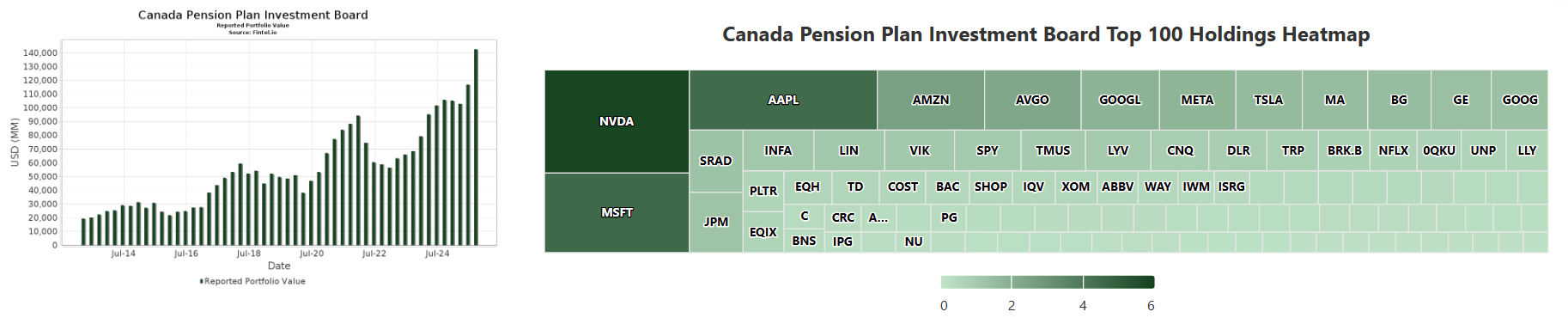

Canada Pension Plan Investment Board (CPPIB) disclosed a total of 1,346 holdings in its latest SEC filing. The latest portfolio value is calculated as USD 142,419,517,113. Actual assets under management (AUM) is this amount plus cash (undisclosed).

The Canada Pension Plan Investment Board is one of the world's largest institutional investors, reporting more than $142 billion in assets in its most recent regulatory filings. A new 13F filing reveals that the fund has decided to open a material position in MicroStrategy in the third quarter of 2025.

Canada Pension Plan Investment Board launches strategy

At the end of the third quarter, the strategy position was valued at $127 million. However, subsequent stock price declines reduced the exposure to $80 million.

This fluctuation reflects the highly volatile nature of MSTR stock, which is highly correlated with the price of Bitcoin. CPPIB chose the strategy because many pension funds are unable to purchase Bitcoin directly due to internal rules and regulatory hurdles. Strategy offers already listed regulated alternatives that comply with SEC requirements.

On the other hand, Canada Pension Plan Investment Board holds a sizeable range of stocks. To date, the company's holdings include NVIDIA Corporation (US: NVDA), Microsoft Corporation (US: MSFT), Apple Inc. (US: AAPL), Amazon.com, Inc. (US: AMZN), and Broadcom Inc. (US: AVGO).

Canada Pension Plan Investment Board shareholdings: Source Fintel

CPPIB's new positions include Netskope, Inc. (US: NTSK), Strategy Inc (US: MSTR), Klarna Group plc (US: KLAR), Amrize AG (US: AMRZ), and Peloton Interactive, Inc. Additionally, CPPIB's top industries include “Textile Mill Products,” “Coal Mining,” and “Agricultural Services.”

Strategy acquires $835 million worth of Bitcoin

The virtual currency market is in the red. Nevertheless, MSTR gained momentum. The company acquired an additional 8,178 BTC for $835.6 million, with an average price of $102,171 per BTC.

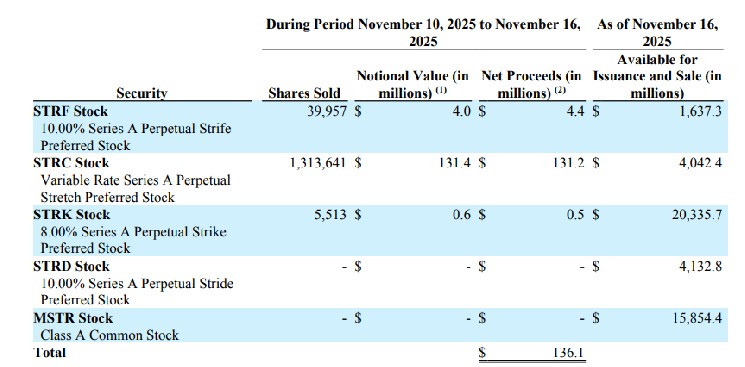

This huge acquisition was primarily funded by sales of the company's latest priority product, STRE, or Steam. These purchases give the strategy higher yields to European investors, which raised about $715 million earlier this month. The company also raised $131.4 million through its STRC (Stretch) Preferred Series, according to a Monday morning filing.

Purchase Bitcoin. Source: Strategy SEC filings

The current total holdings are 649,870 BTC, acquired for $48.37 billion, or $74,433 each. Trading at $199 early Monday, MSTR's enterprise value now barely exceeds the value of Bitcoin on its balance sheet. Bitcoin was trading at $94,500 as of Monday, down slightly from Friday's levels.

The purchase follows the $49.9 million paid for 487 last week. As reported by Cryptopolitan, Strategy also reported that over $15.8 billion of Class A common stock is still available for issuance and sale, leaving room for future Bitcoin purchases.

Strategy is currently trading below NAV

As Cryptopolitan previously reported, Strategy Inc., a business intelligence company turned Bitcoin treasury division, fell below its net asset value on Friday for the first time in nearly two years. This happened when Bitcoin fell below the $100,000 level after holding that level for about three days.

Last week's weakness in the cryptocurrency market continued into Monday, with Bitcoin dropping below $95,000 at one point, pushing Strategy's stock price below $200 per share and pushing the company's market-to-book ratio down to 0.977x.

According to market watchers, the decline in Strategy's NAV could mean investors are concerned about the company's stock dilution, leverage, and the structure of its Bitcoin-centric balance sheet. The company frequently issues shares to acquire more BTC, and its business plan relies on shares trading at a premium to the Bitcoin it buys.