improve speed and customization. For example, multi-wallet restrictions that manage diverse portfolios will increase AIDS professional traders. Axiom also supports dynamic launches on platforms such as LaunchLabs, making it more compatible with the Solana ecosystem.

Point System and Airdrop Outlook

Axiom Points Programs encourage engagement. Users accumulate points through transactions, referrals and quests that contribute to rank and higher reward rates. The system, like those of projects like Arbitrum and Optimism, sparked interest in potential airdrops. Users can sign up with Axiom.trade, connect wallets, trade aggressively and build points. Although Axiom does not confirm airdrops, eligibility is often tied to the duration of use or duration of use.

Traders can increase their chances, such as using referral codes to get 10% off bonuses. However, the results remain uncertain as token distributions depend on future decisions. For now, the program serves as a loyalty mechanism and could lead to a wider range of toconomies if Axiom issues its own token.

Looking ahead

Axiom's blend of accessibility and depth appeals to Solana traders looking for an all-in-one solution. Revenue trajectory and Y-combinator support provide a robust base, but ongoing updates will respond to user needs. Whether it will expand to rivals like the Giants Binance or under It depends on multi-chain expansion, regulatory adaptation, and sustained adoption. For now, it offers practical tools for those navigating Defi's demands. Interested users can directly explore the platform to start with a wallet connection and test functionality.

source:

- Axiom Pro Pricing and Revenue Dashboard (Defillama): https://defillama.com/revenue

- Official document for Axiom Exchange: https://docs.axiom.trade/

- Official Axiom Exchange Website:https://axiom.trade

- Axiom Official X Account (@axiomexchange):https://x.com/axiomexchange