CME, the world's largest derivatives market, has announced that new crypto futures products including Cardano will be launched soon.

It is expected to be published within a week. $ADA Futures represent institutional recognition and provide Cardano with new hedging and professional trading tools.

Important points

- Cardano futures are expected to be launched on the CME derivatives market within a week.

- Cardano will debut with both standard and micro futures contracts, expanding access for traders of various profiles.

- CME also plans to introduce Stellar and Chainlink futures.

- These futures are already available for Bitcoin, Ethereum, Solana, $XRP.

Cardano futures to be launched on February 9th on CME

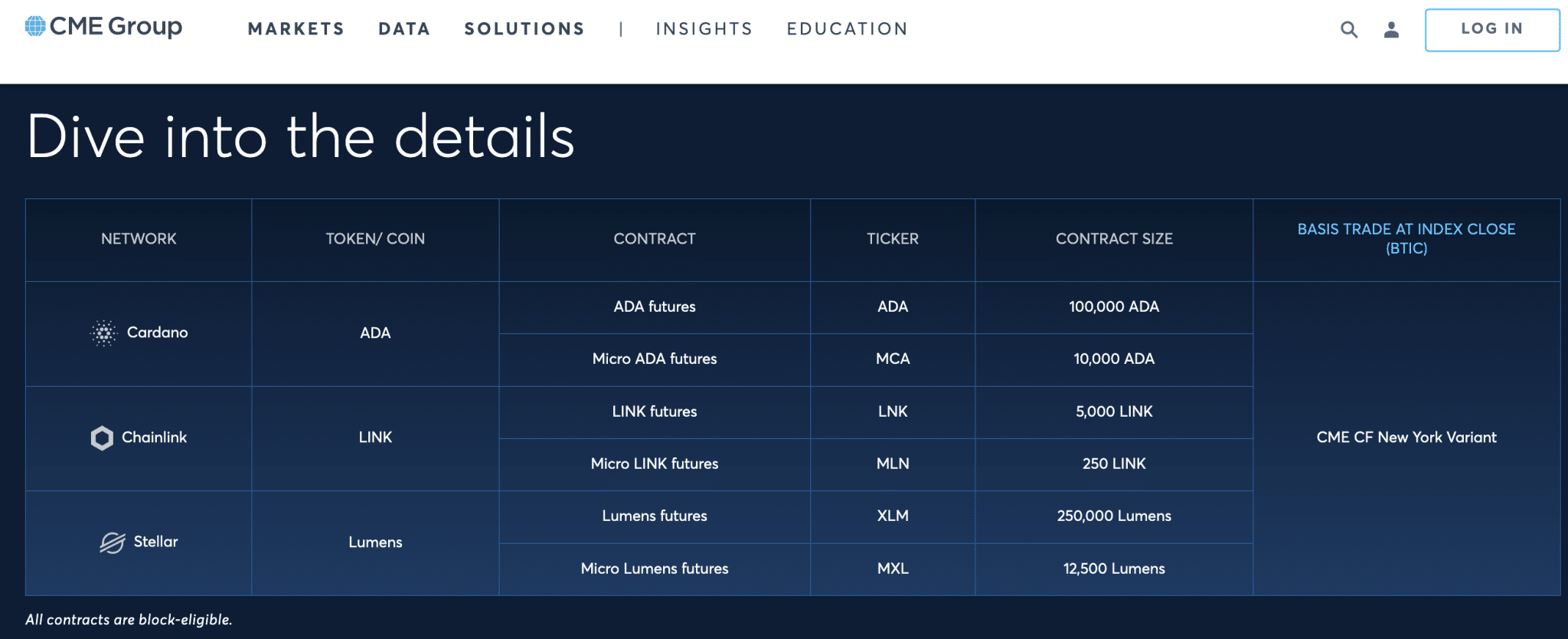

In a recent X post, CME urged traders to prepare for a February 9, 2026 launch to expand its lineup of regulated crypto derivatives. Notably, Cardano will debut at CME with both standard and micro futures contracts.

standard $ADA Futures represent 100,000 $ADA per contract, micro $ADA Futures (MCA) represents 10,000 $ADA per contract.

CME launches Chainlink futures with Stellar

Additionally, CME plans to roll out Stellar and Chainlink futures in parallel with Cardano. Stellar Standard Contract ($XLM) holds 250,000 pieces $XLMMicro version (MXL) is 12,500 $XLM. Chainlink's contract, on the other hand, will include 5,000 contracts. $LINK For standard futures (LNK) and 250 $LINK For Micro Futures (MLN).

New futures pricing tracks the CME CF New York Variant Index, providing greater transparency and consistency. $ADA, $XLMand $LINK We use the same institutional benchmarks used for major cryptocurrency derivatives.

Once launched, these contracts will include Bitcoin, Ethereum, Solana, $XRP.

CME Group

Cardano’s major organizational milestones

release of $ADA Futures trading is an important milestone for institutional investors. Provides regulated exposure to funds that cannot hold spot $ADAimprove liquidity and provide robust risk management tools. Microcontracts reduce capital barriers and expand access while maintaining regulatory standards.

Notably, some Cardano community insiders have described this initiative as follows: $ADAGiven CME's standing in the global derivatives space, this is the strongest institutional validation to date.

CME recorded average daily trading volume of 278,300 contracts last year, with $12 billion worth of notional value and $26.4 billion in open interest, and Cardano futures are widely expected to gain meaningful adoption on the platform.