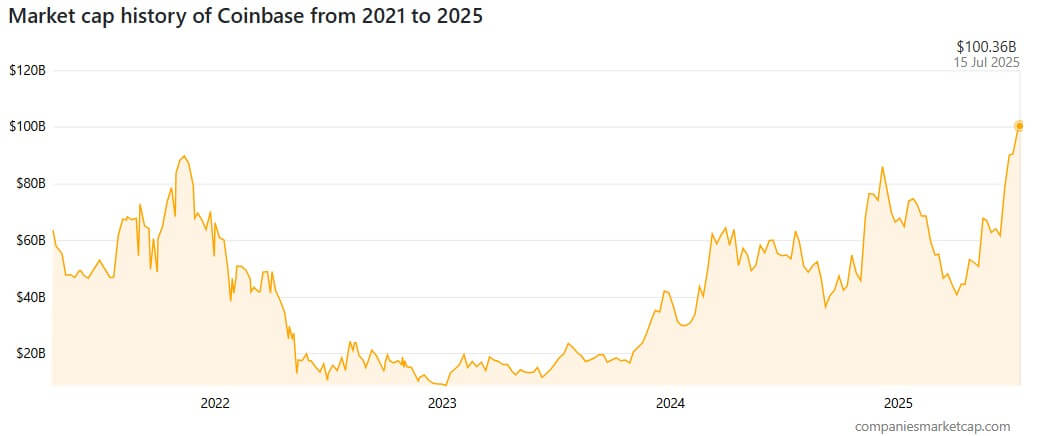

Coinbase has crossed a key milestone and reached a market capitalization of over $100 billion amid new momentum across the crypto sector.

Coinbase (Coin) shares reached a new high of $398.50 during trading hours on July 14, but the stock closed at around $394, reflecting a 2% increase over the period.

Given this performance, Kylie Reidhead, co-owner of Crypto Media Outlet Milk Road, suggested that Coinbase could grow into a $1 trillion company.

He likened Coinbase's trajectory to the rise of Amazon in retail and the rise of Netflix in entertainment, adding that the US-based crypto exchange is positioned as a pillar of “upgrade” the current financial system.

Reidhead said the positioning could help Brian Armstrong-led companies outpace traditional banking giants like JPMorgan.

Why Coinbase Stocks Are Gathering

Coinbase's surge is part of the company's expansion role in improving macro conditions in the crypto industry, rising digital asset prices, and merging traditional finances and emerging industries.

The inclusion in the S&P 500 index earlier this year shows an increased confidence in the basics and profitability of the exchange. Additionally, the move is expected to increase ownership of the institution as index funds adjust their portfolios.

Coin Stock Rally coincided with crypto prices, particularly Bitcoin rise.

Is Coinbase overrated?

Despite the positive outlook, some analysts believe Coinbase's rating could swell.

Analysts at the 10x survey warn that Coinbase could be overvalued, especially as institutional investors prefer large Bitcoin miners as a proxy for top crypto assets.

According to the company, Coinbase is trading at a premium compared to Bitcoin, despite both assets experiencing profits.

The company states:

“Coinbase remains overvalued compared to Bitcoin, but both are being obtained. A small number of assets, including Circle and Robinhood, show stronger momentum than Bitcoin.”

In particular, HC Wainwright recently downgraded Coinbase from buying to selling. We cited the ratio of 150% meetings in the past quarter to earnings that may not reflect the underlying basics.