China's cryptocurrency strategy is turning money into a national strategic weapon. A recent study published by Study Times, the official newspaper of China's Central Party School, argues that digital assets are now shaping war and finance.

The study describes cryptocurrencies and central bank digital currencies (CBDCs) as tools of “financial mobilization.” This would allow states to direct liquidity in the event a bank fails or sanctions are tightened. Blockchain networks have been called “digital logistics fronts,” merging economic survival and national security.

Digital money becomes an instrument of geopolitical power

According to the study, the battleground has now expanded to the financial sector as well. Cryptocurrencies form an infrastructure for “total war” that combines deterrence, capital mobilization, and social stability. Digitizing the flow of funds could help the Chinese government maintain liquidity, fund its defense industry, and support domestic demand in the event of a global financial collapse.

He also outlined three themes: “total war, hybrid war, and digital financial war,” and argued that digital ledgers support national resilience. Digital renminbi and blockchain payments serve as strategic assets within this framework. They are built to operate independently of US sanctions and the SWIFT network.

“Digital currencies have become strategic assets in hybrid warfare, reshaping cross-border capital flows during wartime.”

— study time (2025)

This change reflects a broader trend. Economist Barry Eichengreen points out that the dollar's share of global foreign exchange reserves has fallen from 71% in 2000 to 58% in 2024. He writes that governments are “moving away from the dollar…for geopolitical reasons, but businesses still prefer the liquidity of the dollar.”

Meanwhile, the Chinese government's mBridge project, which connects CBDCs in China, Saudi Arabia, Thailand, and the United Arab Emirates, seeks to bypass SWIFT and create a parallel network beyond the reach of the United States. For China, blockchain means more than speed. It represents autonomy under economic pressure.

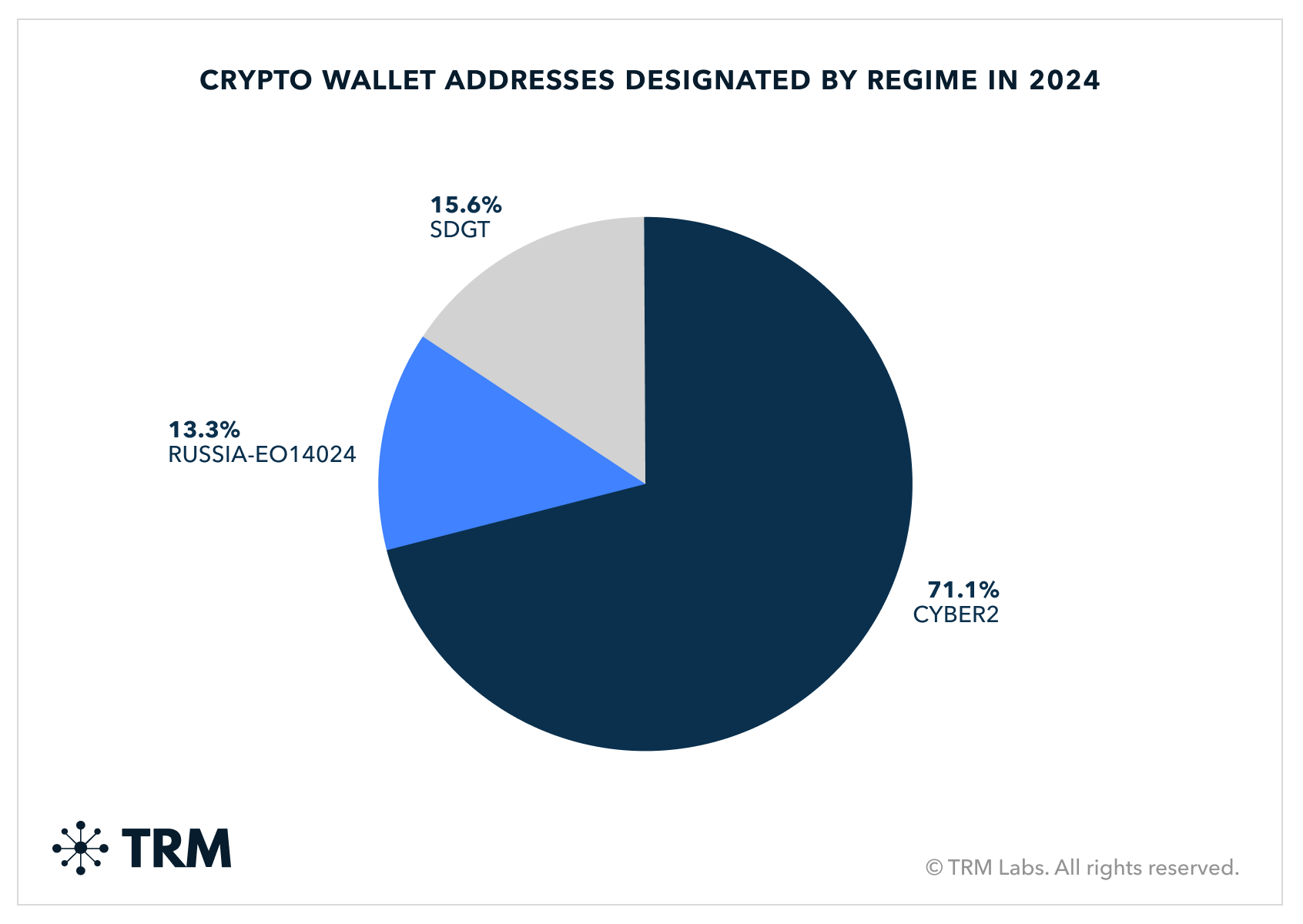

TRM Labs’ 2025 Crypto Crime Report shows that digital assets are active on both sides of the geopolitical battlefield. Sanctioned exchanges such as Russia's Garantex and Iran's Nobitex handled more than 85% of illicit flows into restricted markets.

Distribution of 86 designated addresses | TRM

Terrorist groups, including Hamas, Hezbollah, and ISIS affiliates, have used stablecoins such as TRON’s USDT to raise funds. As a result, Israel froze millions of dollars in related accounts. Digital finance, once celebrated as a borderless innovation, is now a field of control and coercion.

From cyber defense to projecting “soft power”

Military theorist Jason P. Lowery argues that: software Bitcoin is a “non-lethal form of power projection, a digital defense system protected by electricity rather than explosives,” he said. This idea is currently shaping the Chinese government's view of blockchain as a foundation for resilience and deterrence. Building currency controls into the code allows states to project power through networks rather than armies.

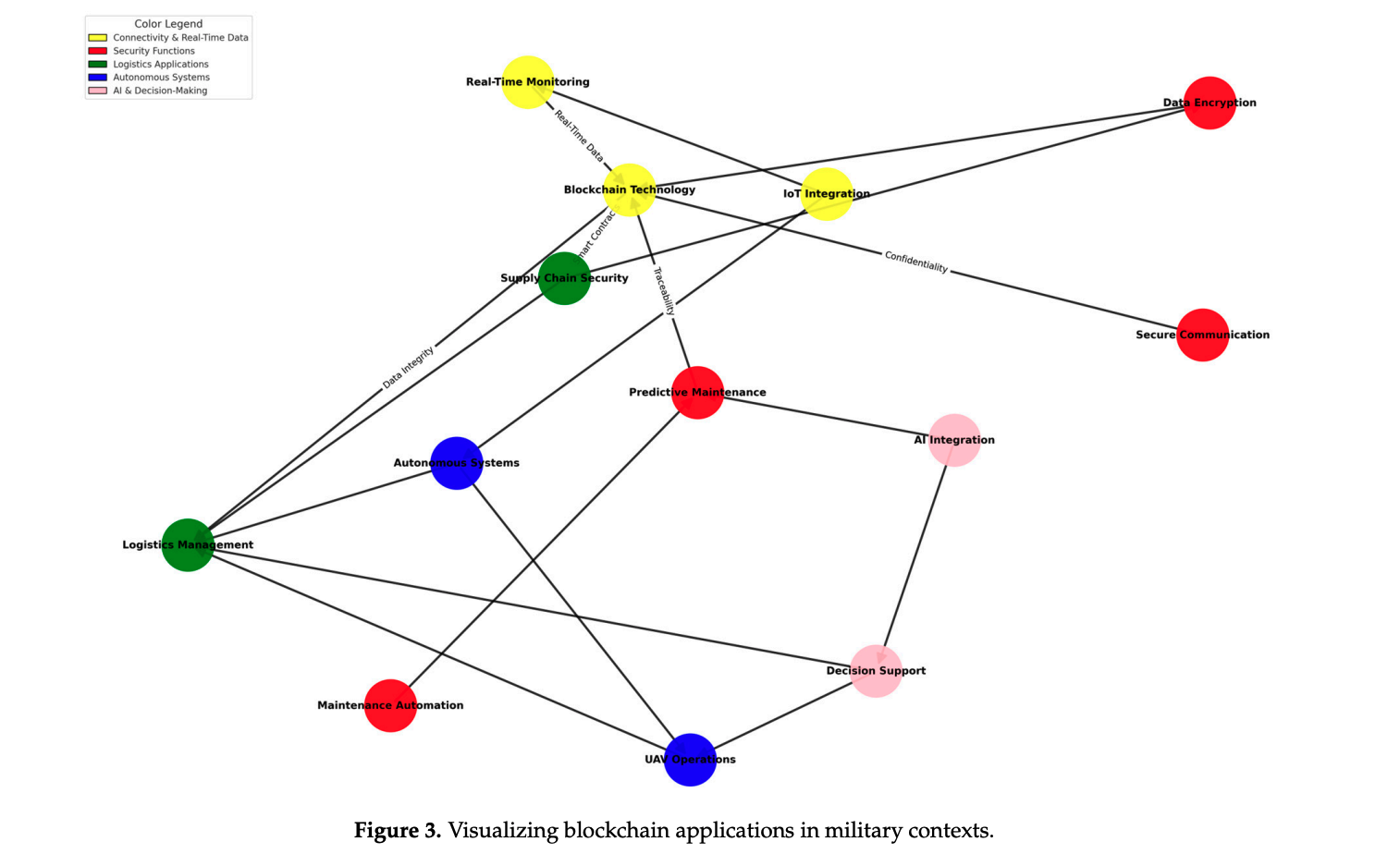

Visualization of blockchain applications in the military field | Applications of blockchain in the military field

A 2025 review published in the journal Technologies found that blockchain “enhances military operations through secure communications, immutable logistics, and quantum-secure authentication.” Researchers said distributed ledgers can strengthen command systems and supply chains against cyber and physical attacks. These findings demonstrate how crypto infrastructure is moving from finance to defense, marrying data integrity, funding agility, and operational reliability.

Geopolitical disparities are widening. While Western governments aim to limit the militarization of cryptocurrencies, China has incorporated cryptocurrencies into its national policy. As Eichengreen warned, “geopolitics goes both ways.” Depending on who builds the rails, cryptocurrencies can either weaken or strengthen the dollar’s dominance. Ultimately, Beijing's hybrid model (combining economic control and technological sovereignty) suggests that the next great power contest will play out across markets, cyberspace, and the distributed ledgers that connect them.

The article “China turns crypto into a national strategic weapon: Digital yuan on the front lines” was first published on BeInCrypto.