Ethereum recovered strongly from its late September low and is now pushing back towards major resistance levels. Although recent movements have changed momentum, the terms and supply zones acquired can pose short-term challenges.

Technical Analysis

By Shayan

Daily Charts

On the daily charts, ETH is trading above $4,500 within the wider upward channel. The assets reclaimed and pushed high on the $4,000 support area, but are now approaching the $4,800 resistance zone that closes out the previous rally.

RSI is only 57 years old and still in neutral territory, indicating that there is room for continuity if momentum continues. Over $4,000 maintains a broader bullish structure, but if daily closings exceed $4,800, you get a new, most massive breakout of all time, over $5,000.

Meanwhile, unless the 100-day moving average around the $3,900 mark is broken down to the downside, market trends remain bullish.

4-hour chart

In the four-hour time frame, ETH has garnered sharply from the $3,900 demand block, regaining its $4,200 level and extending its profits to $4,500. The RSI skyrocketed to an excess level above 70, with minor pullbacks already appearing.

The short-term structure shows strong momentum, but sellers can reintervene, centering on the $4,600 supply zone. If the price is consolidated above $4,200, ETH can set another push higher, and if you don't keep that level, you'll be retraced back to a support area of $3,900-$4,000. This could lead to breaks under rising channels, potentially shifting the overall market structure bearly.

On-Chain Analysis

Replacement Reserve

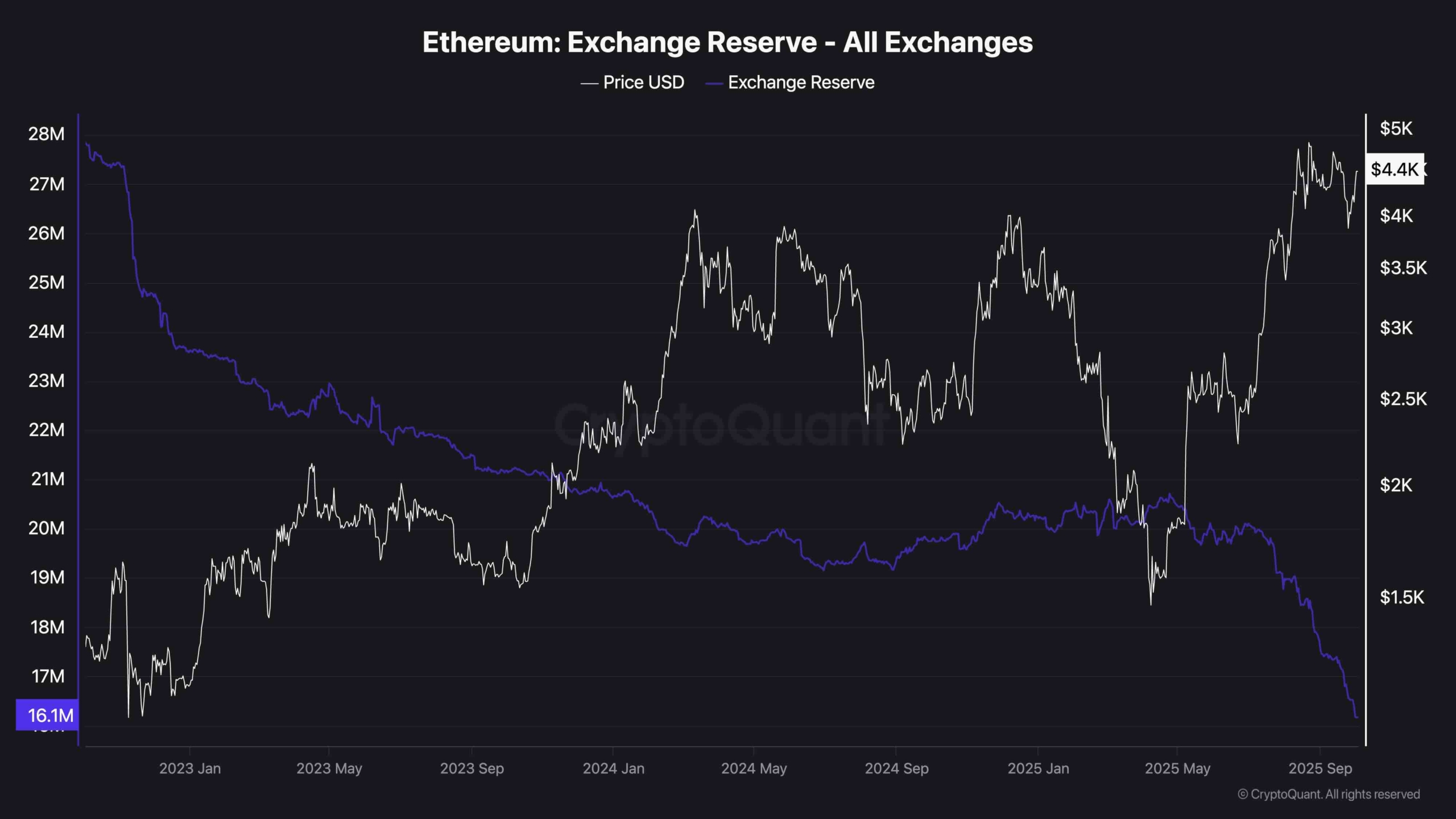

Exchange reserves of ETH have fallen to 16.1m, indicating a steady multi-year decline. This indicates that fewer coins are held in exchange. This is a bullish structural signal that suggests a drop in sales pressure. Historically, such declines have coincided with major accumulation stages and assembly.

With exchange supply falling at a significantly faster pace and reaching its lowest in years, ETH's medium-term outlook remains favored, especially when demand continues to increase its $4,000 range. Of course, it is essential that futures markets do not pass the liquidation cascade, which can overwhelm the demand in spot markets and lead to price crashes.