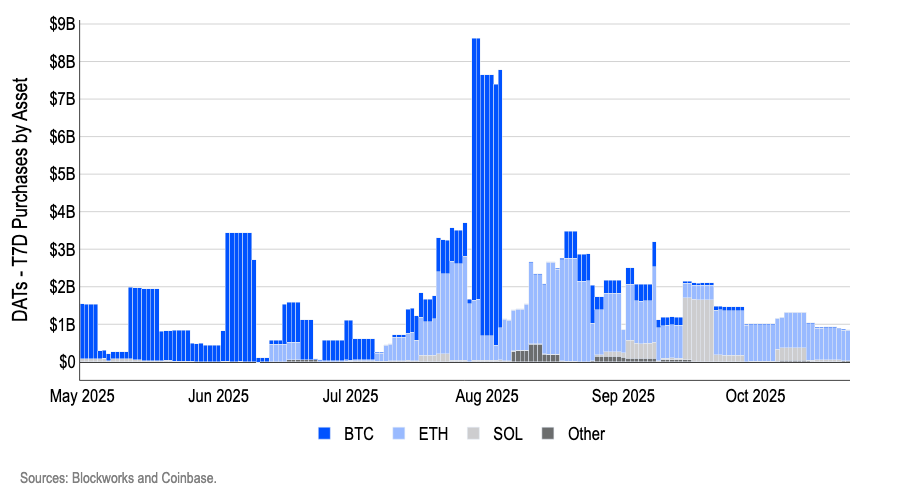

Cryptocurrency purchasing activity by digital asset treasury (DAT) companies has plummeted since the October 10 market crash. In fact, Bitcoin purchases have fallen to their lowest level in a year, according to a top analyst.

David Duong, head of Coinbase Research, posted the analysis on his X account on Tuesday. He started with the question, “Where is the DAT?” His data shows that most DAT purchases have been concentrated in Ethereum (ETH) over the past two weeks.

Bitcoin DAT buying has dried up

Duong highlighted that the area representing the purchase of Bitcoin DAT has virtually disappeared since October 10th. The significant purchases of ETH recorded in August and September set a high benchmark. Still, despite the nagging, current ETH purchases have been reduced by more than half.

Duong noted that Bitcoin DATs are “typically deep-pocketed heavy hitters with the ability to scale and intervene when conviction is high.” He added: “Their absence for almost two weeks shows that their confidence is waning.” DAT-led buying is often seen as an important test to confirm bullish sentiment in the market.

DAT – T7D purchases per asset. Source: Coinbase

Ethereum accumulation concentrated in one company

While ETH has seen consistent buying after the drop, Duong explained that this buying power is highly concentrated in a single company, Bitmine Immersion Technologies (BMNR), the largest ETH DAT company by market capitalization.

On Monday, BMNR strengthened its position by adding 77,055 ETH, bringing its total holdings to over 3.31 million ETH. This massive reserve currently accounts for approximately 2.8% of the total ETH supply, and Bitmine's digital assets and cash holdings exceed $14.2 billion.

Mr. Duong noted that the recent net long purchases of ETH DAT remain positive. However, analysis reveals that this single agency (BMNR) drives nearly all net purchases. This concentration has raised concerns that if the pace of BMNR's purchases slows or stops, the company's overall buying momentum could materially weaken.

Analysts recommend caution

Duong attributed the lack of progress in BTC DAT purchases to large investors taking a cautious approach following the dramatic leverage flush following the October 10 crash. As a result, the event put major companies on the defensive in anticipation of a possible further market decline.

“We believe more prudent positioning will be needed in the near term as the market becomes more vulnerable when the largest discretionary balance sheet is sidelined.”

The post Coinbase says DAT purchases remain frozen after crash appeared first on BeInCrypto.