Circle CEO Jeremy Allaire said the company views the dollar-pegged stablecoin as a neutral financial infrastructure with network effects, rather than a product aimed at competing with established payment companies.

Appearing on CNBC's Squawk Box during the World Economic Forum in Davos, Switzerland, Allaire said Circle doesn't view card networks like Visa and Mastercard as competitors, but rather “important partners.”

Stablecoins are a “network effects business” and usage and circulation are increasing as more developers and institutions integrate, Allaire said, adding that Circle operates as a “neutral company” that does not compete with banks, payment companies or exchanges.

He also said that the long-term impact of stablecoins remains unclear.

Over time, the cost of storing and moving money decreases to zero. In a future world where AI agents move funds, it will be difficult to know exactly what the payment business model will look like in that time period. ”

Jeremy Allaire (right) speaks during a squawk box interview at the World Economic Forum. sauce: CNBC

Asked if the stalled Digital Asset Market Transparency Act could be passed by the US Congress this year, Allaire said, “There is clearly a bipartisan desire to do so,” adding that the bill would go beyond stablecoins and address the broader use of digital tokens in capital markets, which would benefit both traditional banks and crypto companies.

Publisher is Circle USDC (USDC), the second largest stablecoin by market capitalization. The company went public in June 2025 with an initial public offering price of $31 per share and a subsequent trading opening price of $69.

The stock rose to $263.45 in late May, but has since fallen to $72, according to Yahoo Finance data.

Market performance of Circle stock since its NYSE listing. sauce: Yahoo Finance

Related: Bermuda partners with Coinbase and Circle for 'fully on-chain' economy

Stablecoin competitors will emerge in 2025

The rapid expansion of the stablecoin market has brought a new wave of competitors challenging Circle's position.

In March, it was reported that Fidelity Investments was in the final stages of testing a stablecoin pegged to the US dollar. The $5.8 trillion asset management company plans to launch a stablecoin through its cryptocurrency arm, Fidelity Digital Assets.

About a month later, Stripe announced it was building a USD-backed stablecoin for companies outside the US, UK, and Europe. Stablecoins are provided by bridges.

Crypto payments company MoonPay is also launching a USD-backed stablecoin for everyday payments, which it plans to release in early 2026.

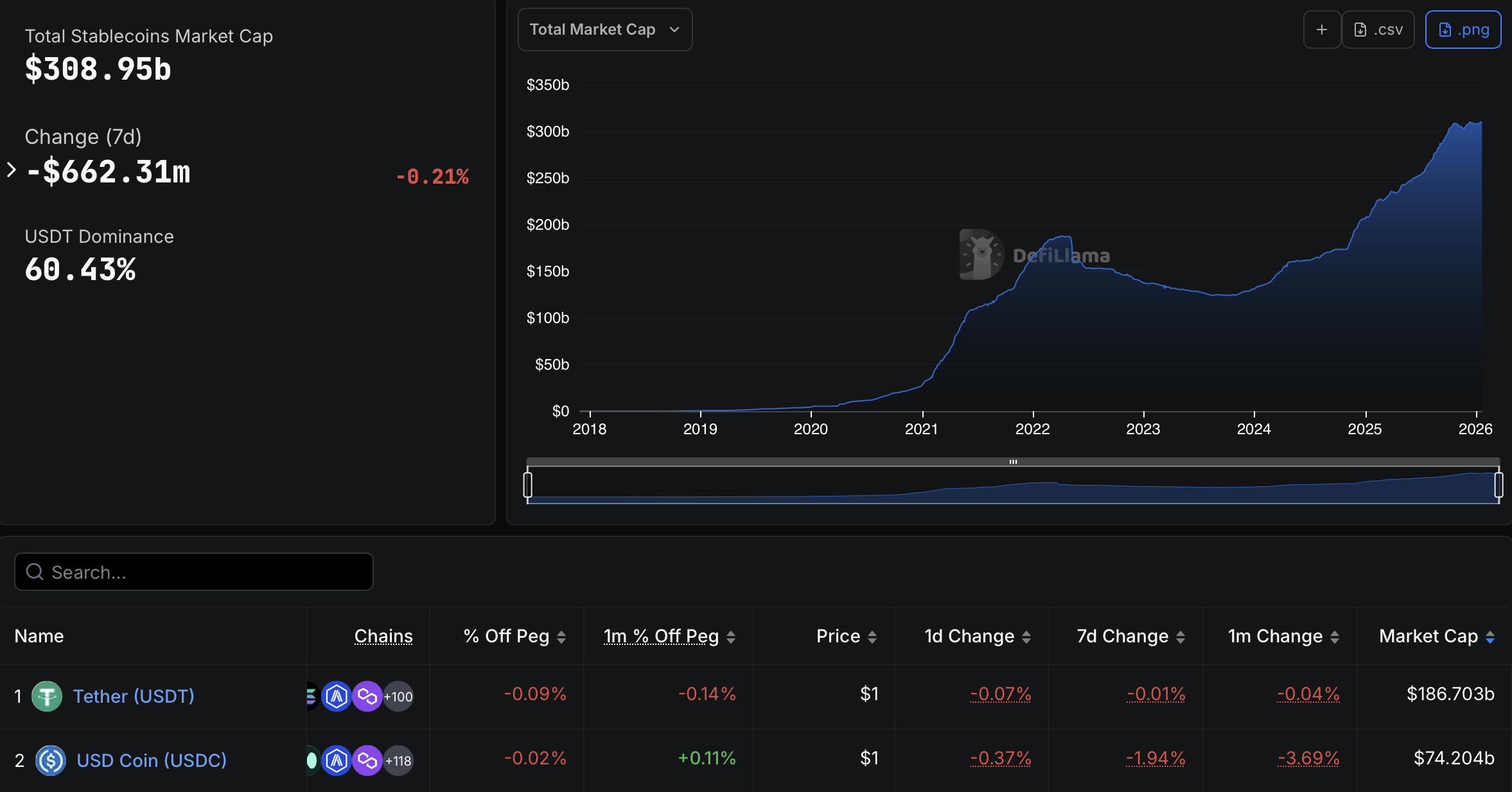

The stablecoin market capitalization was $309 billion as of Thursday, according to data from DefiLlama.

Circle's USDC It accounts for about $74.2 billion of the market and ranks second behind Tether's USDt (USDT), which remains the dominant issuer with about $186.7 billion in circulation.

Stablecoin market capitalization. sauce: Defilama

magazine: Important reasons why you should not seek legal advice from ChatGPT