Bitcoin trades today at $108,220, with a market capitalization of $2.15 trillion and a 24-hour trading volume of $10.4 billion. Throughout the day, cryptocurrencies move within the intraday price range of $107,138 to $108,320, indicating a narrow but important integrated zone in a wider bullish context.

Bitcoin

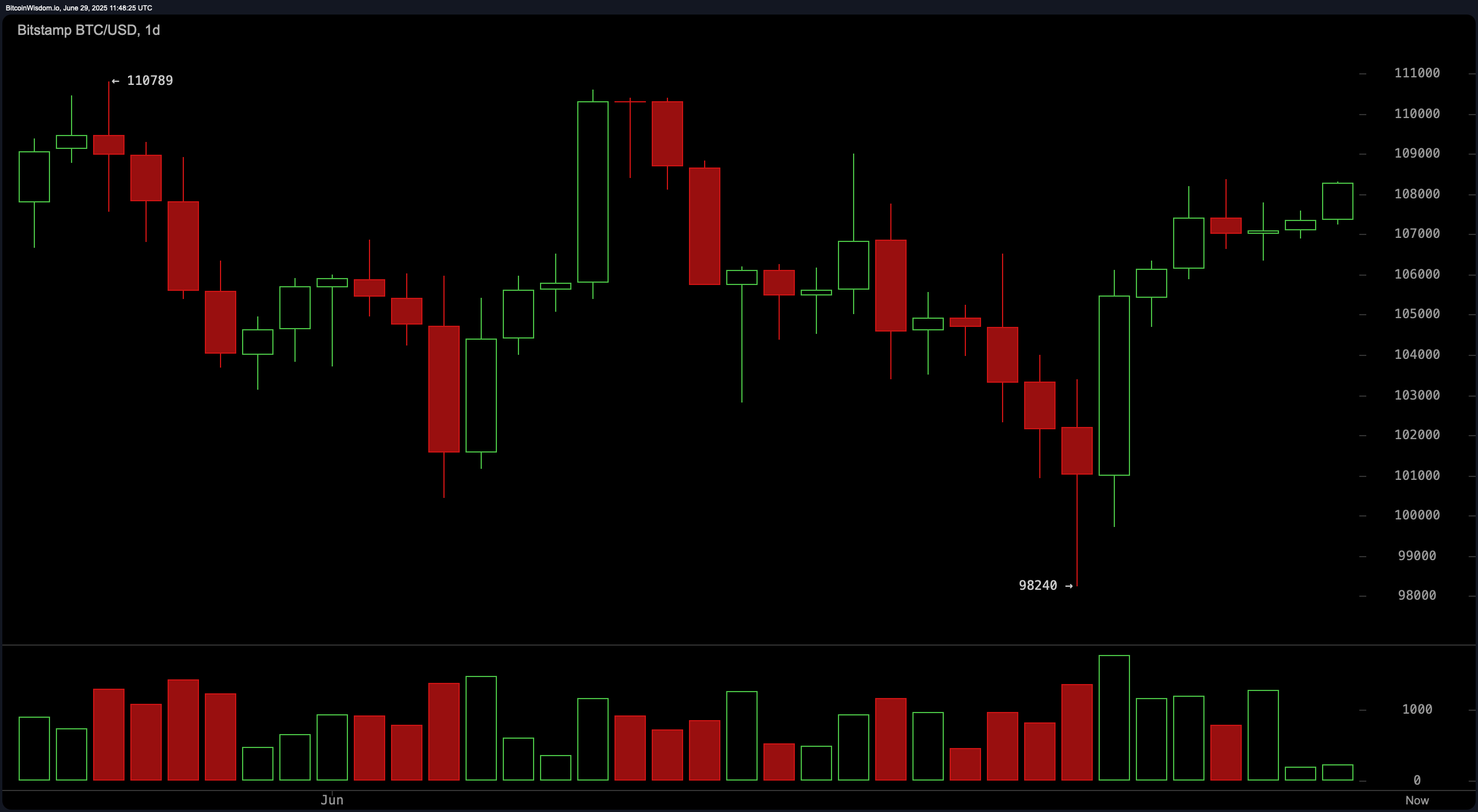

On the daily charts, Bitcoin price action shows a strong V-inversion following a revision from the recent high of $110,789 to $98,240. The rebound is characterized by increased volume and smaller green candlesticks on the body, suggesting slow but still positive momentum. Currently, the price is consolidated just below the $108,000 mark. A confirmed breakout that exceeds a massive $110,000 resistance could indicate a continuing long-term upward trend. The main support zones remained at $103,000 and $98,000, with a focus on pre-purchase activities.

BTC/USD Daily Chart for June 29, 2025.

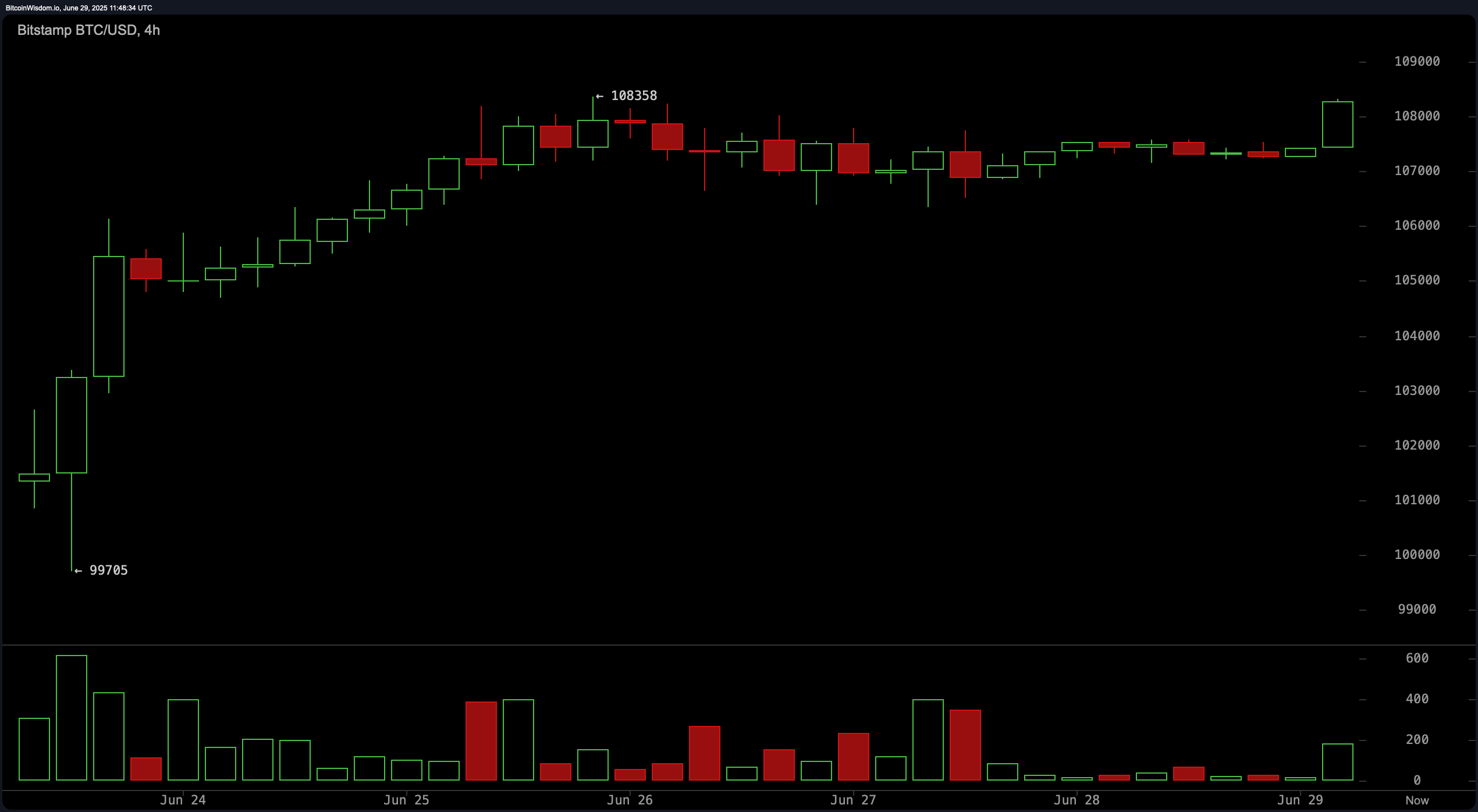

From a medium-term perspective, the 4-hour BTC/USD chart shows the formation of a bullish flag, highlighted by a gentle upward grind. A breakout candle near the $108,358 level with outstanding volume spikes indicates that buyers are confident. If you successfully retest an area with prices between $107,000 and $107,500, you may present a low-risk entry in a bullish position. Conversely, sustained movements below $106,800 negate this short-term structure and require a reassessment of directional bias.

BTC/USD 1-hour chart for June 29th, 2025.

On the one-hour chart, Bitcoin shows short-term momentum through narrow consolidation and subsequent rapid upward movements. Recent green candle volume checks validate bullish breakouts from what appears to be accumulation zone. Traders looking to take advantage of this setup may consider entries for pullbacks to the $107,700-$108,000 range. Protective outages below $107,200 are wise, especially when accompanied by an increase in sell-side volume.

The oscillator measurements provide a subtle neutral bias. The relative strength index (RSI) is located at 59, indicating that it is not over-bought or sold. The probabilistic and commodity channel index (CCI) is also neutral, but momentum (10) and moving average convergence branching (MACD) are in the purchase area. The 14 mean directional index (ADX) reflects the strength of the weaker trend, but is consistent with bullish signals from other momentum indicators.

All major moving averages (MAS) show strong bullish alignment. The exponential moving average (EMA) and simple moving average (SMA) over all important periods from 10 to 200 days are below current prices, each of which issues a purchase signal. The 10-day 10-day EMA is $106,462 and the 10-day SMA is $105,524, suggesting immediate short-term support, but the long average of $94,475, such as the 200-day EMA is $96,224, confirming that the general upward trend is well supported. These technical layers establish a solid foundation for potential upward continuance subject to volume and breakout confirmation.

Bull Verdict:

Given the matching of all important moving averages in the purchase area, along with bullish signals from momentum (10) and moving average convergence divergence (MACD), the technical structure across the 1 hour, 4 hour, and daily charts supports continuous uptrends. A breakout of over $110,000 with a strong volume can confirm a bullish advantage and pave the way for new highs.

Bear Verdict:

Despite the bullish signal, oscillators such as relative strength index (RSI) and probability theory remain neutral, while the mean directional index (ADX) reflects weak trend intensity. The breakdown of under $106,800 on the 4-hour chart, especially with volume increases, is under $107,200 on the 1-hour chart, which can disable current setup and trigger a short-term bearish reversal.