worldcoin was launched in the US and rose 19.78% last week.

The top ten wallets of copy still control 77.62% of WLD's total token supply.

Critics, including Zachxbt, have denounced the manipulation and fraud projects.

The US launch of WorldCoin (WLD) began with a lot of positive price action, but that doesn't necessarily mean buying WorldCoin.

Digital identity cryptocurrency related to Sam Altman's World Project aims to counter the impact of artificial intelligence (AI) by offering a tampered way to verify your identity online and launching in the US on May 1st.

WLD surged from $1.03 to $1.16, increasing its retreat to $1.08 by press time on May 1, bringing its daily chart return to 4.31%. Within the last seven days, WorldCoin has risen 19.78%.

Despite positive pricing action, the project is controversial and plagued by legal issues, which could help to slow down bullish momentum going forward.

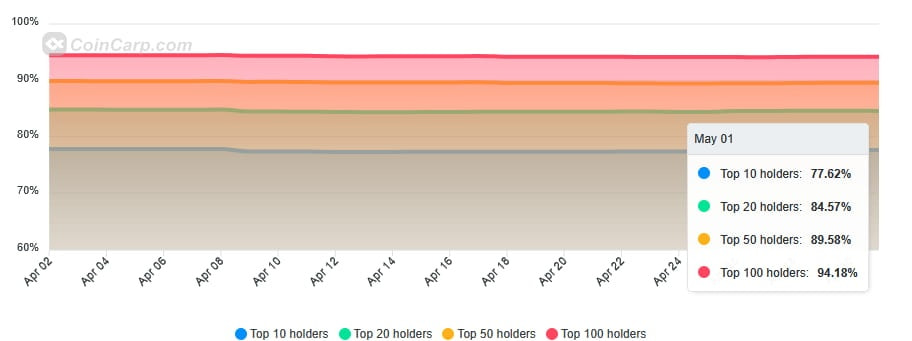

WorldCoin launch is suffering from high concentrations continuously

Furthermore, the issue of concentration remains a hot topic. In August 2023 there were only 10 wallets, accounting for 98% of WLD's total supply. Progress is being made in that respect, but it also does not mean that the current situation is satisfying.

For each data retrieved by Finbold from the Market Intelligence platform Cincarp On May 1, the top 10 World Coin owners still control 77.62% of the total supply of tokens. To boot, none of the 10 largest wallets belong to exchanges. The largest wallet of this kind is the 15th largest address, accounting for just 0.58% of the supply.

What's more, well-known cryptocurrency investigators Zachxbt Previously, he raised concerns about how the project's teams will manipulate the tokens, calling it “Bull Run's biggest fraud token.”

Featured Images via ShutterStock