Cryptocurrency whales, or large investors, have purchased hundreds of millions of ether. This is because analysts point to an organic rotation of investor mindshare for altcoins that could be higher.

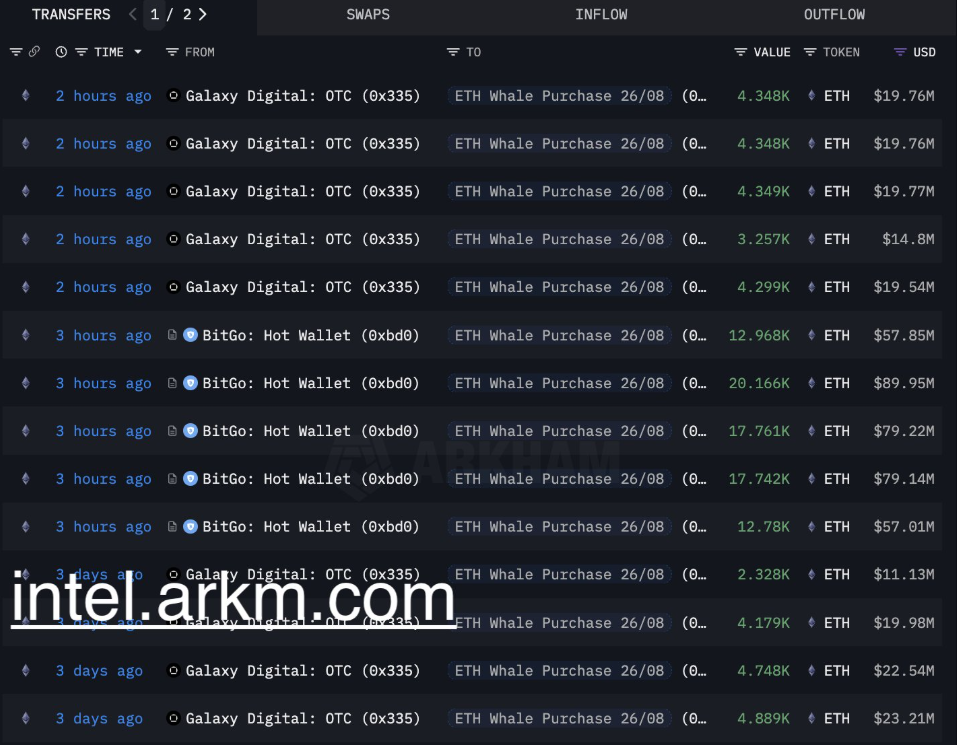

Nine “large” whale addresses have purchased cumulative $456 million worth of ether (ETH) from Bitgo and Galaxy Digital, Arkham said.

According to Nicolai Sondergaard, research analyst at Crypto Intelligence Platform Nansen, the growing demand for the world's second-largest cryptocurrency indicates a “natural rotation” to market ethers and other Altcoins, and a “natural rotation” to other Altcoins, which could be more reversed.

“Many of this looks like a natural rotation. Investors get trapped in profit from running Bitcoin and move to other tokens to catch potential benefits,” the analyst told Cointelegraph, adding:

“Ether in particular is benefiting from its current mindshare and the momentum of the Ether Treasury.”

While the recent whale movement has been “notable,” the analyst said, “the broader trend is that flows are spreading beyond Bitcoin as market participants are looking for the next move.”

sauce: Arkham

Related: Andrew Tate Shorts Kanye West's Yzy won a $700,000 loss on high fat

Still, increasing Bitcoin profits could possibly portend “investment mindsharing” rather than focusing on ether, Sondergaard added.

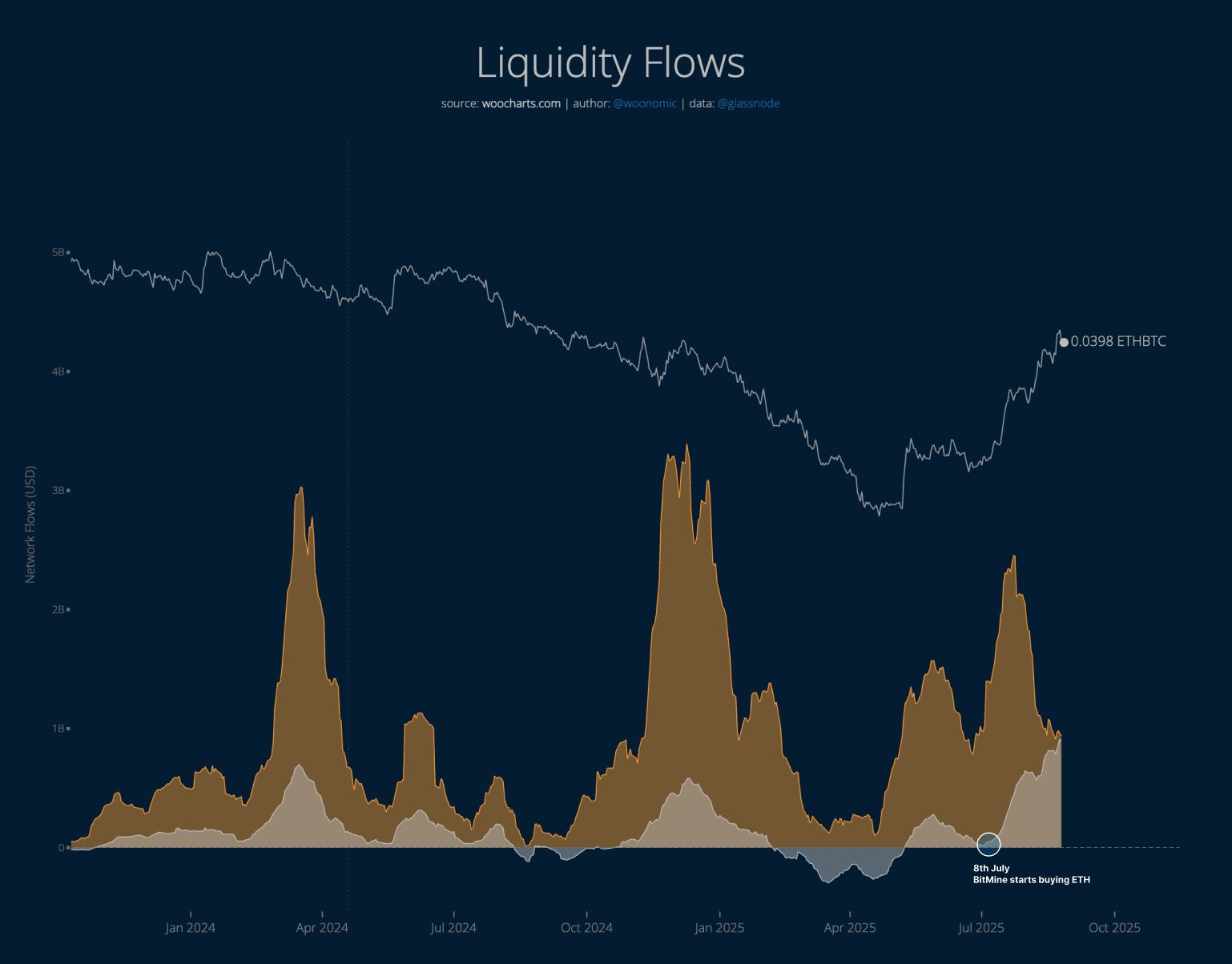

Crypto analyst Willy Woo pointed to an increase in capital turnover from Bitcoin (BTC) to ether.

Source: Willie woo

“Inflows to ETH at 0.9b USD (silver) per day are now approaching BTC inflows (orange),” analysts wrote in X-Post Tuesday, adding that the latest influx streak “started when Tomley's ETH Treasury, Bitmine, began its ETH accumulation.”

These comments come a week after more than $11 billion of Bitcoin Zilla sold $25.9 billion worth of Bitcoin and sold a permanent long position of $2.2 billion spot ether and $577 million ether.

Related: US retirement plans could fuel Bitcoin rallies at $2 million despite the recession: financial redefinition

Smart Money Trader buys Altcoins: Nansen data

Tracked as a “smart money” trader on Nansen's blockchain intelligence platform, the industry's most successful cryptocurrency trader has already been spinning into altcoins, robbing investors' expectations for the 2025 altcoin season.

Looking at their most important, large-scale cap token acquisitions, smart money traders have acquired $1.2 million worth of chain link (link) tokens, $967,000 worth of Ethena (ENA) and $614,000 worth of Rido Dao (LDO) tokens, Nansen's data shows.

Smart Money Trader, Top Holdings. Source: Nansen

Cointelegraph reported Tuesday that Cointelegraph may have responded to bit-by-bit asset management filings to launch funds whose link acquisitions were traded on link-based exchanges with the U.S. Securities and Exchange Commission.

However, these cumulative altcoins acquisitions are pale compared to the $28 million ether acquired by dormant whales that have been inactive since 2021, Cointelegraph reported Tuesday.

https://www.youtube.com/watch?v=4n4pznl8syw

magazine: Altcoin Season 2025 is pretty much here…but the rules have changed