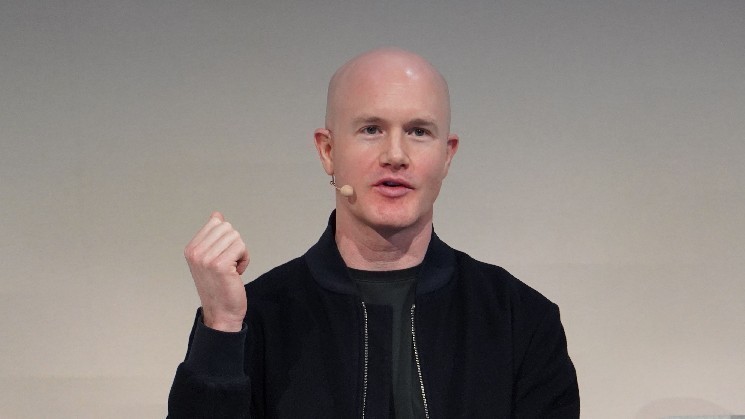

Coinbase (COIN) is partnering with some of the largest U.S. banks on a pilot program that includes stablecoins, crypto custody and trading, CEO Brian Armstrong said at the New York Times Dealbook Summit on Wednesday.

“The good banks are going to look at this as an opportunity,” Armstrong said in a discussion with BlackRock CEO Larry Fink. He did not mention specific bank names. “Those who are fighting it will be left behind.”

The announcement signals a quiet but growing adoption of crypto infrastructure by mainstream financial institutions, even though the broader market remains under heavy regulatory scrutiny. Stablecoins – digital tokens backed by cash or cash-like assets – have become a central focus for banks considering tokenized finance.

The joint appearances also covered broader themes. Mr. Fink is a person who once denied Bitcoin. BTC$93,034.11now seeing it as a hedge in uncertain times. “You own Bitcoin because you fear for your physical security. You own Bitcoin because you fear for your financial security,” he said. For Fink, Bitcoin is not speculative, but is meant to provide long-term protection from currency depreciation and mounting debt.

Fink said:

Armstrong also called for clearer rules from Washington. He said he expected the U.S. Senate to vote soon on a bill known as the CLARITY Act, which would establish legal definitions and responsibilities for crypto exchanges, token issuers and other players in the digital asset space.