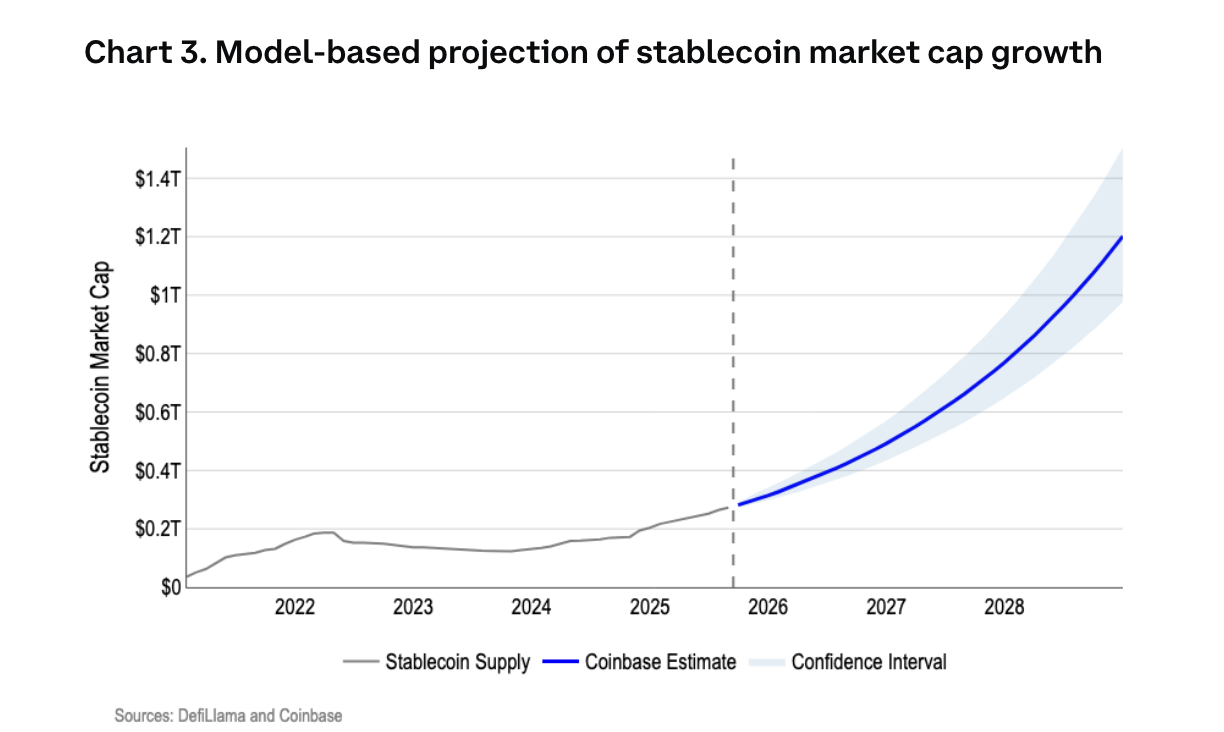

According to Crypto Exchange Coinbase, the total Stablecoin market for US Dollar Pegg will swell to $1.2 trillion by 2028, spurring comprehensive US crypto regulations.

Coinbase said the forecast means that the US Treasury issuance should be $5.3 billion over the next three years to meet demand from Stablecoin issuers who use short-term US Treasury bills as support collateral for digital fiat tokens.

Stablecoin market capitalization forecast by 2028. source: Coinbase

This issue schedule causes a minor and temporary decline in financial yields of around 4.5 basis points (BPS), contrary to analysts' predictions that requests from Stablecoin issuers will significantly reduce interest on US government debt. Coinbase wrote:

“We believe that predictions do not require unrealistically large or permanent rate dislocations to achieve. Instead, it relies on the adoption of incremental policy-enabled over time.”

The passing of the Genius Bill, a ridiculous regulatory framework in the United States, which comes into effect in January 2027, is a catalyst for the growth of the stubcoin market, Coinbase said.

However, US law forced other countries to consider legalizing their own stubcoins to stay competitive with the dollar in the digital age.

Related: The US Treasury Department is seeking public comment on the genius stablecoin building

The Stablecoin sector grows as other countries signal they are taking part in the race

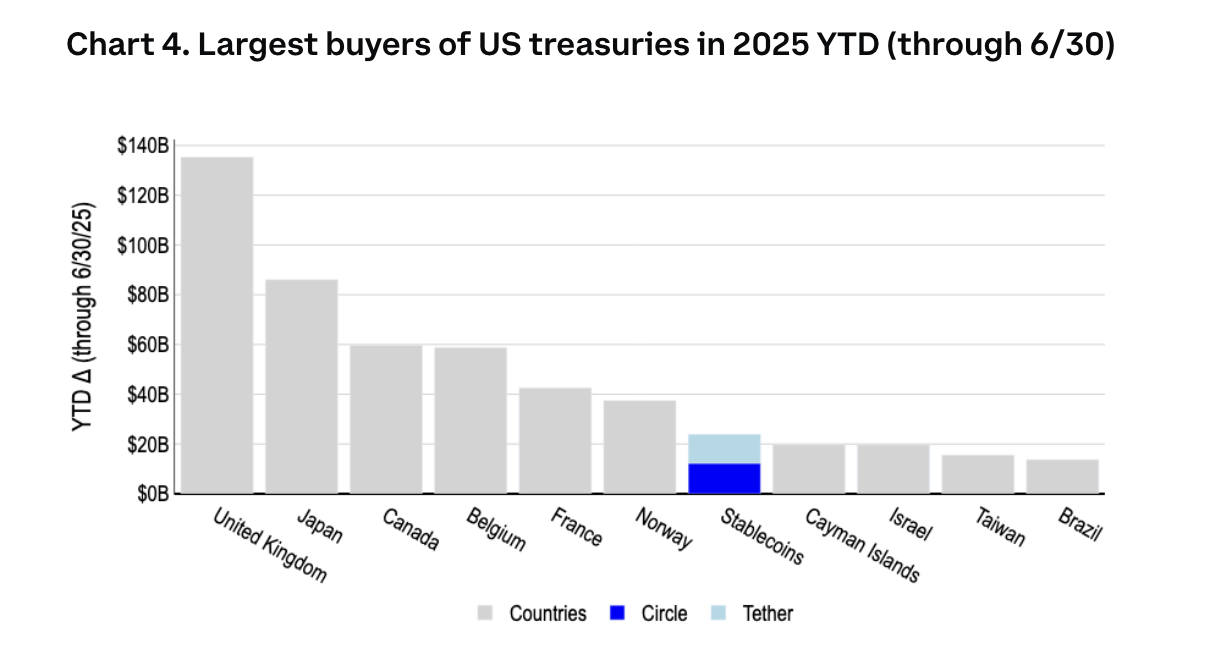

Private Stablecoin publishers such as Tether and Circle have become top buyers in countries such as US government debt, South Korea, the United Arab Emirates (UAE), and Germany.

Stablecoins became the top buyer of US government debt in 2025, beating most countries. sauce: Coinbase

So far, the dollar has been dominated by religious stubcoins, but other countries are now investigating stubcoins as a supplement to traditional Fiat currency.

The South Korean Financial Services Commission (FSC), the government's regulator, announced in October that a comprehensive stablecoin regulatory bill will be introduced to Congress for consideration.

With a long history of cryptocurrencies on the other side and privately issued funds, the Chinese government reportedly could see the yuan-backed silly silly spread to the market.

Analysts and industry executives say the original stubcoin rollout is likely to be limited to Chinese economic zones such as Hong Kong and the international currency market.

magazine: Japan and China Stubcoin, India changes crypto tax: Asia Express