Ethereum needs to break above the $3,297 Fibonacci resistance level as a mix of short-term performance and institutional interest add to market optimism.

As of January 9th, Ethereum (ETH) It traded at $3,095.10, reflecting a 1.2% decline over the past 24 hours amid continued market volatility. The crypto asset experienced a narrow trading range between $3,058 and $3,133, declining during the day before partially recovering. This slight decline coincides with a 0.8% decline versus Bitcoin (measured at 0.03428 BTC), while 24-hour trading volume remains at over $22.4 billion.

Recent performance has been mixed, with a 7-day increase of 2.4% and a 14-day increase of 4.1%, compared to a 6.9% annual decline. With the price testing key levels and showing positive momentum over the past week, traders are asking, “Can Ethereum break through resistance and maintain its bullish trend?”

Can Ethereum maintain its bullish trend?

Looking at the TradingView daily technical chart, the price has recently tested the $3,297 Fibonacci resistance level. This immediate resistance proved to be significant as Ethereum failed to break through this level.

Ethereum predictions

Failure to break out of this resistance level could lead to a pullback to the next support zone at the $3,071 level. If the price breaks below this support level, it is likely to test the next major support near $2,958.

Meanwhile, the Awesome Oscillator indicator further supports the technical analysis as its current reading of 123.53 suggests a continuation of the bullish momentum. However, if Ethereum fails to break above the Fibonacci resistance level of $3,297, the weakening green bars and visible red bars could indicate an impending deceleration.

Big money remains interested in Ethereum

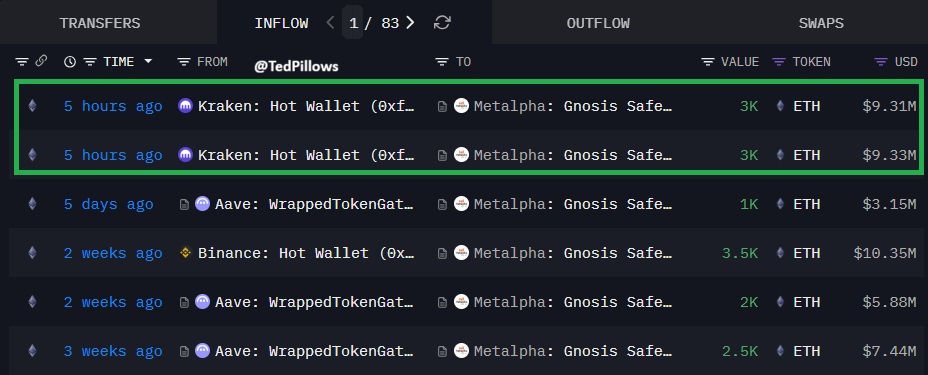

In other places, According to According to market watcher Ted, big money remains interested in Ethereum as recent trades highlight how much confidence remains in the market. For example, Metalpha withdrew a total of $18.64 million in ETH from Kraken earlier today and transferred 6,000 ETH in two separate transactions, each worth approximately $9.31 million.

Ethereum transfer

This move highlights the continued interest in Ethereum, especially from institutional investors. This suggests that large investors are bracing themselves for future price movements.