With only a few days left until the end of 2025, Coinglass has released its 2025 year-end report.

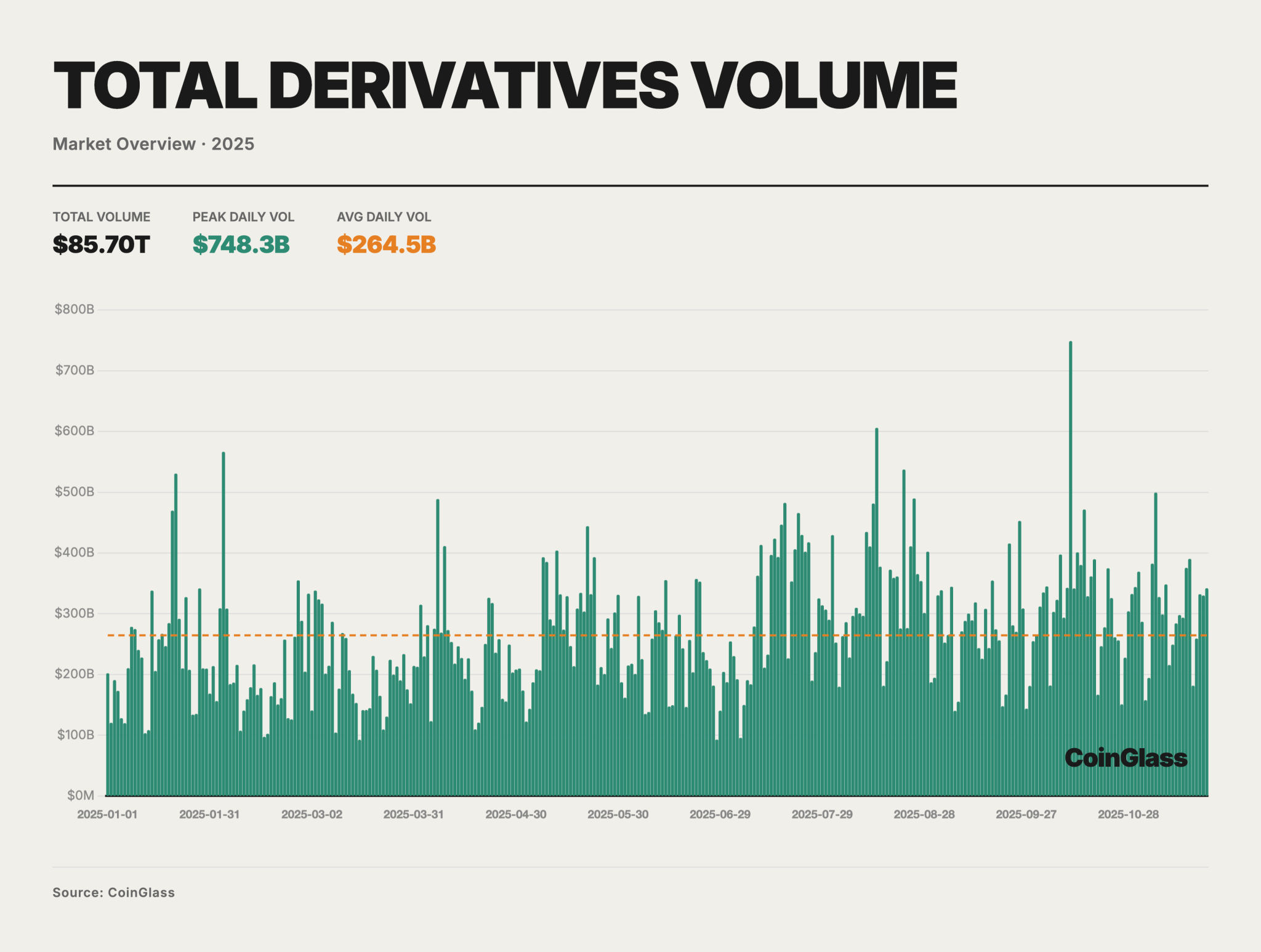

According to a report by CoinGlass, the total trading volume of the crypto derivatives market in 2025 is expected to be approximately $85.7 trillion, with an average daily trading volume of $264.5 billion.

2025 is the year of DAT.

The report highlighted that 2025 is the year of DAT (Depth of Activated Transactions). DAT companies increased their Bitcoin holdings from 600,000 BTC at the beginning of the year to 1.05 million BTC by November, capturing about 5% of the total Bitcoin supply.

The total trading volume of the cryptocurrency derivatives market reached approximately $85.7 trillion throughout the year, with an average daily trading volume of $264.5 billion. Open positions in global crypto derivatives fell to a yearly low of about $87 billion in the first quarter due to lower leverage, but rose rapidly in mid-year and reached a record high of $235.9 billion on October 7th.

The fourth quarter was also tough, with a sharp reset in early October that wiped out more than $70 billion in positions, roughly a third of all open positions, due to a sudden delegitimization event.

Coinglass attributed this decline and liquidation to US President Donald Trump's decision to impose 100% tariffs on products from China.

Despite this decline, open positions at the end of the year amounted to $145.1 billion, an increase of 17% from the beginning of the year.

The total nominal amount of long and short positions liquidated reached $150 billion, with daily liquidations averaging $400 million to $500 million.

These purges were mainly concentrated in October and November.

“The unexpected and extreme events of 2025 have put existing collateral mechanisms, clearing rules, and cross-platform risk transfer methods under unprecedented stress test.”

Binance has taken the lead!

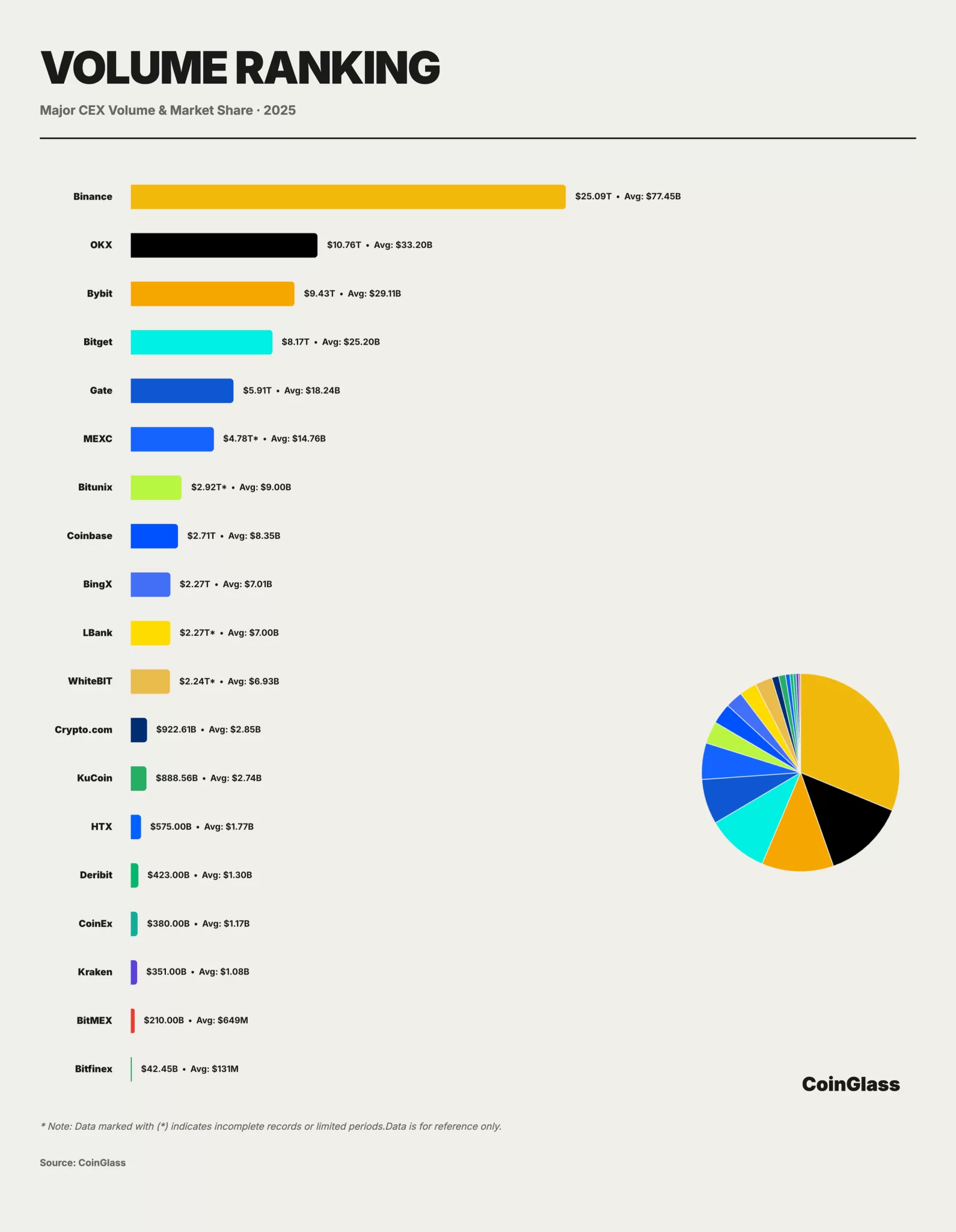

According to a report by CoinGlass, Binance led the market with total derivatives trading volume of approximately $25.09 trillion.

This accounts for about 30% of the world's trading volume, meaning that about $30 out of every $100 traded is done through this exchange. Binance was followed by OKX with $10.7 trillion, Bybit with $9.4 trillion, and Bitget with $8.1 trillion. These four exchanges accounted for approximately 62.3% of the total market share.

*This is not investment advice.