After weeks of lackluster momentum, Bitcoin faces a key test with Friday's U.S. inflation data. The September CPI report will be released today, October 24, 2025 at 8:30 a.m. ET (12:30 p.m. UTC) and is likely to impact the market's near-term risk appetite.

Consensus forecasts are for headline inflation to rise 0.4% month-on-month and core prices to rise 0.3%.

Overview of the current Bitcoin market

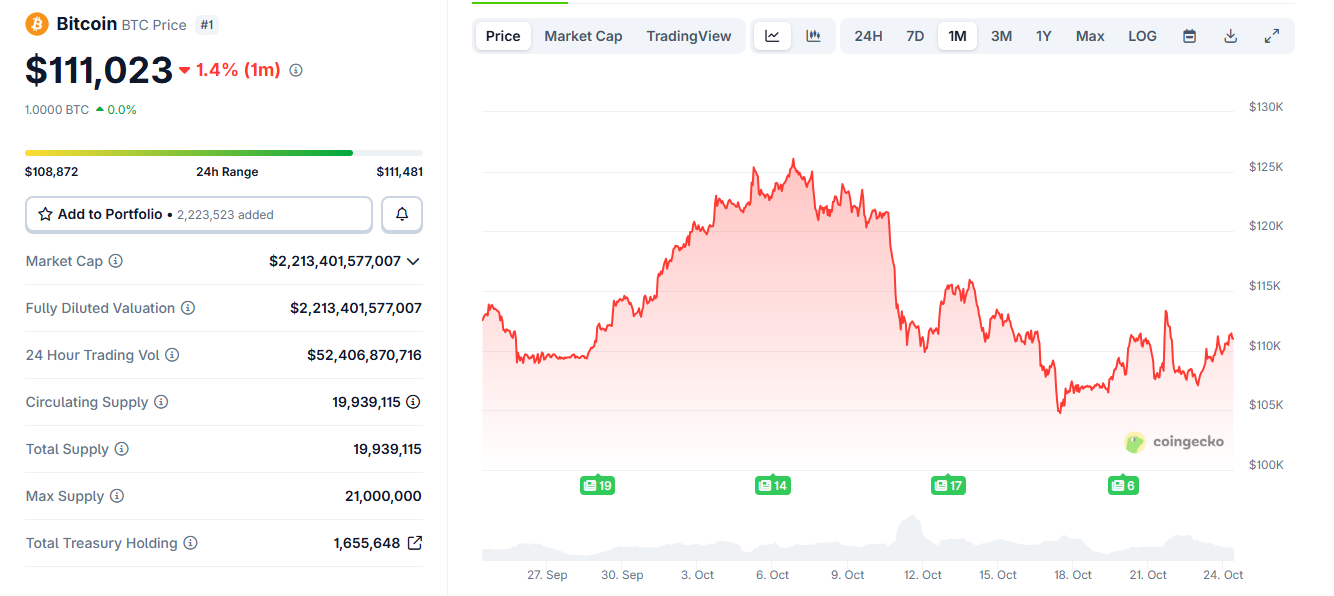

Bitcoin has been trading in a range of $107,000 to $111,000 after falling from a high of around $126,000 in early October. Volatility in short-term options has climbed into the 30s, indicating traders are positioning for a move but not preparing for major stress.

Meanwhile, funding rates on major exchanges remained close to neutral, suggesting limited confidence in the future of the data.

Bitcoin October price chart. Source: CoinGecko

Overall, the setup looks balanced on paper. However, when macro data arrives, positioning often reverses rapidly.

Considering all the possibilities, we asked ChatGPT how they would handle Bitcoin to get a pre-print game plan ahead of Friday's CPI release.

ChatGPT recommends deleveraging before release. It's also no wonder, given that CPI data can reverse markets in seconds (and quickly increase slippage on paper).

If you must remain exposed to risk, one safe way is to hedge with short-term puts (1-7 days). In other words, it's best to prepare a “stop” before the numbers are hit. Once the data is available, re-evaluate your positioning once volatility has subsided.

When you get the number

CPI looks like this: 12:30 PM (UTC)And that's usually when the chaos begins. The first candlestick often traps both longs and shorts before the direction is clear. You will see the spread widen and liquidity disappear for a few seconds.

Therefore, the wise thing to do in such a situation is to wait until the situation calms down. Just trade after the order book normalizes.

After printing: 3 possible paths

- Hot CPI (above 0.4%): ChatGPT expects a stronger USD, higher yields, and a near-term Bitcoin decline. If the support breaks, it is better to maintain defense or strengthen the stop.

- Inline CPI: Volatility will likely collapse. There are benefits for option sellers. In this case, keep the position size light until the direction is clear.

- Cool CPI (lower than expected): Bitcoin could rebound if DXY and 2-year Treasury yields fall. Wait until resistance is fully restored before continuing longer.

Please pay attention Preprint highs and lowswith VWAP. Once a definitive recall or failure occurs, we typically see a bias for the next 12 to 24 hours. Option premiums are still expensive, so stick to defined risk setups like spreads rather than naked options.

According to ChatGPT, even if inflation slows a bit, the annual rate should remain about the same. 3%this will keep the “longer” debate alive. This means that BTC is more likely to reflect changes in yield expectations than anything else.

conclusion

So, to put it simply, you are coming into this CPI in an emotionally unstable and slanted state.

Bitcoin has already priced in some inflation risk, and the neutral stock could soar as traders unhedge it. However, the higher-than-expected numbers will support a short-term rebound before a recovery can take place.

Considering the setup, the smarter play here is balance. Overall, it's a good idea to consider risk reduction before release. Avoid risks when necessary and react to what the data shows rather than guessing.

If yields start to fall and Bitcoin breaks above resistance, the upside will be cleared. If not, expect price movements to flatten out quickly once the volatility is drained from the system.

ChatGPT says this is how to trade Bitcoin ahead of Friday's US CPI print This article was first published on BeInCrypto.