CAN had been trading below $1 for several months, but it has once again surpassed that level. With a landmark 50,000-unit ASIC order and new partnerships with SLNH and Luxor, sentiment is changing rapidly. So is this a smart entry point?

The following guest post is from bitcoinminingstock.io, A public market intelligence platform that provides data on companies exposed to Bitcoin mining and crypto treasury strategies. First published by Cindy Feng on October 15, 2025.

A few weeks ago, some of my followers pinged me about Canaan Inc. (NASDAQ: CAN). They argue that the company's stock price is cheap compared to its OG peers, many of which have posted triple-digit profits this year. While these names dominate the headlines, Kanan has been quietly making a comeback since last week.

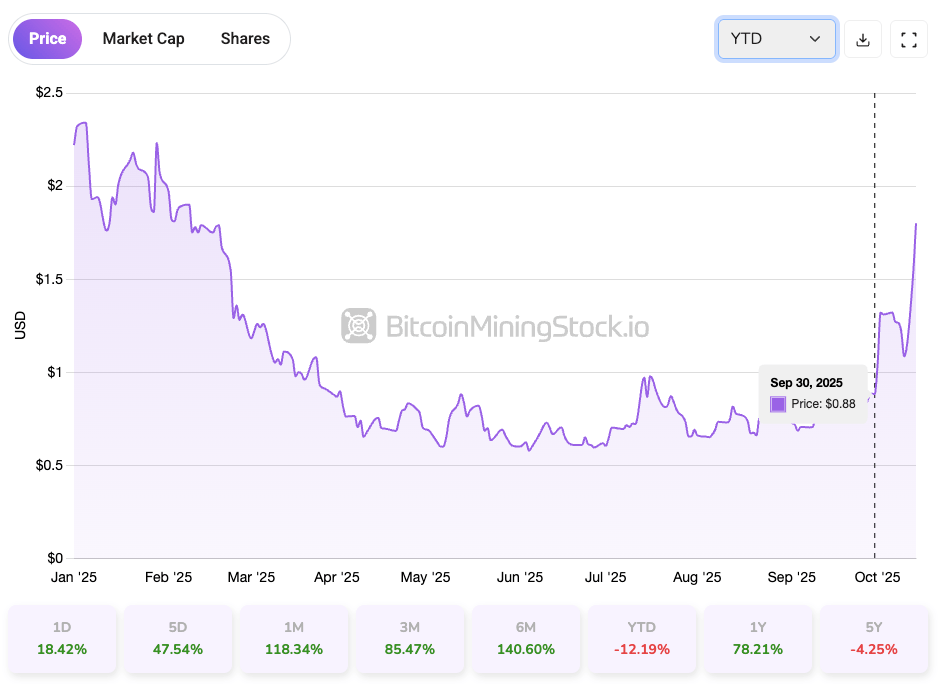

Canaan, primarily known for its Avalon ASIC mining machines, spent much of 2025 out of sync with the market's focus on HPC and AI infrastructure. On top of that, the ongoing U.S.-China tariff war has pushed the stock below $1 for months, raising real concerns about a possible Nasdaq delisting.

But something has changed recently. Since September 30th, thanks to the wave of corporate development, the stock price has exceeded $1 and continues to rise. Although the year-to-date performance still stands at -12.19%, momentum is clearly shifting. So the real question is Is now a wise time to jump in? Let's break it down.

Company profile: More than just an ASIC manufacturer

Founded in 2013, Canaan Inc. is a Singapore-based technology company with deep roots in China's semiconductor ecosystem. Canaan, best known for designing and manufacturing Avalon-branded ASIC Bitcoin mining machines, gradually transformed From pure hardware providers to more diverse participants in the crypto mining space.

self mining

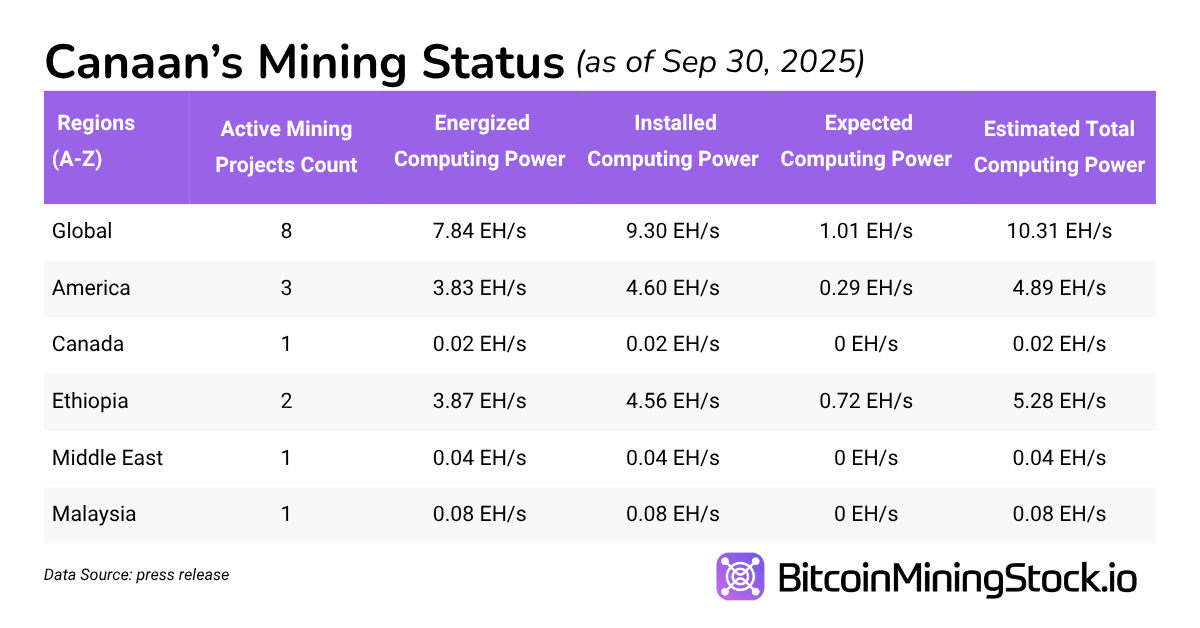

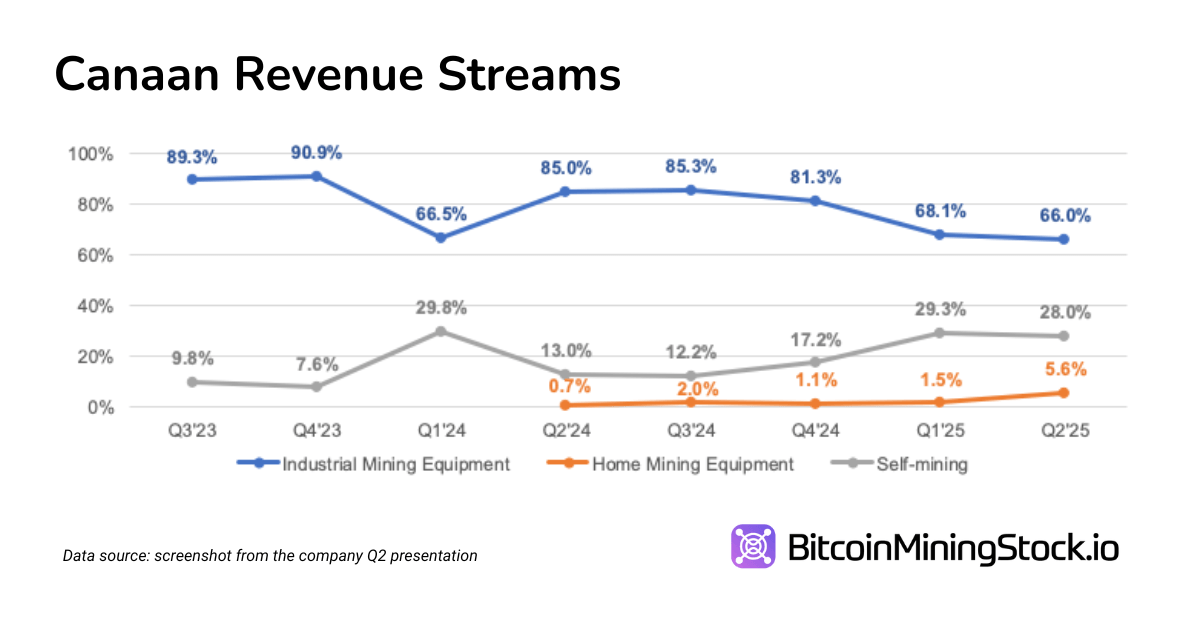

As of September 2025, Canaan is operational 9.30 EH/s hash ratemainly in the United States and Ethiopia. Once the pending ASIC delivery is installed, the self-mining capacity can be scaled up to 10.31 EH/s. Since January of this year, Canaan has reported that up to 87 Bitcoins have been mined each month. Revenue from this business segment has been consistently increasing since Q2 2024.

bitcoin treasury

Canaan holds 1,582 BTC as of September 30, 2025. According to the second quarter earnings presentation, BTC mix Self-mining, paying for hardware sales, purchasing on the spot market, etc. The company also actively uses its Bitcoin holdings as collateral to fund research and development and hardware production, and some Short-term interest-bearing account to generate yield. According to CFO James Jing Chen, the company’s Bitcoin finances are still in the early stages.. Regardless, our website already ranks the company's Bitcoin assets as the 35th largest among publicly traded companies in the world. In terms of exposure, Canaan's Bitcoin holdings account for 20.29% of its market capitalization, a ratio similar to some large companies. riot platform and clean spark.

retail home mining equipment

Canaan recently introduced pre-assembled Avalon Miner kits aimed at home miners and small businesses. These kits are designed for easy deployment and include plug-and-play containerization units. Although current revenues from this line are still modest, Strengthen brand awareness and helps reduce dependence on unstable institutional demand cycles.

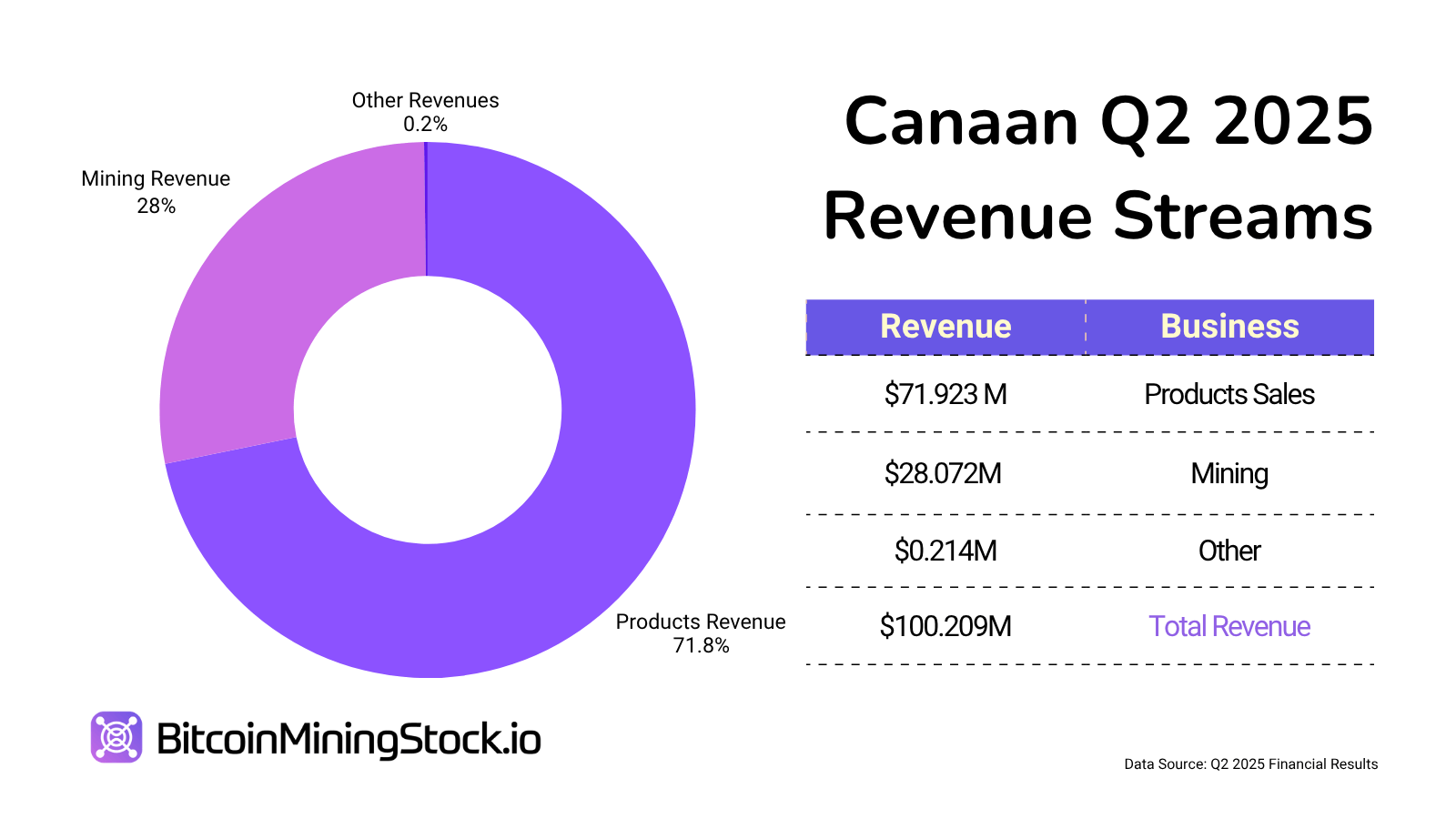

In Q2 2025, Canaan generated total revenue of $73.9 million. Of this amount, 71.7% came from hardware sales, 28.1% from mining operations, and less than 1% from other services.

Recent Catalysts: Momentum is building

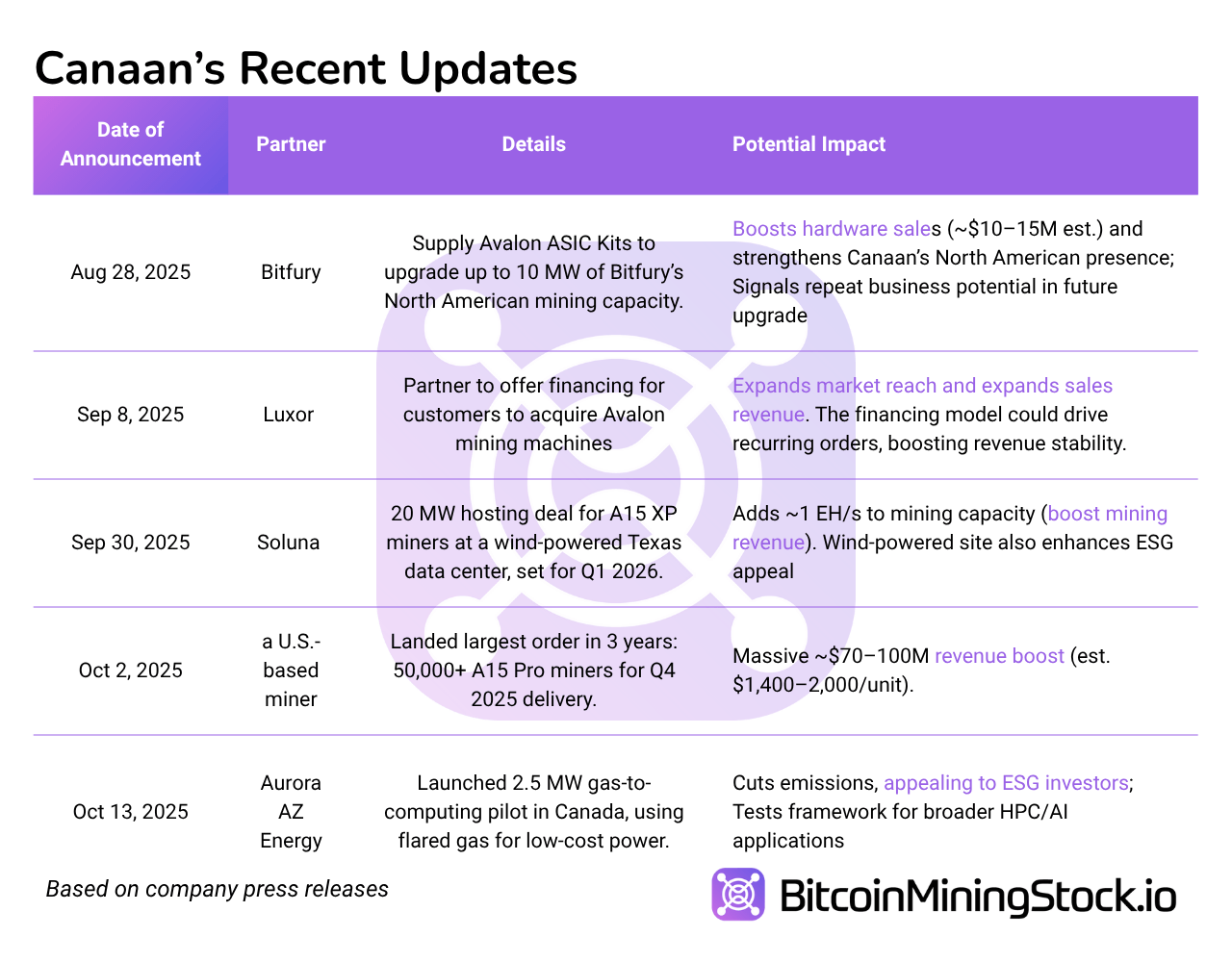

Investor sentiment towards Canaan is changing thanks to a series of business successes and strategic partnerships. Recent updates show the company gaining momentum, with each deal helping to not only increase sales potential but also generate new investor interest. To help you track the situation, below is a timeline of key business updates.

Putting these developments together, Suggests that Canaan is doubling into North America. Some deals hint at a shift to renewable energy, which could be attractive to ESG-minded investors. the most important thingthese movements appear in the numbers. The company expects third-quarter revenue to be between $125 million and $145 million, representing growth of 25% to 45% sequentially.

Is CAN Stock a bargain at $1.80?

Canaan's valuation of $1.80 looks convincing compared to its peers, but let's see if it's still a bargain.

As of October 15, 2025, Canaan's market capitalization is $881.96 million. Enterprise value after adjusting for $179 million in Bitcoin (1,582 BTC x $112,833), $11.63 million in Ethereum (2,830 ETH x $4,111), $65.9 million in cash, and $268.5 million in debt (EV)* sit around $894 million. This provides a clearer picture of the company's core operating value excluding equity.

*for My calculations: EV = Current Market Capitalization + Total Debt – Cash and Cash Equivalents – Fair Value of Bitcoin Holdings – Fair Value of Ethereum Holdings. Debt and cash figures are taken from the latest quarterly report, while the fair value of the crypto assets is based on current spot prices and the company's recently disclosed holdings.

Canaan's third quarter 2025 revenue is expected to be between $125 million and $145 million, implying an annual revenue run rate of $500 million to $580 million. Based on these forecasts, the company's trading price is EV/revenue multiple 1.5-1.8xbelow the 2.5x to 4x range commonly seen among U.S.-listed peers during bull cycles.

From a profitability perspective, Canaan posted $25.3 million in adjusted EBITDA in the second quarter, which translates to approximately $100 million annually. Translating this, EV/EBITDA multiple is approximately 8.9xwhich is modest compared to top-tier miners that trade at 10-20x under favorable market conditions. Therefore, there is room for multiple expansions if profit margins are maintained and investor sentiment strengthens.

On an asset basis, the company reported net assets of approximately $484.5 million excluding cryptocurrencies and $592.1 million including crypto holdings. This determines the reservation price (P/B) 2.7x to 4x It depends on how you handle your digital assets. These aren't deep value levels, but they're also not overly stretched, especially given that many of Canaan's recent partnership deals have had no full financial impact.

In the end, the stock price was $1.80, not a deep discount, but also not aggressively priced. The market is recognizing Improving fundamentals and visualizing short-term returnsbut has not yet assigned a premium for growth or broader strategic upside factors.

final thoughts

Canaan is evolving from a hardware supplier to a supplier. More vertically integrated crypto mining playerswith the expansion of self-mining operations, meaningful crypto assets (1,582 BTC and 2,830 ETH), and expansion of global partnerships. The recent 50,000 unit miner order should significantly boost revenue in the coming quarters and help improve valuation metrics.

However, challenges still remain. Canaan posted a net loss of $11.1 million in the second quarter, and its bottom line could continue to be under pressure unless Bitcoin prices continue to rise or cost efficiencies improve. High operating costs and depreciation expenses continue to put pressure on profit margins.

In particular, geopolitical risks surrounding US tariffs on Chinese high-tech exports are also lingering. Canaan is working to alleviate this issue through new manufacturing lines in the US and Malaysia, but execution risks remain.

Ultimately, the results for the next few quarters, especially Q3 (Estimated amount is $125 million to $145 million.), Bitcoin price direction, and network difficulty trends could determine whether Canaan is valued in the market. For investors betting on a broader crypto bull cycle, this stock has potential, but it's not without risk.