Bitcoin's price could rise in 2026 as easy monetary policy injects “a ton of” liquidity into the market, according to Bill Berheit, CEO of crypto exchange and wallet company Abra, but other analysts are more cautious.

In an interview with Schwab Network, Berheit said he expects a “huge” liquidity injection from the Federal Reserve next year as policymakers continue to cut interest rates, reinstate quantitative easing, and potentially increase risk assets such as Bitcoin, adding:

“We are now seeing light on quantitative easing. The Fed is starting to buy its own bonds. I think we will see a significant decline in demand for government bonds next year as interest rates fall. All of this bodes well for all assets, including Bitcoin.”

Abra CEO Bill Berheit presents his predictions for BTC and the crypto market in 2026. source: schwab network

With regulatory clarity and an increase in institutional investors in the US, as well as lower interest rates, BTC and the broader crypto market are likely to continue “for years to come,” he added.

Only 14.9% of investors expect a rate cut at the next Federal Open Market Committee meeting in January, down from 23% of respondents in the November survey, according to data from the Chicago Mercantile Exchange (CME) Group.

Interest rate probabilities for the January FOMC meeting. sauce: CME Group

Bitcoin early adopters and analysts countered this bullish price prediction by claiming that 2026 will be another down year for BTC and that Bitcoin has entered a bear market that could last for months or years.

Related: Here's how an AI model predicts Bitcoin and altcoin price ranges in 2026.

Analysts say BTC could bottom in 2026, US midterm elections pose a risk

2026 is likely to be a bad year for Bitcoin prices, according to early BTC investor Michael Terpin, who predicted that BTC could bottom out at around $60,000 in the final quarter of 2026.

He said the new chairman of the Federal Reserve is also expected to ease interest rates, but any improvement in macroeconomic conditions could be offset by the outcome of the 2026 US midterm elections.

“Anything short of a landslide Republican victory in the midterm elections will undermine consideration of further regulation,” Terpin said.

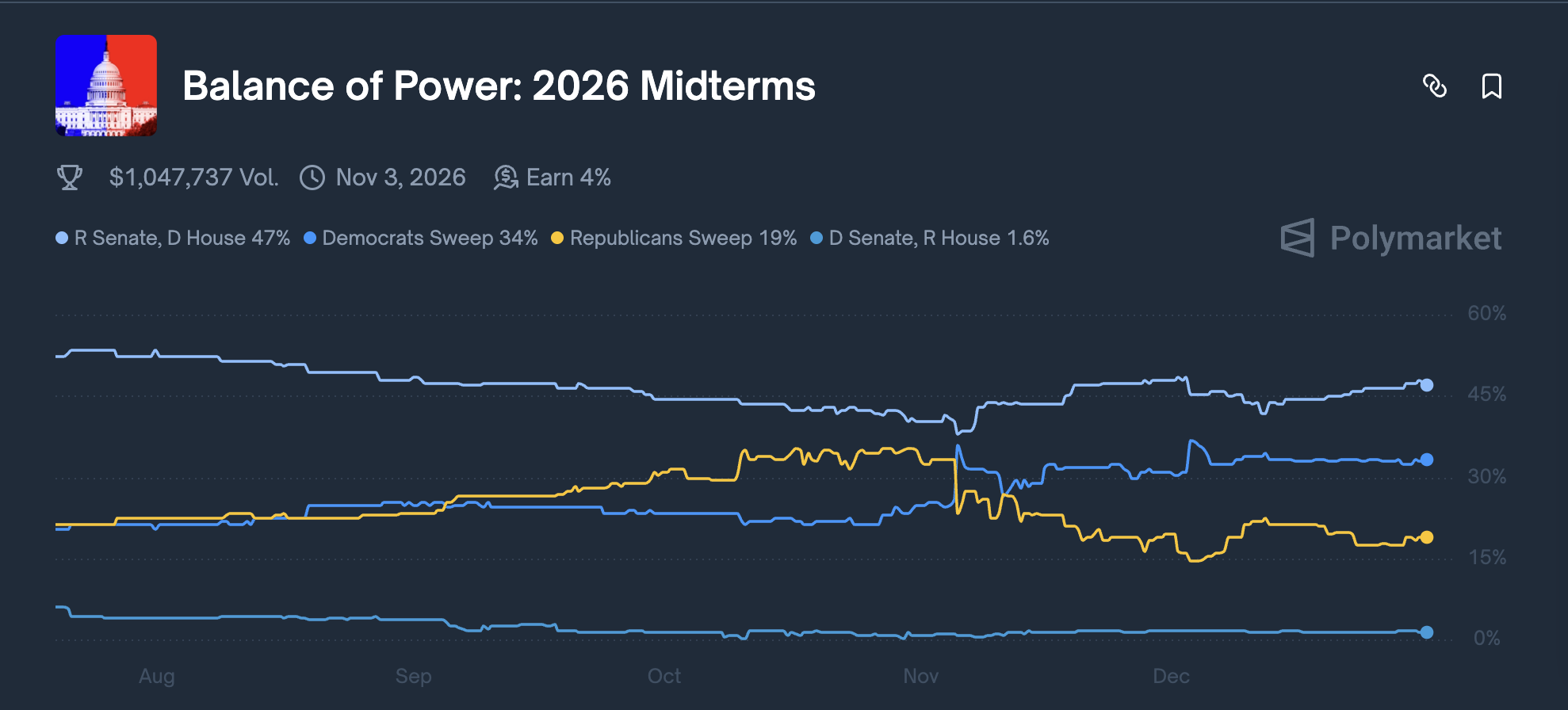

Predictions for the 2026 US midterm elections. sauce: Polymarket

At the time of writing, the probability of a Republican victory in prediction market Polymarket was 19%, with 47% of traders betting on each party controlling one Congress.

Joe Dole, general counsel at non-fungible token (NFT) market Magic Eden, previously told Cointelegraph that the balance of power “almost always” flips in U.S. midterm elections.

magazine: Bitcoin's crisis level is $82,500, Ethereum is 'not over yet': trade secrets