Cipher Mining has expanded outside of Texas for the first time with the acquisition of a 200-megawatt power plant in Ohio called Ulysses, entering the PJM wholesale power market, the largest electricity market in the United States.

The 195-acre site has secured power capacity from AEP Ohio, all necessary utility contracts are in place and is expected to be energized in the fourth quarter of 2027, according to Tuesday's announcement.

Cipher said the facility is suitable for Bitcoin (BTC) mining as well as high-performance computing and data center applications. Financial terms of the deal were not disclosed.

The move is aimed at meeting growing demand for data centers from hyperscalers, major cloud computing companies such as Amazon Web Services and Google Cloud. “Hyperscalers are driving unprecedented demand for large-scale sites,” said Cipher CEO Tyler Page, adding that the company's new site will give it additional capacity to grow its high-performance computing (HPC) hosting business.

sauce: crypto mining

The deal follows extensive efforts by publicly traded Bitcoin miners to extend beyond traditional mining to power, data center, and manufacturing infrastructure.

For example, Hut 8 recently signed a 15-year lease worth approximately $7 billion to provide 245 megawatts of AI data center capacity at its Riverbend, Louisiana campus. Infrastructure provider Fluidstack will be the tenant, and Google will support lease payments.

A few days later, Bitdeer leased approximately 188,000 square feet of land at its Sparks, Nevada, distribution facility to expand its U.S. manufacturing footprint, according to The Miner Mag.

Related: How Bhutan is building a green Bitcoin economy from scratch

Bitcoin mining hash price puts pressure on miners

The hash price for Bitcoin mining, a key measure of miner revenue per unit of computing power, has been below $40 since mid-November, a level that many operators consider break-even. Margins across the sector remain under pressure, and the recession is forcing mining companies to reevaluate their operating models.

Bitcoin hash price over the past 3 months. sauce: hash rate index

Many miners are looking to diversify through the demand for AI and HPC, while others are turning to renewable energy as a way to reduce costs and stabilize profitability.

Sanga Renewables recently commissioned a 20-megawatt solar mining facility in Ector County, Texas, and Phoenix Group started a 30-megawatt hydropower project in Ethiopia in November.

Separately, Canaan partnered with Soluna in September to bring mining capacity to a wind farm in Texas and is developing an adaptive mining rig that uses AI to optimize energy efficiency.

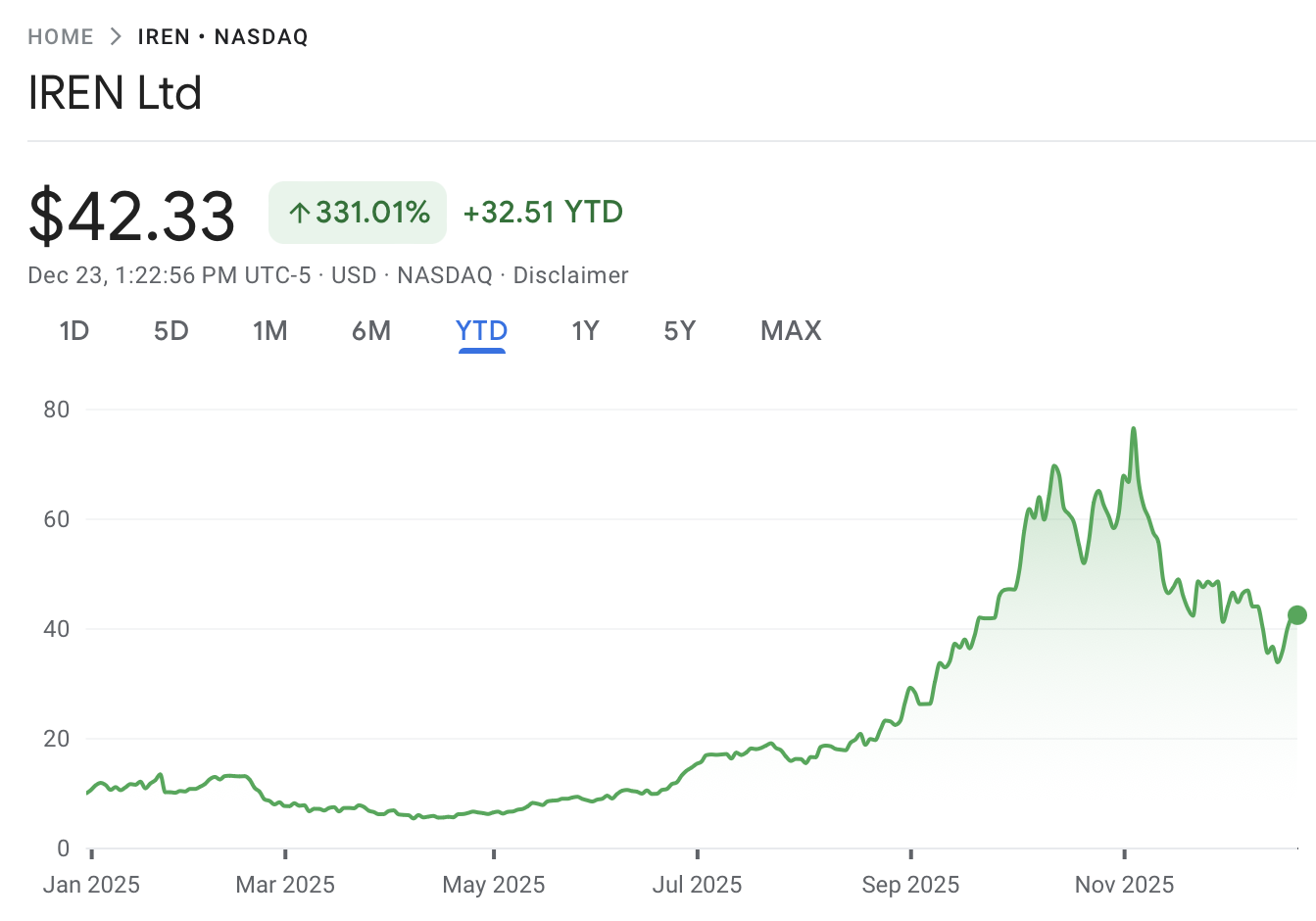

Despite increasing pressure on the mining economy, Bitcoin mining stocks have soared in 2025, showing that public markets are increasingly focused on miners' long-term strategic positioning, rather than just short-term Bitcoin production.

Among the top five listed miners, IREN Limited is up about 331% since the beginning of the year, followed by Applied Digital (246%), Cipher Mining (250%), Hut 8 (160%), and Riot Platforms (36%), according to Google Finance data.

Iren Limited year-to-date stock price. sauce: Google Finance

magazine: The big question: Can Bitcoin survive a 10-year blackout?