Cryptocurrency investment products continued to decline last week due to weakening investor sentiment, resulting in capital outflows for the second consecutive week.

European crypto investment firm CoinShares announced on Monday that crypto exchange-traded products (ETPs) experienced $1.7 billion in outflows this week.

Outflows were slightly lower than the previous week's $1.73 billion, bringing total outflows over the past two weeks to $3.43 billion. This turned year-to-date flows into negative territory, with $1 billion outflowing.

“We believe this reflects a combination of factors, including the appointment of a more hawkish Federal Reserve chairman, continued whale selling following four-year cycles, and heightened geopolitical volatility,” said James Butterfill, head of research at CoinShares.

Total assets under management have fallen by $73 billion since October last year.

This outflow reduced crypto funds' total assets under management (AUM) to $165.8 billion, with $73 billion removed from AUM since October 2025, Butterfill noted.

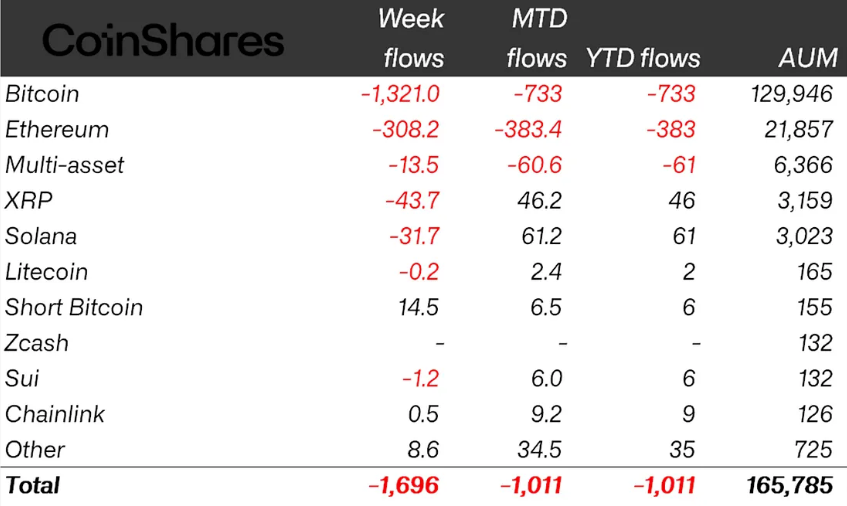

Bitcoin ($BTC) Cryptocurrency funds accounted for most of the outflows, with $1.32 billion outflows. $BTC Investment products have resulted in $733 million in outflows year-to-date.

Weekly crypto ETP flows by asset (in millions of USD) as of Friday. Source: CoinShares

The Ether (ETH) fund recorded weekly outflows of $308 million, bringing year-to-date losses to $383 million. Solana (SOL) and $XRP ($XRP) were unable to avoid the economic downturn, with total outflows of $31.7 million and $43.7 million, respectively.

Meanwhile, Bitcoin short products saw inflows of $14.5 million, consistent with negative market sentiment.

BlackRock's iShares again brings the most losses

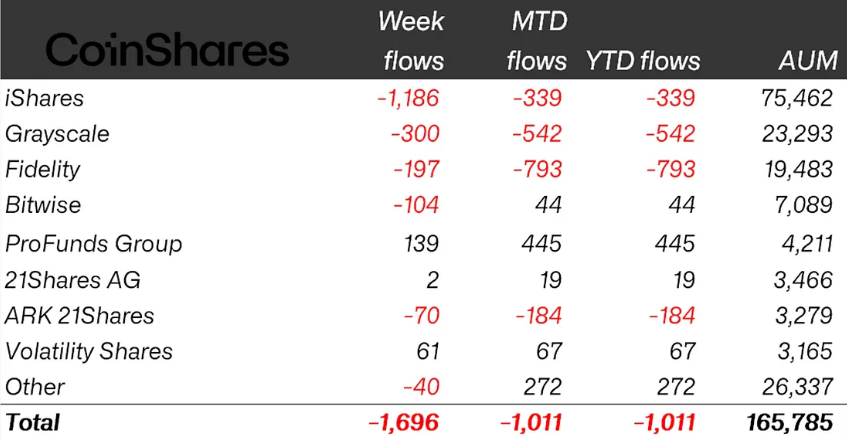

Outflows hit most issuers last week, with BlackRock's iShares ETF leading the way with $1.2 billion. Grayscale Investments and Fidelity lost $300 million and $197 million.

On the upside, Profans Group and Volatility Shares bucked the trend with inflows of $139 million and $61 million.

Weekly crypto ETP flows by issuer as of Friday (in millions of USD). Source: CoinShares

CoinShares' Butterfill also said that Hyperliquid (HYPE) is one notable exception, benefiting from tokenized precious metals activity.

Crypto ETF outflows last week preceded a sharp decline over the weekend, with Bitcoin dropping below $75,000 on Sunday.

Related: In Polymarket, the probability that Bitcoin will fall below $65,000 increases to 72%

The Crypto Fear & Greed Index currently sits at an “Extreme Fear” score of 14, suggesting that crypto funds could face another negative week unless the market recovers sharply.

At the time of publication, Bitcoin was trading at $77,610, down 1.7% in the past 24 hours, according to CoinGecko.

magazine: How will cryptocurrency law change in 2025 and how will it change in 2026?