Digital asset stocks are split this week, with spot prices flattening, and sharper signals emerge from public companies holding digital assets.

A study by research firm 10x said the sector is split between constrained incumbents and new winners. The premium that once promoted growth is compressed and creates a risk of stress as a change in liquidity.

Ministry of Finance, companies rebound

Bitcoin's flat performance contrasts with the expansion of splits, warning that 10x research could precede a more dramatic spin.

“What appears as integration may actually be gentle before a sharp turn.”

Once Bitcoin's most aggressive buyer, MicroStrategy is currently facing restrictions. Its net asset value (NAV) multiple fell from 1.75 times in June to 1.24 times in September, suppressing new purchases. The stock price slides from $400 to $326 and how Financial Model It becomes weak without premium support.

Skepticism is reflected outside the research desk.

“My best financial advice is that you just need to buy Bitcoin and stay as far away as possible from $MSTR.

Comments from investors and podcaster Jason highlighted the concerns Financial stocks It can add complexity rather than direct exposure.

Metaplanet, often referred to as “Japan's micro-strategy,” has surpassed 66% amid concerns over tax policy this summer. Despite trading close to 1.5 times more NAV, volatility remains high and retail flow remains volatile.

In contrast, the circle has recovered 19.6% since September 9th, after USDC adoption expanded through the Finastra partnership. Ten times more research reaffirmed the bullish attitude, calling Circle more attractive as a liquidity beneficiary than Coinbase.

Options reset, puts pressure on finance companies

In addition to these equity shifts, the derivatives market has signaled moderately. Ten times reported a 6% drop in volatility implied BTC, and a 12% drop in ETH on September 12, after a 12% drop in ETH and softened producer prices and inline CPI. Traders actively sold volatility and handled conditions steady. However, 10x warned that pricing for compressed premiums and lower options could set a sharper squeeze stage if the flow was reversed.

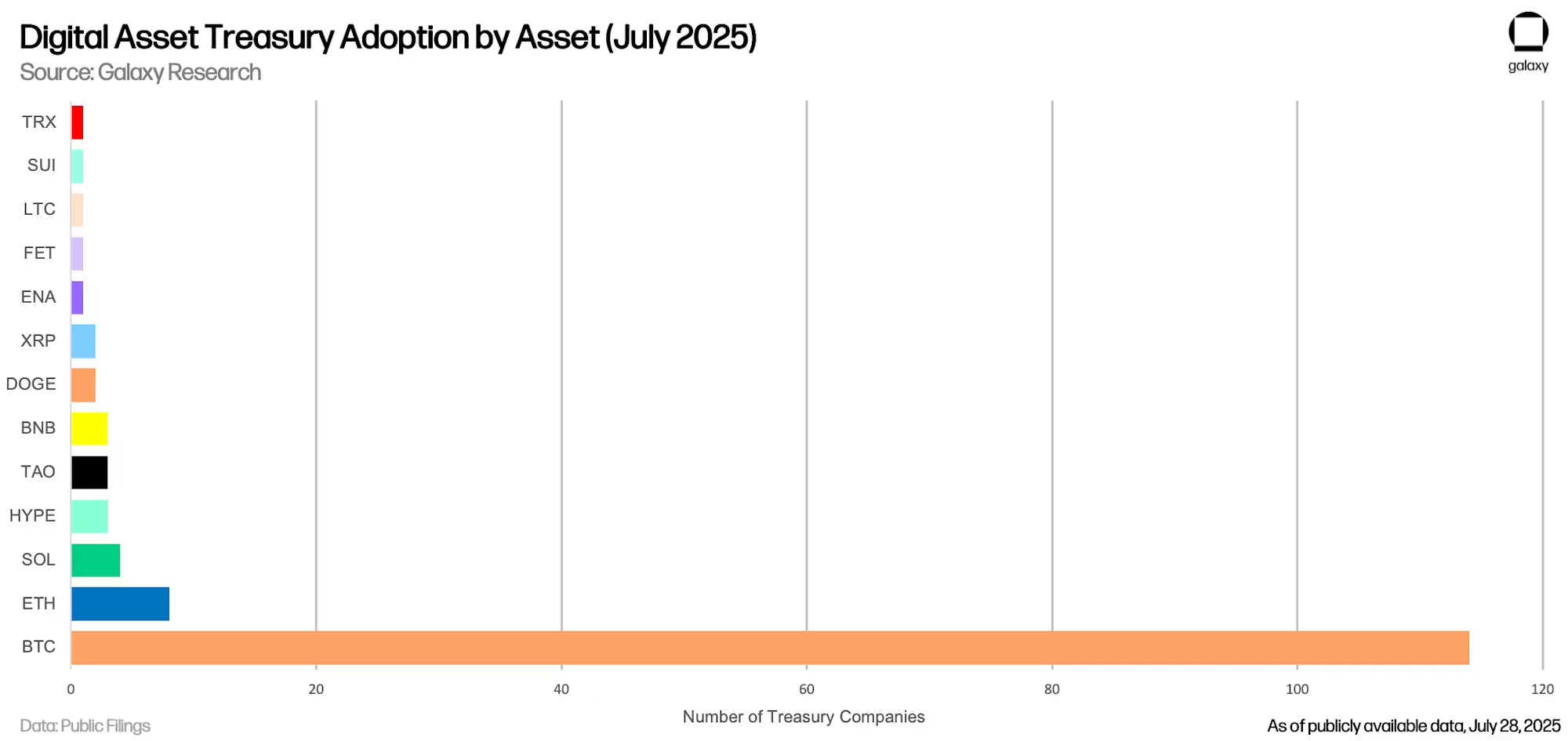

Digital Assets by Assets Ministry of Finance (July 2025) :Galaxy Research

Galaxy Research estimated that Digital Asset Finance Company (datcos) currently owns more than $100 billion in crypto, led by Strategy (formerly MicroStrategy), Metaplanet and others. This model thrives on stock insurance premiums, but collapsed valuations threaten capital access. Galaxy warned that fuel growth and pipes in the market and pipes can backfire the recession.

Coinbase Institutional's monthly outlook explained that the sector will enter the “PVP stage” where success depends on execution rather than imitation. DAT Flow still supports Bitcoin, but claimed that the simple premium era is over In the second half of 2025.

Beincrypto reported it Finance Company“Purchases are slower, and several ethnic focused companies are currently trading below MNAV, poses the risk of funding and forced sales. He also said a small number of players relying on debts are increasing vulnerability, and liquidation is an imminent threat.

The outcome of Bitcoin may depend on whether circle rebounds build confidence or whether NAV compression across incumbents causes stress. For now, the options suggest mild, but there are differences between Financial stocks Indicates the cycle under strain.

Post-digital asset stock branches: Circle Rises and MicroStrategy Stalls first appeared in Beincrypto.